- Bitcoin perpetual futures open curiosity returns to $16 billion, however funding charges stay average.

- This determine coincides with Bitcoin hitting $71,400 right now, led by Binance merchants.

- The short-term holder's SOPR measure reveals managed revenue taking at 1.017, under the overheating stage.

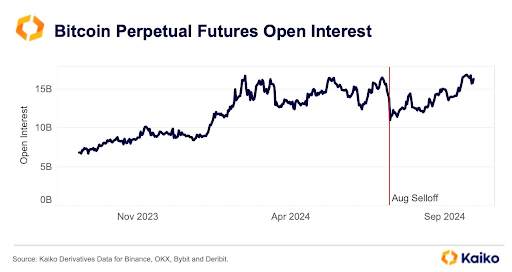

As Bitcoin approaches its all-time excessive, open curiosity within the perpetual futures market has climbed again to $16 billion, based on Kaiko Knowledge.

This brings open curiosity again to ranges seen in August, simply earlier than a selloff. The inflow of capital signifies elevated participation out there.

Notably, the most recent determine coincides with Bitcoin reclaiming the much-anticipated $70,000 mark, a stage it had struggled to achieve over the previous 4 months. Bitcoin is now making substantial progress in direction of its earlier all-time excessive, hitting an intraday excessive of $71,400. This places it simply 3.48% away from the all-time excessive of $73,750.

Regardless of elevated exercise within the perpetual futures market returning to August highs, funding charges stay subdued. This implies average demand, even when Bitcoin worth climbs to $71,000. Funding charges replicate the prices related to holding lengthy or quick positions and supply perception into market sentiment.

Binance Whales Drive Bitcoin Uptrend

In line with CryptoQuant, the current rise in Bitcoin worth could also be linked to important buying and selling exercise from Binance whales. CryptoQuant noticed that Binance whales have been lively throughout Asian buying and selling hours since October 14, impacting the Coinbase Premium Hole (CPG), which tracks worth variations between Coinbase and Binance. Regardless of the rise in Bitcoin costs, the CPG has declined, indicating a “destructive premium.”

This destructive premium doesn’t replicate a drop in American demand. Over the previous two weeks, US Bitcoin spot ETFs have seen important inflows of round $3.34 billion. So whereas robust US demand sometimes results in a optimistic CPG, the present destructive premium suggests that enormous Binance merchants primarily decide the worth of Bitcoin.

Brief-term holders present modest profit-taking

In a separate evaluation, CryptoQuant highlighted the Brief-Time period Holder Spent Revenue Ratio (SOPR) for Bitcoin, which at present sits at 1.017. This metric measures revenue realization for cash held between one hour and 155 days. Values above 1 point out that short-term holders are promoting at a revenue.

Traditionally, an SOPR stage above 1.03 indicators that the market is approaching an overheated state. At 1.017, short-term holders are making modest earnings with out extreme profit-taking, leaving room for additional worth will increase.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.