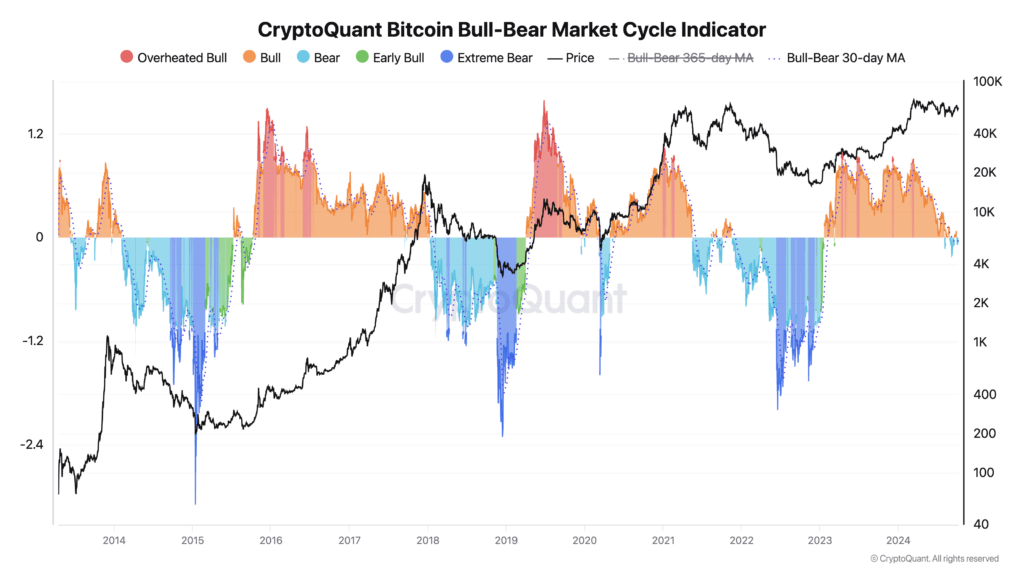

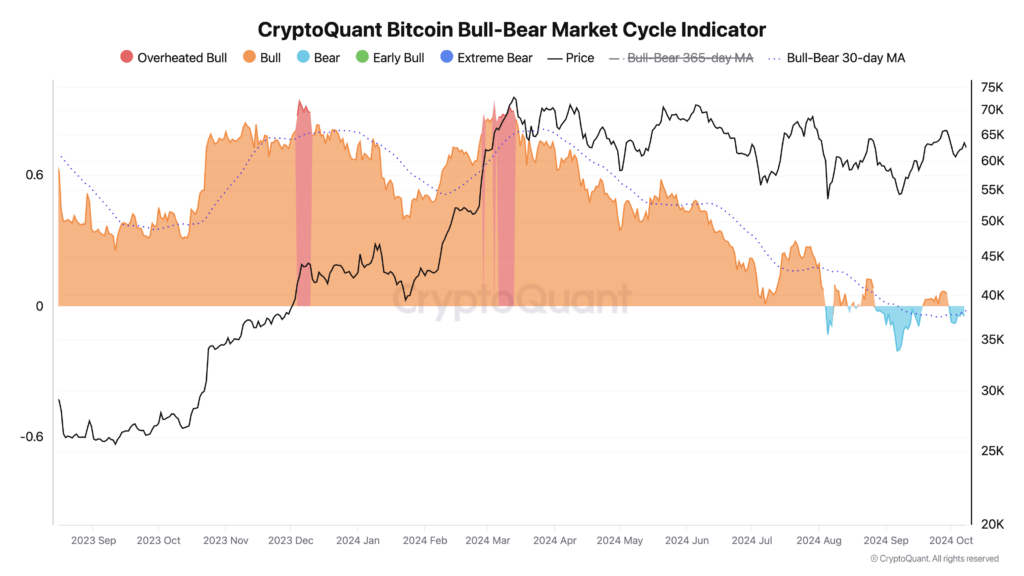

Latest Bitcoin market developments increase questions on whether or not the bull run of early 2024 is over or whether or not there’s nonetheless potential for additional development by 2025, aligning with historic peaks after the bitcoin discount. half. In accordance with CryptoQuant's Bitcoin Bull-Bear Market Cycle Indicator, Bitcoin has moved right into a bearish part after an overheated bullish interval earlier this 12 months.

In March 2024, Bitcoin reached an all-time excessive of $73,750.07, reflecting a big spike in market optimism. This improve corresponds to an overheated bullish part, the place costs have far exceeded historic averages. Traditionally, Bitcoin bull markets peak round 500 days after a halving occasion, suggesting that the present cycle might not have absolutely matured.

