Information exhibits that Bitcoin mining hashrate lately registered its third highest 3-month improve up to now 5 years.

Bitcoin Mining Hashrate has risen sharply lately

As an analyst on Twitter identified, solely the implications of the China ban in 2021 and the bear market of 2019 noticed sooner will increase. The “mining hashrate” is an indicator that measures the overall quantity of computing energy that miners have related to the Bitcoin blockchain.

As the worth of this metric will increase, miners are at the moment bringing extra machines on-line to the BTC community. Such a development means that blockchain is at the moment fascinating to use for these chain validators.

Then again, the drop within the worth of the indicator implies that some miners are disconnecting their rigs from the community. This could possibly be an indication that the common miner doesn’t discover BTC mining as worthwhile proper now.

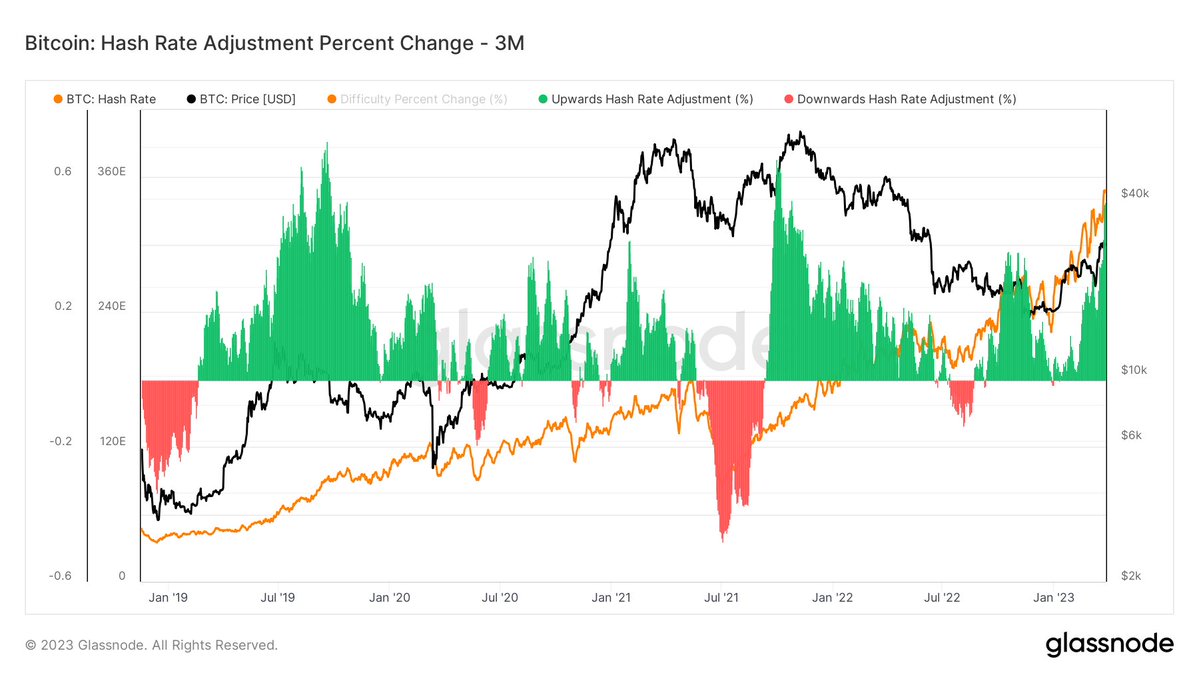

Now, here’s a graph that exhibits the development of Bitcoin mining hashrate, in addition to its 3-month proportion change, over the previous few years:

The worth of the metric appears to have been fairly excessive in current days | Supply: James V. Straten on Twitter

The chart above exhibits that Bitcoin’s mining hashrate (the orange curve) has seen a powerful upward development over the previous few weeks. As a result of this distinctive and fixed progress, the proportion change over 3 months of the indicator has additionally elevated.

In line with this peak, the worth of the metric has elevated by roughly 52% over the previous three months. This improve in hashrate is the third highest BTC blockchain within the final 5 years.

The largest throughout this era got here within the aftermath of the 2018-2019 bear market, when the April 2019 rally occurred. Many miners could discover it unprofitable to mine the coin throughout bear markets. Subsequently, the hashrate can drop considerably when miners disconnect from the community.

When the April 2019 rally was proper after the worst a part of the bear market, miners out of the blue discovered it very worthwhile to mine the asset once more, so that they reconnected their machines shortly, therefore why the hashrate confirmed such a soar.

The second greatest 3-month upside adjustment got here when the 2021 H2 bull run kicked off. Earlier that 12 months, China imposed a ban on Bitcoin mining within the nation, which led to an enormous migration of miners overseas.

This migration may also be seen within the chart, as a big adverse 3-month change in hashrate occurred in Might-July 2021. When miners accomplished their migration and reinstalled their rigs, the hashrate rebounded.

Now, the current development of the indicator is fascinating. Throughout the 2022 bear market, the hashrate solely noticed upward progress, regardless that the worth noticed a pointy decline.

The possible motive behind that is that the miners made immense income within the bull run of 2021, so that they introduced their enlargement plans protecting them in thoughts, and the installs simply took some time to fall into place, therefore the optimistic progress of the bear market. .

Naturally, the newest robust progress within the indicator is probably going due partly to this progress and partly to the truth that the newest restoration made mining worthwhile once more.

BTC worth

As of this writing, Bitcoin is buying and selling round $26,900, down 4% up to now week.

BTC has plunged | Supply: BTCUSD on TradingView

Featured picture by Dmitry Demidko on Unsplash.com, charts by TradingView.com, Glassnode.com