Bitcoin’s difficulty-adjusted puell a number of has been beneath one lately, here is why this will counsel that BTC miners are nonetheless beneath stress.

Puell A number of Adjusted Bitcoin Problem Not But Larger Than 1

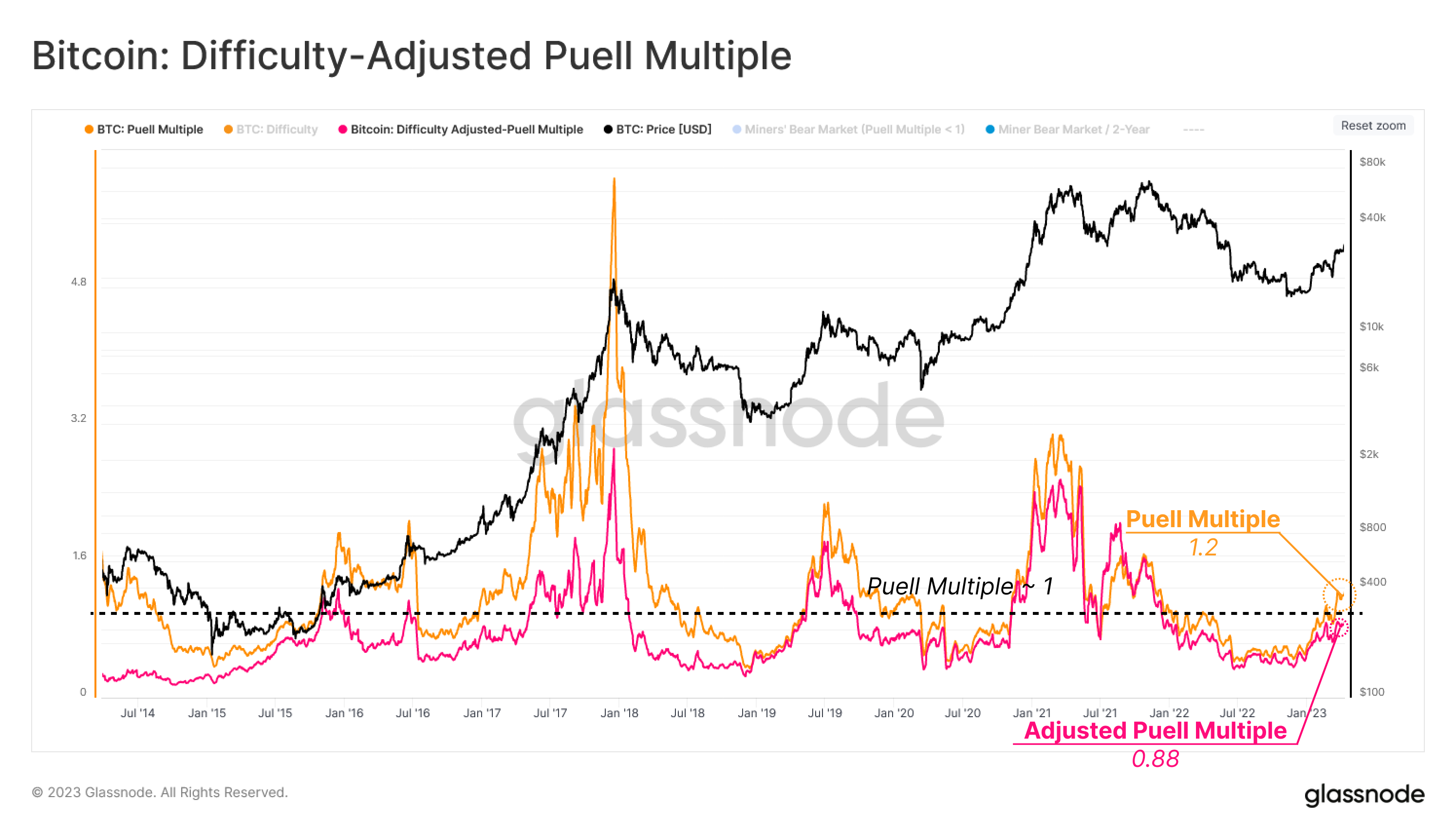

In response to a searcher at on-chain analytics agency Glassnode, miners are nonetheless incomes about 12% lower than final 12 months’s common. The indicator of curiosity right here is the “puell a number of”, which measures the ratio of day by day Bitcoin miner earnings (in USD) to the 365-day shifting common (MA) of it.

When the worth of this metric is bigger than one, it implies that miners are presently incomes greater than their common for the previous 12 months. Throughout these occasions, miners typically discover mining to be worthwhile.

However, values beneath this threshold suggest that miners’ earnings are beneath the annual common, maybe suggesting that this cohort may be beneath stress.

There may be nonetheless an issue with the a number of puell, and that’s that it solely is determined by the value of the cryptocurrency. The metric doesn’t consider one other necessary issue for miners: mining problem.

Mining problem is a built-in function of the Bitcoin blockchain that decides how onerous miners would presently discover mining blocks on the community. This idea exists as a result of the BTC blockchain goals to maintain the block manufacturing price (or extra merely, the speed at which miners course of transactions) at a relentless worth.

When the community hashrate (a measure of the full computing energy linked to the chain) will increase, miners can hash blocks quicker. However because the chain does not need that to occur, it will increase the issue of slowing down miners simply sufficient to convey them again to the specified tempo.

As a result of existence of the issue, the earnings of particular person miners lower every time the hashrate will increase. It is because block rewards all the time keep the identical (besides throughout halving occasions, the place they’re halved), which implies that if extra miners hook up with the community, the person shares of all of the individuals concerned develop into smaller.

The “difficulty-adjusted puell a number of” is a modified model of the indicator that gives a extra sensible illustration of the state of affairs for miners, because it takes mining problem under consideration.

Here’s a graph that exhibits the pattern of this metric over the previous few years:

The worth of the metric appears to have been beneath one lately | Supply: Glassnode on Twitter

As proven within the chart above, the Bitcoin puell a number of broke above the bar earlier within the 12 months when the continuing rally within the worth of the asset started. At present, this indicator has a worth of 1.2, which means that miners as an entire earn considerably greater than the annual common.

The issue-adjusted model of the metric, nonetheless, continues to be beneath one and has been so for your complete bear market, although the value has lately seen a big rally.

On the present degree of 0.88, miners are incomes 12% lower than the yearly common, implying that they might nonetheless be beneath some stress presently, however not as extreme as throughout bear market lows.

BTC worth

As of this writing, Bitcoin is buying and selling round $30,400, up 9% prior to now week.

Seems like BTC has sharply surged | Supply: BTCUSD on TradingView

Featured picture by Brian Wangenheim on Unsplash.com, charts by TradingView.com, Glassnode.com