A earlier article examined a technique on Ethereum (ETH) based mostly on the calculation of the ADX, an indicator whose acronym stands for “Common Directional Motion Index” and which is used to measure the energy of a development.

If the indicator tends in direction of low values then the development will likely be virtually absent, if the ADX takes excessive values then the underlying development will likely be extra vital.

Backtesting the ADX buying and selling system on Bitcoin, MATIC and BNB

Since this buying and selling technique offered attention-grabbing outcomes on ETH, the choice was made to check the identical logic on different cryptocurrencies as nicely. Particularly, the technique concerned lengthy entries solely, with ADX under 50 on the very best highs of the final 200 bars (at quarter-hour).

The exits had been made on the bottom of the final 200 bars, in addition to presumably on the cease loss (5% of the worth of the place), or after a most of 5 days available on the market.

How may this logic work on different cryptocurrencies?

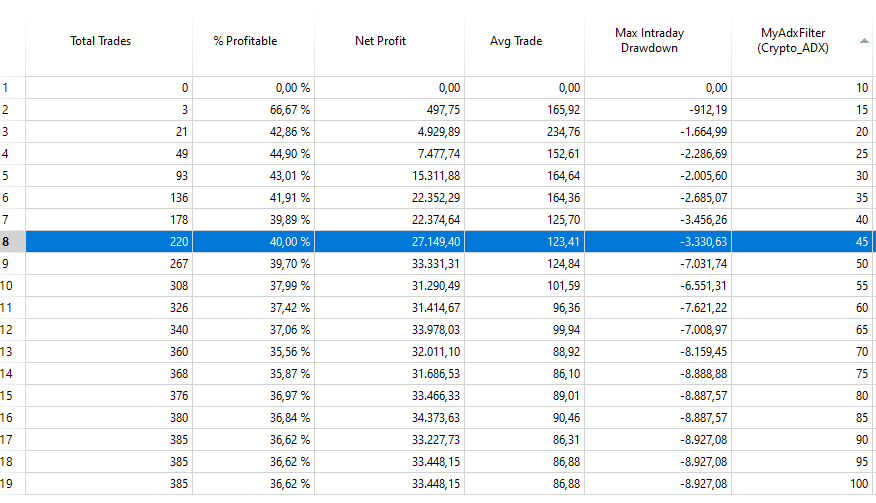

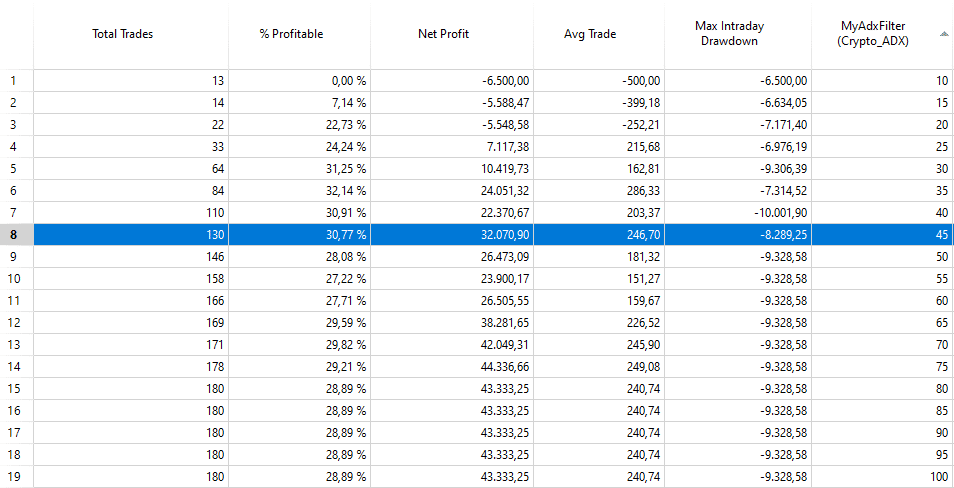

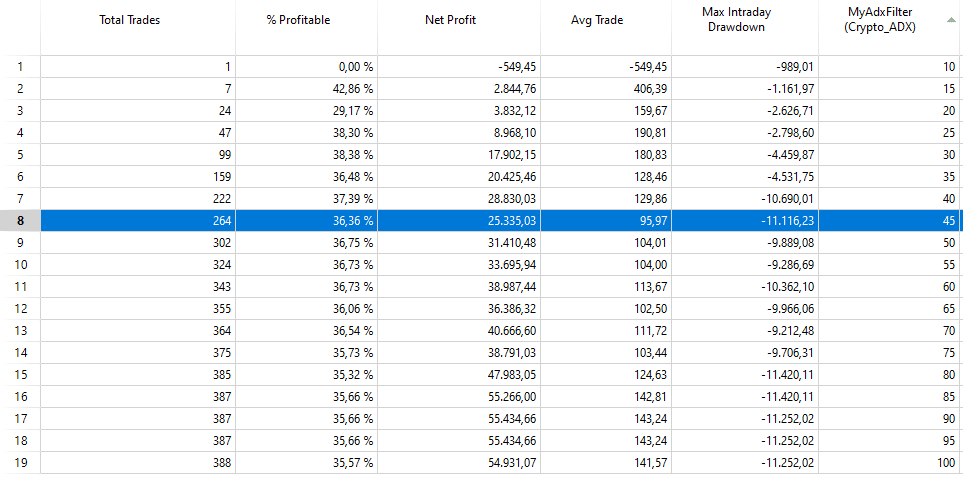

Testing the buying and selling system on Bitcoin (BTC), MATIC and BNB instantly reveals a sure continuity in comparison with the outcomes obtained on ETH.

