Bitcoin miners have lately garnered traditionally excessive transaction charges, however on-chain information reveals this cohort remains to be not promoting out.

Bitcoin miners have not transferred a lot quantity to exchanges lately

Transaction charges on the Bitcoin community have lately elevated attributable to elevated site visitors attributable to ordinals, a protocol that permits information to be entered into the Bitcoin blockchain with transactions.

Usually, transaction charges stay low throughout instances when there’s little exercise on the blockchain, as buyers don’t have to pay larger charges to make transfers shortly.

Nevertheless, when the community is congested, wait instances within the mempool can turn into lengthy, so senders who need their transfers processed sooner incur excessive charges. This incentivizes miners to deal with these transfers first.

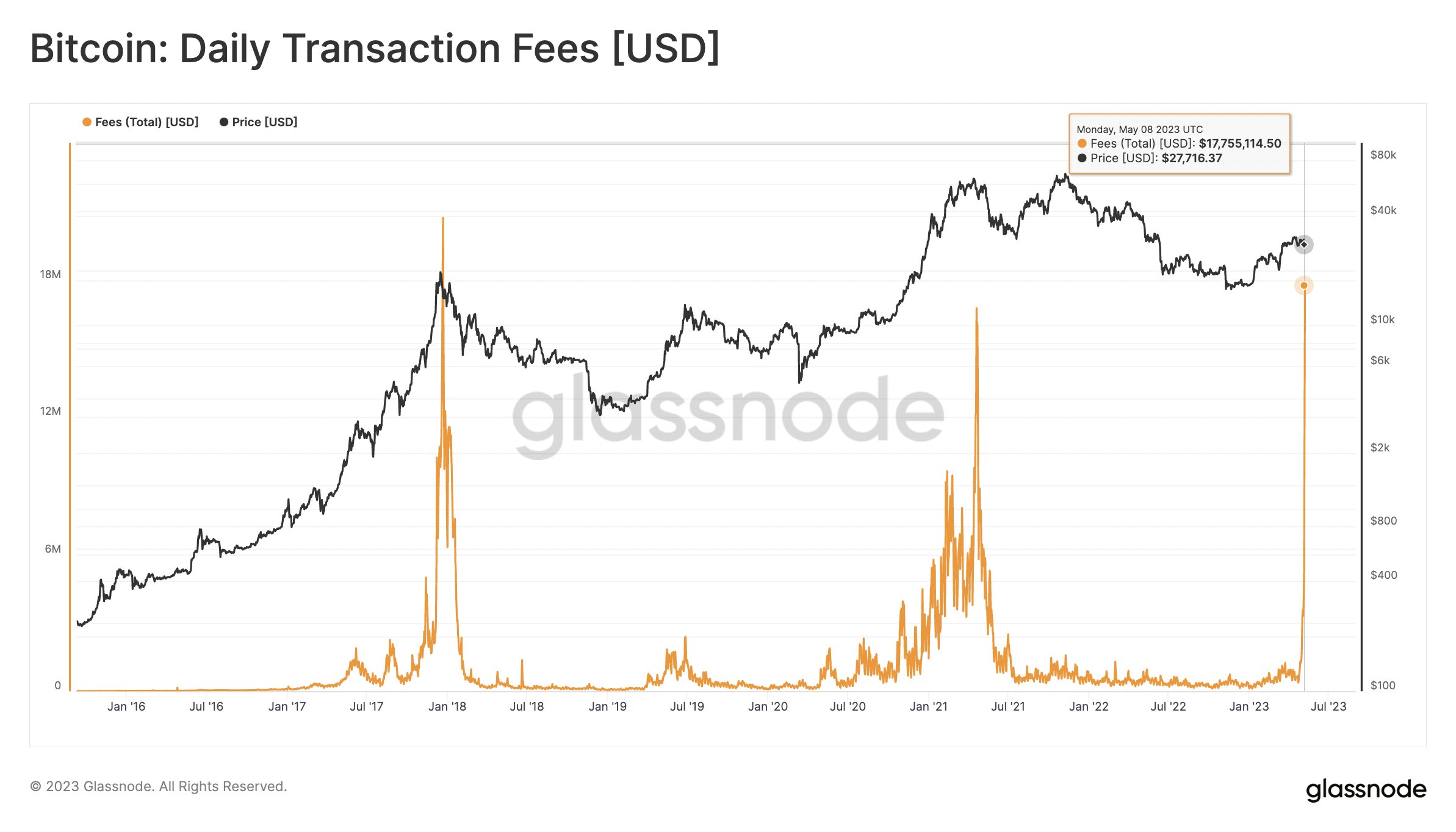

There was extraordinary congestion on the blockchain lately, so it is no shock that transaction charges have exploded to fairly excessive ranges, just like the chart under from Rafael Schultze-Kraftthe co-founder of Glassnode, poster.

The worth of the metric appears to have been fairly excessive in current days | Supply: Rafael Schultze-Kraft on Twitter

As proven within the chart above, Bitcoin transaction charges lately spiked to $17.7 million, which is a particularly excessive quantity even in comparison with the peak of current bull runs.

The principle purpose for this enhance was the spike in ordinal utilization. Specifically, the rise in reputation of BRC-20 tokens, fungible tokens that had been created utilizing the Ordinals protocol, has been a spotlight of this exercise. Many meme cash primarily based on this protocol have been created, together with the extremely popular Pepe Coin (PEPE).