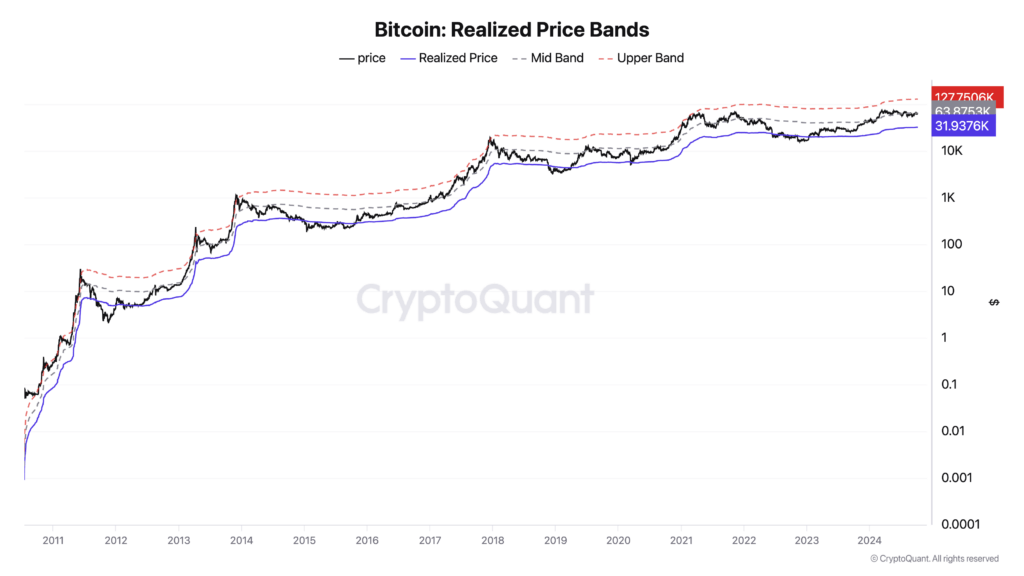

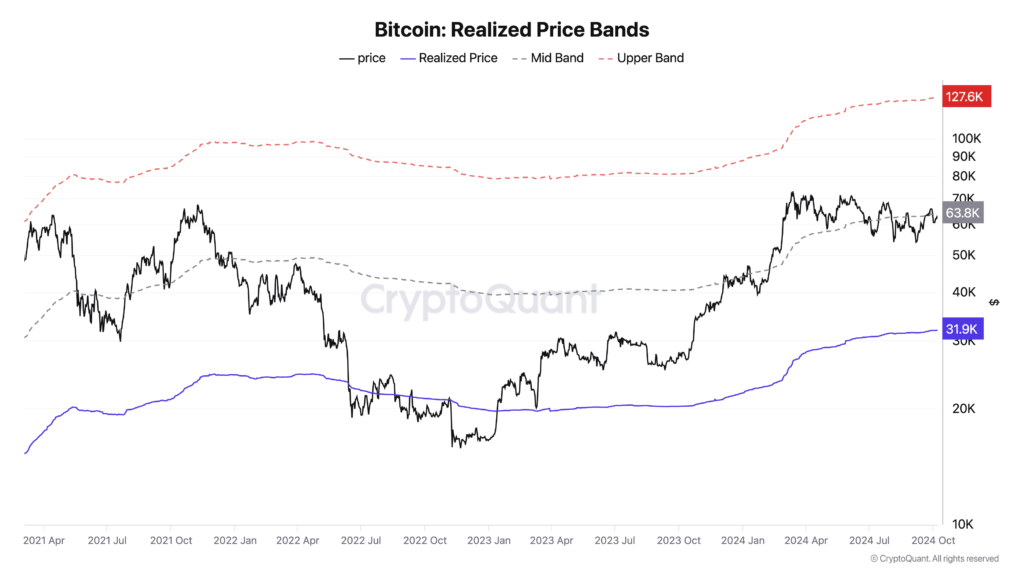

Nonetheless, the realized worth chart, which calculates the typical worth of all Bitcoins primarily based on their final transfer, signifies that Bitcoin continues to be midway by its cycle. In earlier cycles, the realized worth reached new highs earlier than the market entered a protracted bear part. Present information implies that Bitcoin has but to succeed in the excessive sometimes seen in previous bull markets.

Regardless of getting into a bearish part, the value of Bitcoin stays sturdy in comparison with the beginning of the 12 months. On October 9, Bitcoin was buying and selling at $62,151, virtually double its worth since January, when it was round $42,000. This sustained efficiency suggests sturdy market help, even amid fluctuations and cooling market sentiment.

Bitcoin market cycles are characterised by intervals of fast development adopted by corrections. The current shift right into a bearish part might sign a brief consolidation slightly than the top of the bull market. Earlier cycles have exhibited related developments, with intermediate bearish phases occurring earlier than the market resumes its upward trajectory to new highs.

Analysts are debating whether or not the early 2024 peak represents the excessive level of the cycle or whether or not Bitcoin will proceed to rise by 2025, which inserts the historic sample of bull market highs showing greater than a 12 months after the final drawdown. half. The realized worth chart helps the potential of additional development, as the height normally happens after passing the midpoint, with the higher band at present at $127,000.

Elements corresponding to regulatory developments, the 2024 US elections, institutional adoption and different macroeconomic situations might affect Bitcoin's trajectory within the months to come back. The interplay between the bear/bull market indicator and realized worth means that regardless that market sentiment has cooled, the underlying fundamentals should help continued development. Moreover, with Bitcoin holding above $60,000, it’s tough to be bearish on this asset.

The important thing query stays whether or not Bitcoin will respect its historic cycles, with a big peak coming, or whether or not the early 2024 rally was the height of this era, reinforcing fears of a big decline in yields.

The article Bitcoin Dips Into Bear Market Zone, Though Worth Realization Exhibits Room For Development Up To $127,000 appeared first on forexcryptozone.