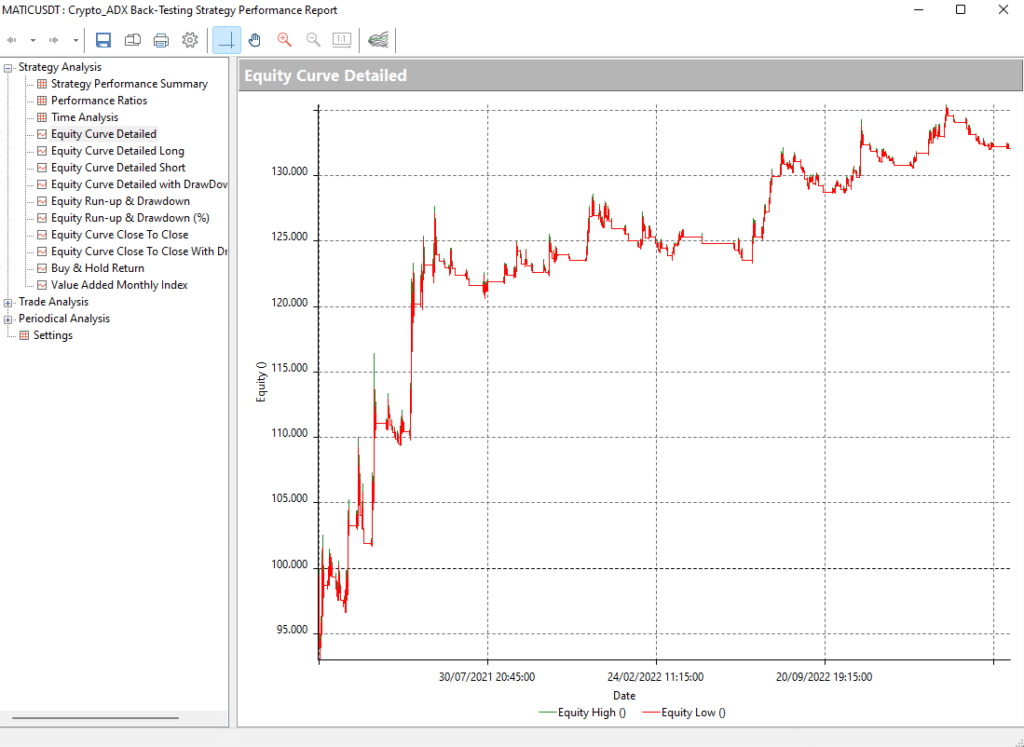

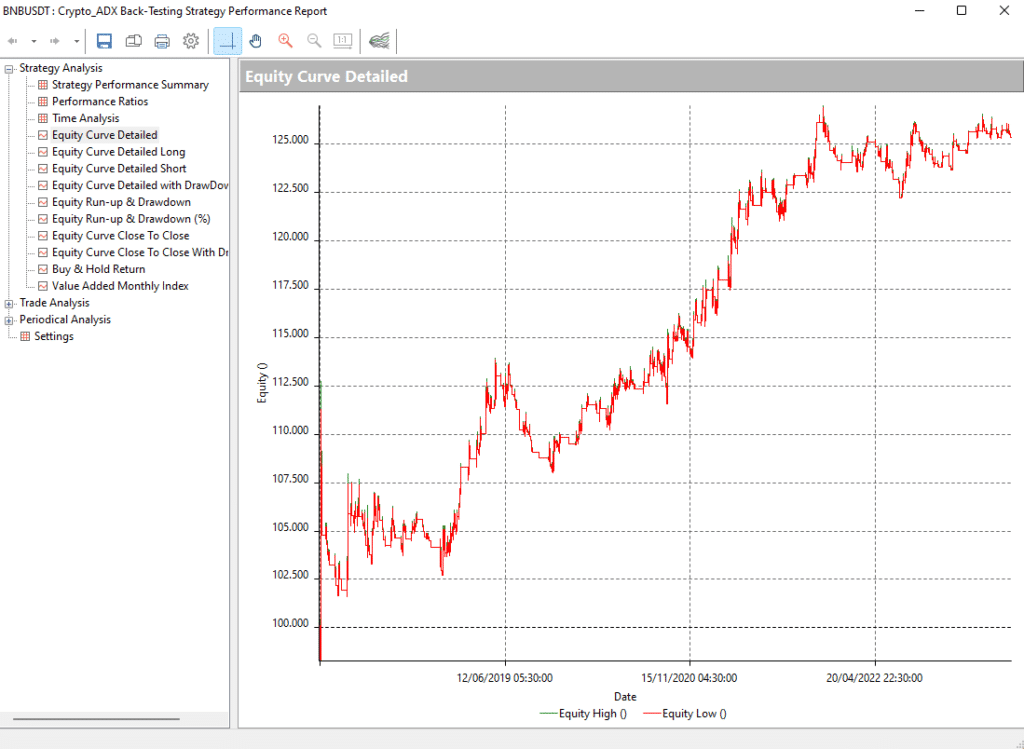

We selected to make use of ADX values under 45 (barely tighter than the ETH technique) for these crypto property as a result of they supply the most effective outcomes (Figures 2-3-4) in combination phrases. The revenue decreases because the ADX values lower, however the common commerce will increase (besides on BNB which different ADX values appear to work on), due to this fact the drawdown decreases because the ADX filter turns into stricter.

That is definitely a sign of the great filtering job completed by the indicator, as the standard of the common commerce has elevated.

The place is at all times fastened and equals $10,000 in financial worth. The typical trades obtained are undoubtedly massive sufficient to commerce in the actual market.

