Whereas the worth of gold rose 2.1% yesterday and is now near an all-time excessive, right this moment the worth of Bitcoin is staging one other try to interrupt via the $28,8000-29,000 resistance zone. $ which has been in place since mid-March. The most recent macro information and a continued robust gold value may present the required impetus to interrupt out of the present consolidation part.

At $2,042 an oz, gold is just some {dollars} off its 2020 excessive of $2,069.40. The normal safe-haven asset is up 13% over the previous month, whereas Bitcoin has gained 27% over the previous 30 days. Thus, the 2 property have risen in tandem (Bitcoin with the next beta) in latest weeks.

Digital #Golda.ok.a #Bitcoinsrallied in tandem with analog gold. pic.twitter.com/tOH41oIKXi

— Holger Zschaepitz (@Schuldensuehner) April 4, 2023

Does Bitcoin lastly transform digital gold?

The latest rally in gold costs is because of a weaker US greenback, decrease expectations for key rates of interest and geopolitical tensions, in accordance to The Kobeissi Letter analysts. As well as, there are rising issues concerning the looming menace of a recession in america later this yr.

Over the previous few years, the inverse correlation of gold and the US greenback has been clearly evident. And it is the identical now. In latest weeks, the US greenback has come below important stress. International locations like Saudi Arabia, Russia and Brazil commerce with China in Chinese language Yuan somewhat than USD. This put stress on the greenback and due to this fact supported the worth of gold.

In the meantime, in america, the Federal Reserve nonetheless faces a regional banking disaster that’s removed from resolved. This disaster led to the withdrawal of just about 400 billion {dollars} from American banks in simply 4 weeks, as The Kobeissi Letter stories.

Traders are apparently in search of safe-haven property comparable to Bitcoin and gold as weaknesses within the banking system have turn into obvious. And yesterday’s macro information continues to play into the fingers of each.

Weaker-than-expected manufacturing facility orders in February and an sudden drop in job creation to 9.931 million from expectations of 10.5 million (from 10.824 million the earlier month) are the primary indicators that the coverage of tightening the Fed has an impression on the labor market and, by extension, the financial system.

Fewer jobs on supply extra clearly point out a cooling financial system than earlier than, lowering stress on the Federal Reserve to boost rates of interest.

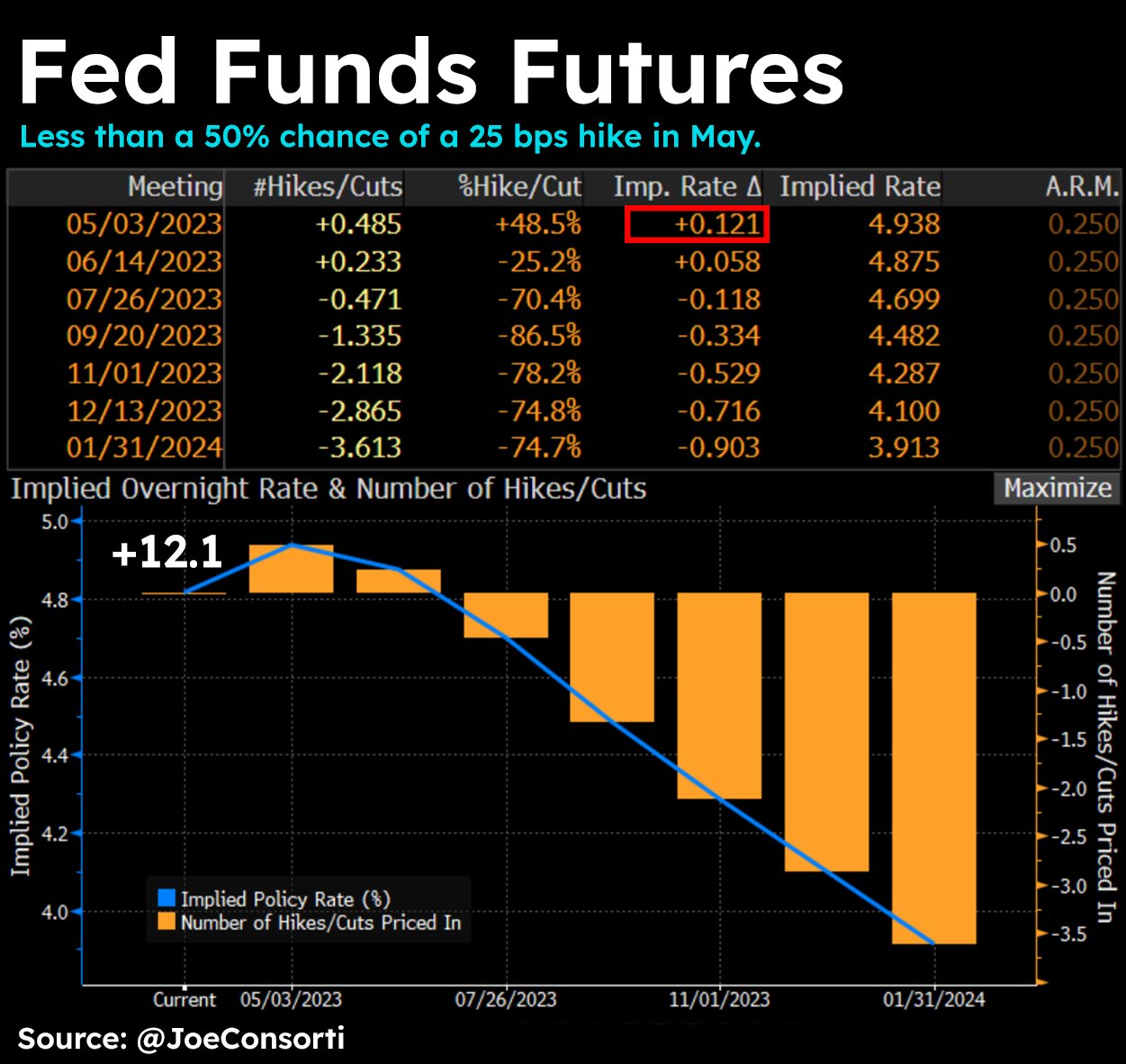

Yesterday, this led markets to as soon as once more reinforce their expectation that the Fed will finish charge hikes quickly and begin chopping charges later this yr, triggering the bullish development for Bitcoin and Gold. Analyst Joe Consorti wrote through Twitter:

Right here it’s. Fed funds futures forecast lower than a 50% likelihood that the Fed will hike 25 foundation factors on the Could assembly. Unhealthy ISM information, falling demand for crude, falling demand for labor, quickly falling charges – the market is feeling the slowdown. Break ⏸️

As of press time, the worth of Bitcoin has risen to $28,545 following macro circumstances. After the latest spike, the realm between $28,450 and $28,500 ought to be defended by bulls. If this zone acts as assist within the occasion of a retest, a rally in direction of $30,000 may very well be within the playing cards.

Featured picture from iStock, graphic from TradigView.com