From the chart, it’s seen that solely the bullish excessive of 2017 noticed the overall transaction charges on the blockchain attain larger values. The primary half of the 2021 bull run prime noticed comparable ranges, however nonetheless barely decrease than the present peak.

Naturally, miners are benefiting from the explosion of exercise seen on the community proper now, as transaction charges are one of many two fundamental sources of revenue for these chain validators (the opposite being block rewards). .

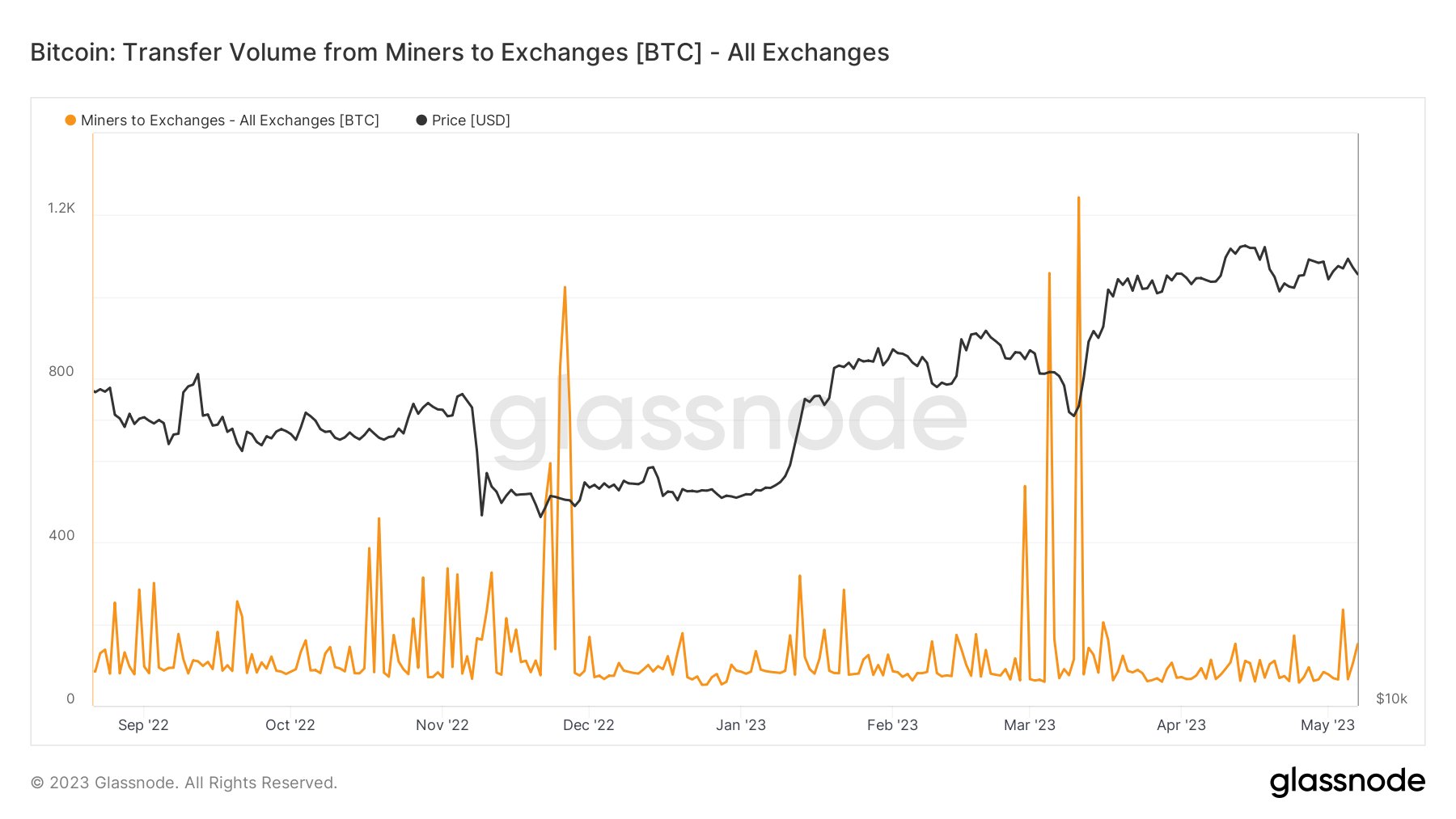

In such a interval of booming exercise, one wonders if the miners would promote a few of their reserves right here to make these excessive revenues. However thus far, the amount of transactions from miners to centralized exchanges has remained low, based on the chart shared by Mitchell from Blockware Options.

Seems like the worth of the metric has stayed low lately | Supply: MitchellHODL on Twitter

Often, these buyers switch their cash to the exchanges every time they wish to take part within the distribution of the asset. Since they have not despatched any suspicious quantities to those platforms lately, it is attainable that they haven’t any intention of promoting their Bitcoin but.

This is usually a optimistic signal for the market, because it might imply that this BTC cohort has determined to build up the additional revenue they acquired lately.

BTC worth

As of this writing, Bitcoin is buying and selling round $27,600, down 4% prior to now week.

BTC has noticed some decline in the previous few days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com