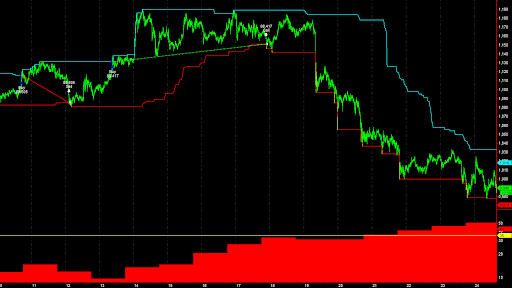

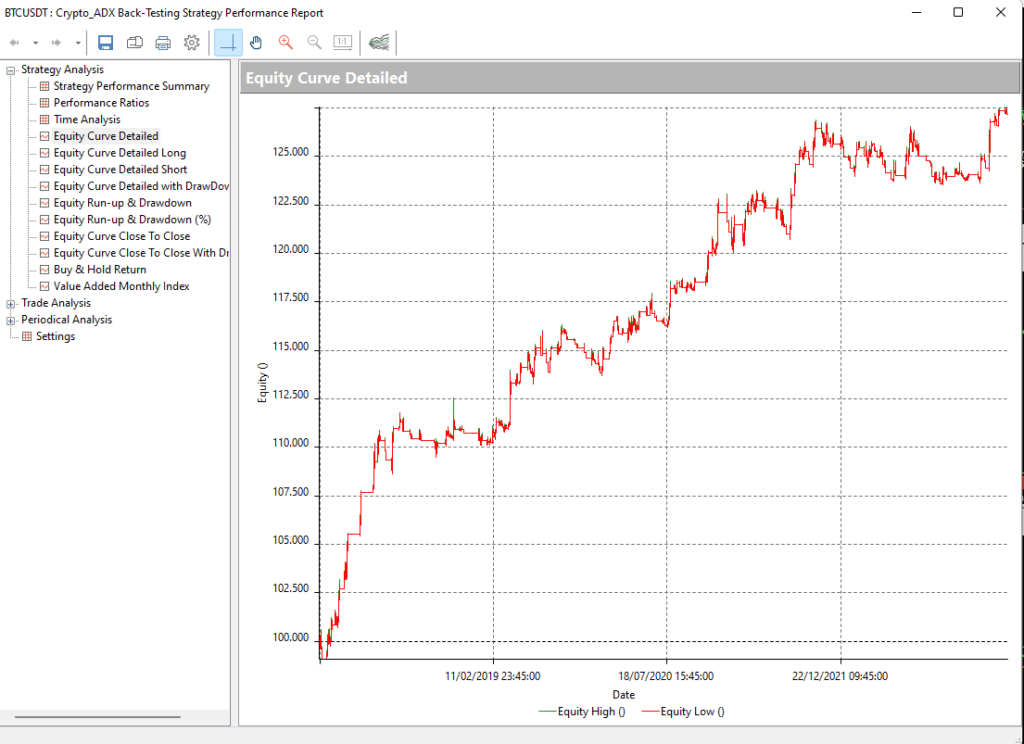

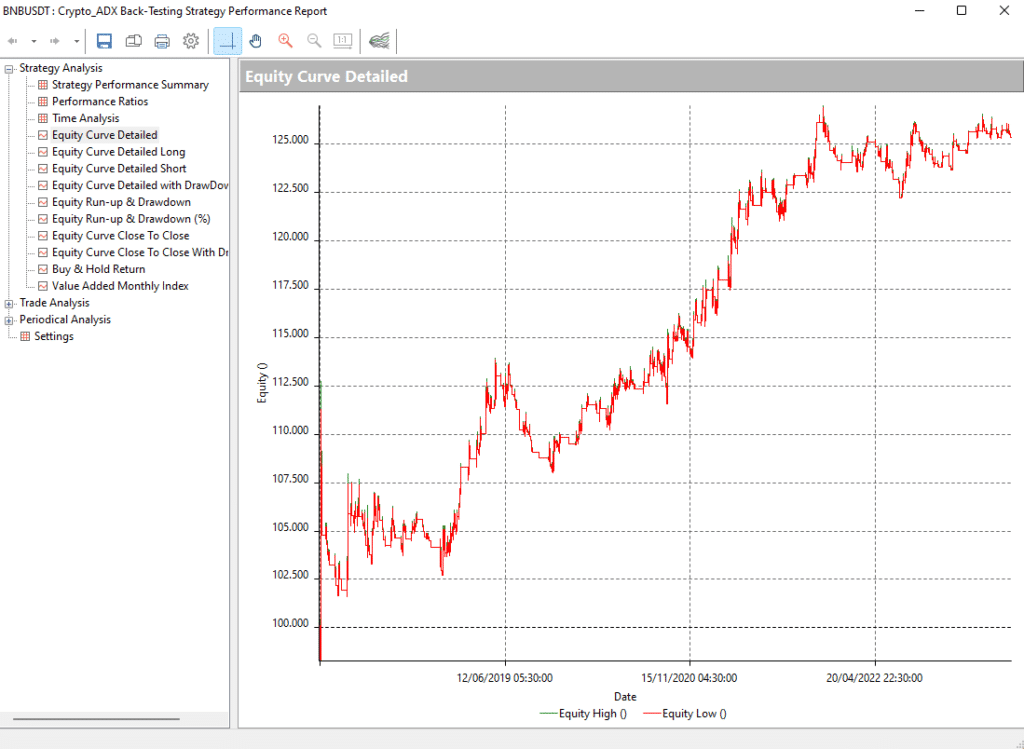

Within the following figures (5-6-7), it may be seen that the person curves are additionally considerable. ADX appears to have the ability to ship attention-grabbing outcomes even in youthful and newer markets reminiscent of cryptocurrencies.

