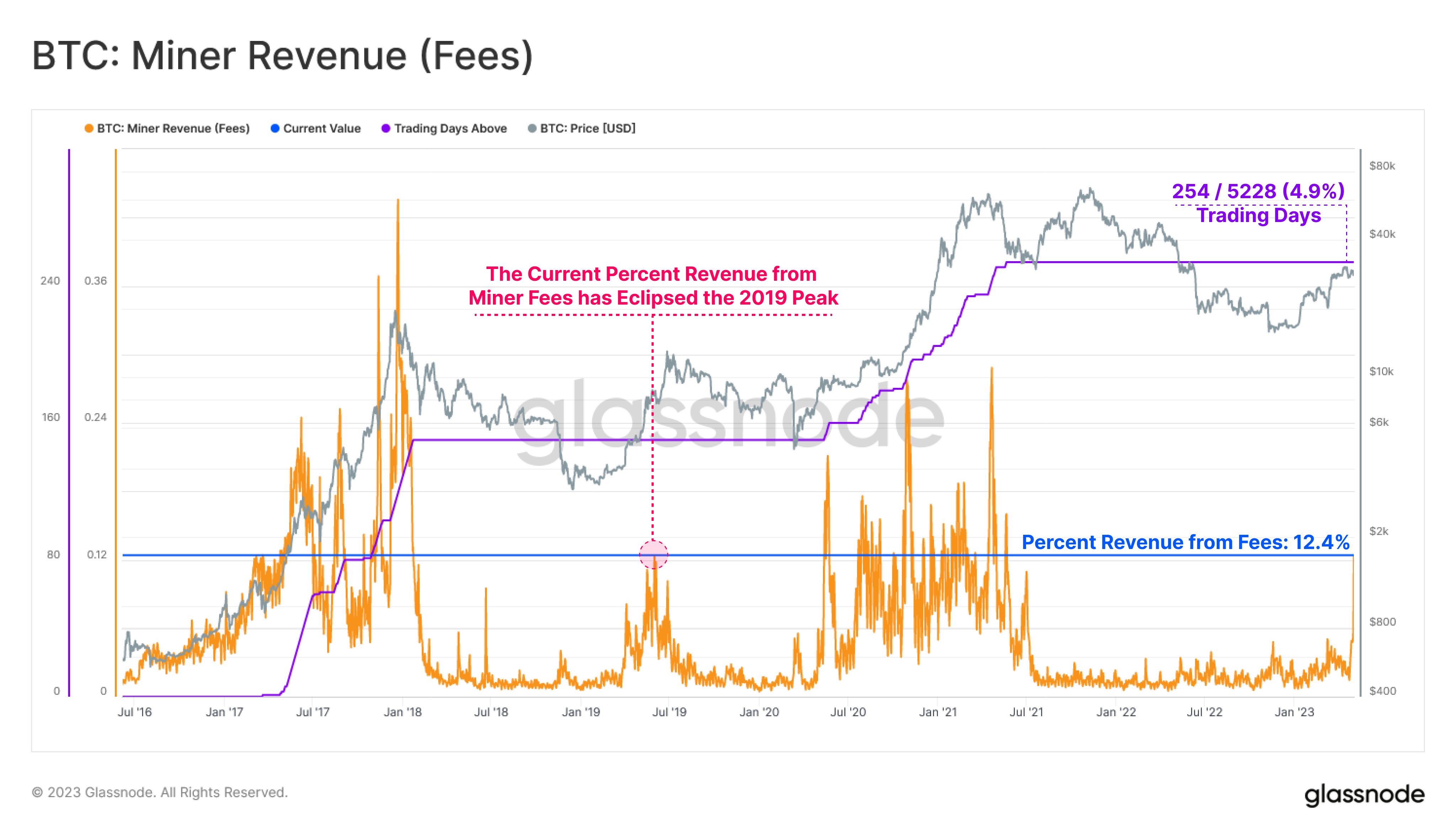

On-chain information exhibits Bitcoin miners incomes 12.4% of their income from charges after the variety of transactions hit an all-time excessive.

Bitcoin Miner’s income share of transaction charges has just lately elevated

In keeping with information from the on-chain analytics firm glass knotsolely 254 days of buying and selling in your complete historical past of cryptocurrency have seen transaction charges contribute a bigger share to the full income of those chain validators.

There are primarily two elements to the income generated by miners: block rewards and transaction charges. Block rewards are what this cohort receives as compensation for mining blocks on the Bitcoin community. These rewards all the time have a set worth, except halving occasions, after which they’re completely halved.

Transaction charges, however, will be extremely variable, as it’s as much as blockchain customers to connect as a lot quantity as they want. Usually, in occasions of comparatively low community site visitors, costs stay low. Certainly, the capability of the channel is adequate for his or her switch to be carried out comparatively shortly, even with low charges.

Nevertheless, issues change when the community turns into energetic. Miners can solely deal with a restricted variety of transactions at a time, so they begin prioritizing transfers with the next variety of charges. With a purpose to compete with different customers to hurry up their transactions, senders are beginning to cost excessive charges.

At occasions like these, common charges can naturally improve, and thus the proportion of miners’ earnings they compensate for surges. Lately, such market circumstances have fashioned once more.

The chart under exhibits how the present proportion of income from charges for miners compares to ranges seen all through Bitcoin’s historical past.

The worth of the metric appears to have been fairly excessive in current days | Supply: Glassnode on Twitter

As proven within the chart above, Bitcoin miner income from transaction charges has just lately seen a reasonably large spike. The excessive charges got here as the full variety of transactions on the community hit a brand new all-time excessive.

The supply of this sudden quantity of transfers appears to be primarily as a result of explosion in reputation of “signups”, BTC expertise that’s akin to non-fungible tokens (NFTs) on different blockchains. Particularly, textual content listings have just lately seen a really excessive demand.

Resulting from this excessive exercise on the community, royalties now characterize 12.4% of miners’ revenue. From the graph, it’s seen that there have been only a few situations the place the metric noticed larger magnitude spikes.

To be particular, solely 254 buying and selling days in your complete historical past of cryptocurrency (or 4.9% of the asset’s buying and selling lifetime) noticed miners reaping the next proportion of income from prices, which exhibits how uncommon this example is. Definitely, miners would welcome this growth induced by the Inscriptions.

BTC worth

As of this writing, Bitcoin is buying and selling round $29,000, down 1% up to now week.

Seems to be like the worth of the asset has been shifting sideways just lately | Supply: BTCUSD on TradingView

Featured picture by Brian Wangenheim on Unsplash.com, charts by TradingView.com, Glassnode.com