- BCH’s shopping for energy has weakened since much less cash has flowed into the market.

- Regardless of a barely bullish bias, the coin may solely face consolidation round $262.

- Merchants evaded lengthy positions as indicators emerged that BCH value may decline.

Bitcoin Money (BCH) was compelled to face a retracement after a current lengthy stretch of inexperienced printing. Regardless of the drop in value, the coin’s 30-day efficiency remained round a 149% upside.

One of many the reason why BCH, the exhausting fork of Bitcoin (BTC) in 2017, rallied round its inclusion within the launch of the EDX Markets alternate. In consequence, BCH crossed the $300 threshold on June 30.

A rally is probably not quick

On high of that, the BCH/KRW buying and selling pair had the best quantity on South Korean alternate Upbit, CoinMarketCap revealed. This helped the cryptocurrency recuperate on July 6 after an preliminary drawdown.

However regardless of remaining within the high two buying and selling volumes on Upbit, BCH’s value had fallen to $282 at press time.

On the 4-hour BCH/USD chart, the Chaikin Cash Circulate (CMF) had fallen to -0.04. The CMF, crossing beneath the zero line, signifies that the energy of BCH out there may have weakened.

Furthermore, it was an indication of extra capital outflows than inflows. Thus, distribution thrived on accumulation. Thus, BCH may discover it extraordinarily troublesome to observe an uptrend as a result of falling demand.

The chart above additionally took into consideration the volatility of BCH. Primarily based on the Bollinger Bands (BB), the coin’s volatility has began to contract since promoting stress started round $297.21 on July 3.

Nonetheless, the stress drove BCH to an oversold degree after the worth touched the decrease band at $262.42. At this level, the contraction has cooled down a bit. Furthermore, BCH value had escaped the decrease or higher band. Subsequently, the coin may proceed to consolidate within the brief time period.

Anticipate one other drop?

Moreover, the Shifting Common Convergence Divergence (MACD) has collapsed across the midpoint at 0.67. Alongside the identical traces, consumers and sellers have been struggling for management because the dynamic orange and blue traces have come collectively.

Nonetheless, the MACD remaining above zero signifies that there was extra of an uptrend than a bearish sign. However on the identical time, if the worth of BCH had been to rise, it’d solely be slight.

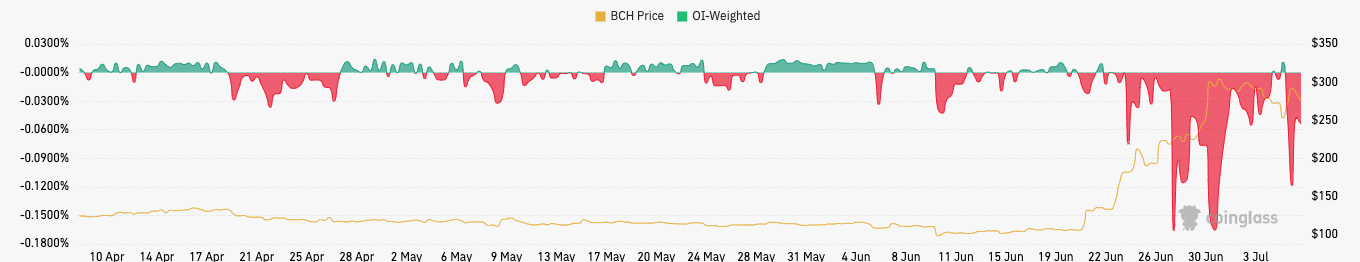

In the meantime, BCH’s 8-hour funding charge had fallen to $274 at press time. Sometimes, the funding charge means the distinction between the perpetual value of an asset and its spot value.

When the funding charge is optimistic, it means merchants are bullish. However the decline in BCH’s funding charge means that brief merchants had been dominant. Thus, the broader market expects the cryptocurrency to dip additional.

In conclusion, buyers anticipating BCH to regain the $300 mark might have to attend longer. Because the technical outlook revealed, a consolidation or drop beneath its present value may very well be on the playing cards.

Disclaimer: The views, opinions and knowledge shared on this value prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates shall not be answerable for any direct or oblique damages or losses