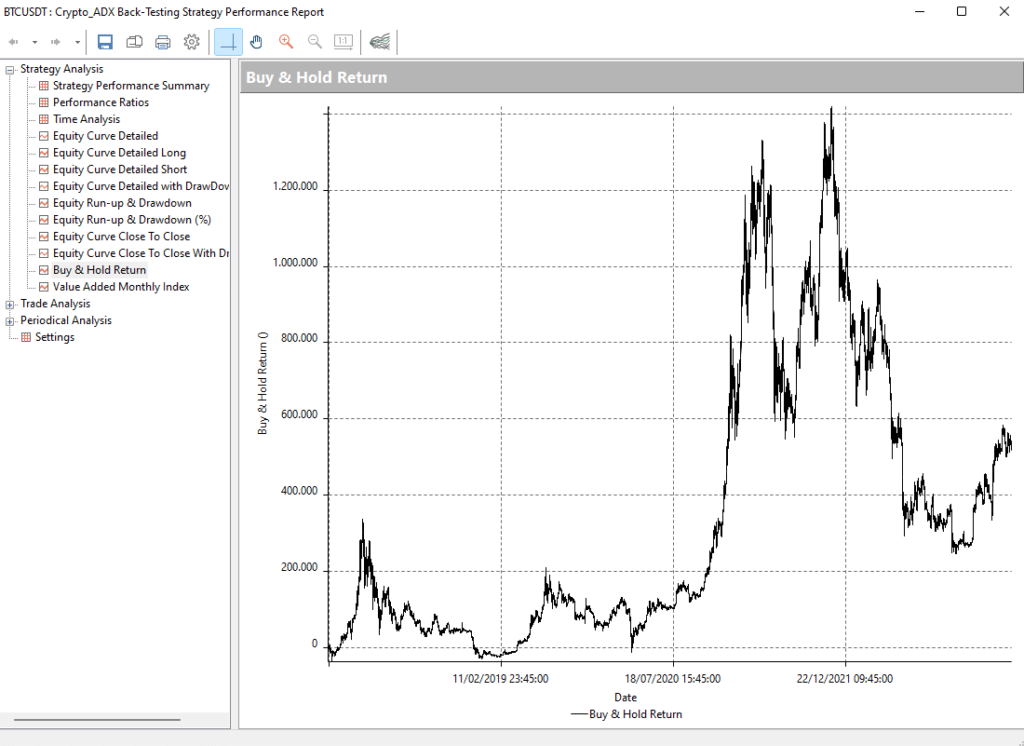

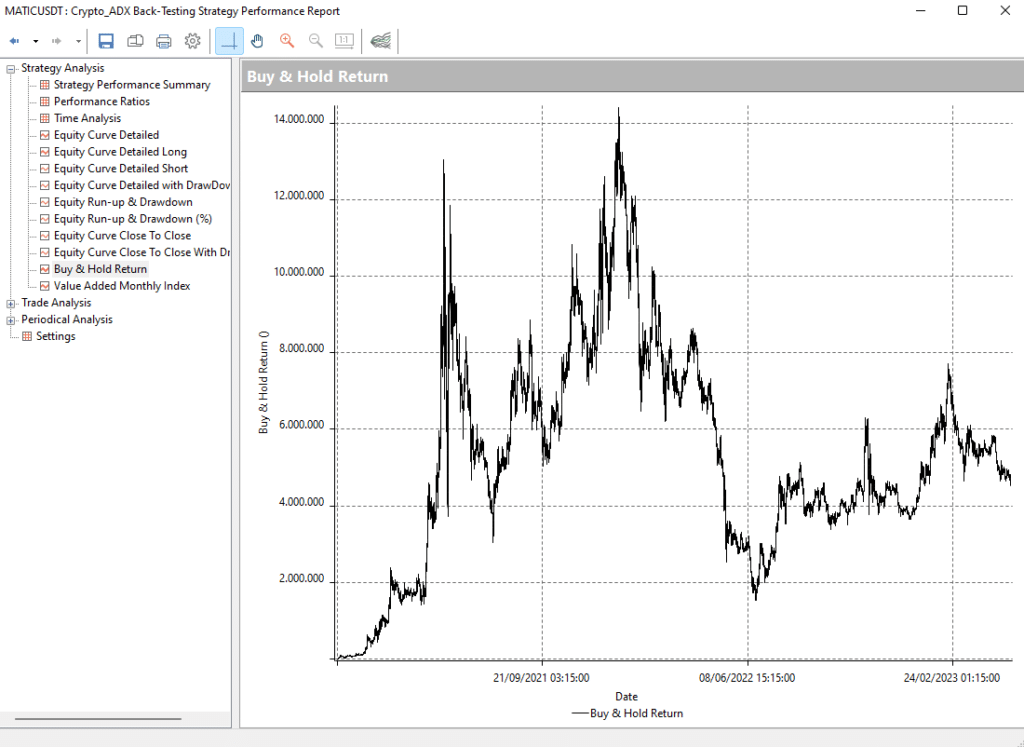

Additionally it is attention-grabbing to see the comparability between the straightforward purchase&maintain of those merchandise and the technique that has simply been used.

Conclusions on the ADX buying and selling system on Bitcoin, MATIC and BNB

What instantly stands out is that in the newest a part of the backtest, or extra usually over the past yr and a half, the technique has carried out higher than the straightforward purchase&maintain of the instrument.

Certainly, if the general revenue of the technique is decrease than that of the purchase&maintain, there are not any sharp declines like these recorded by the markets between the start of 2022 and the top of the identical yr.

The automated technique, with the assistance of ADX, was capable of skim the market phases the place it was impractical to enter and take lengthy positions.

Even on Bitcoin – a market definitely extra inclined to the event of automated methods since it’s the oldest amongst cryptographic property – the fairness peaks of this technique have lately been reached, within the face of the rebound observed that this similar market has achieved within the first months of 2023.

Additionally on this case, the automated technique was ready on the one hand to include the danger and however to replace the historic highs extra incessantly than the basic purchase and maintain method.

Until subsequent time!

Andrea Unger