Information from Glassnode reveals that Bitcoin switch quantity continues to be 79% decrease than what was seen through the bull run in 2021.

Bitcoin Switch Quantity Stays Low Regardless of Rally

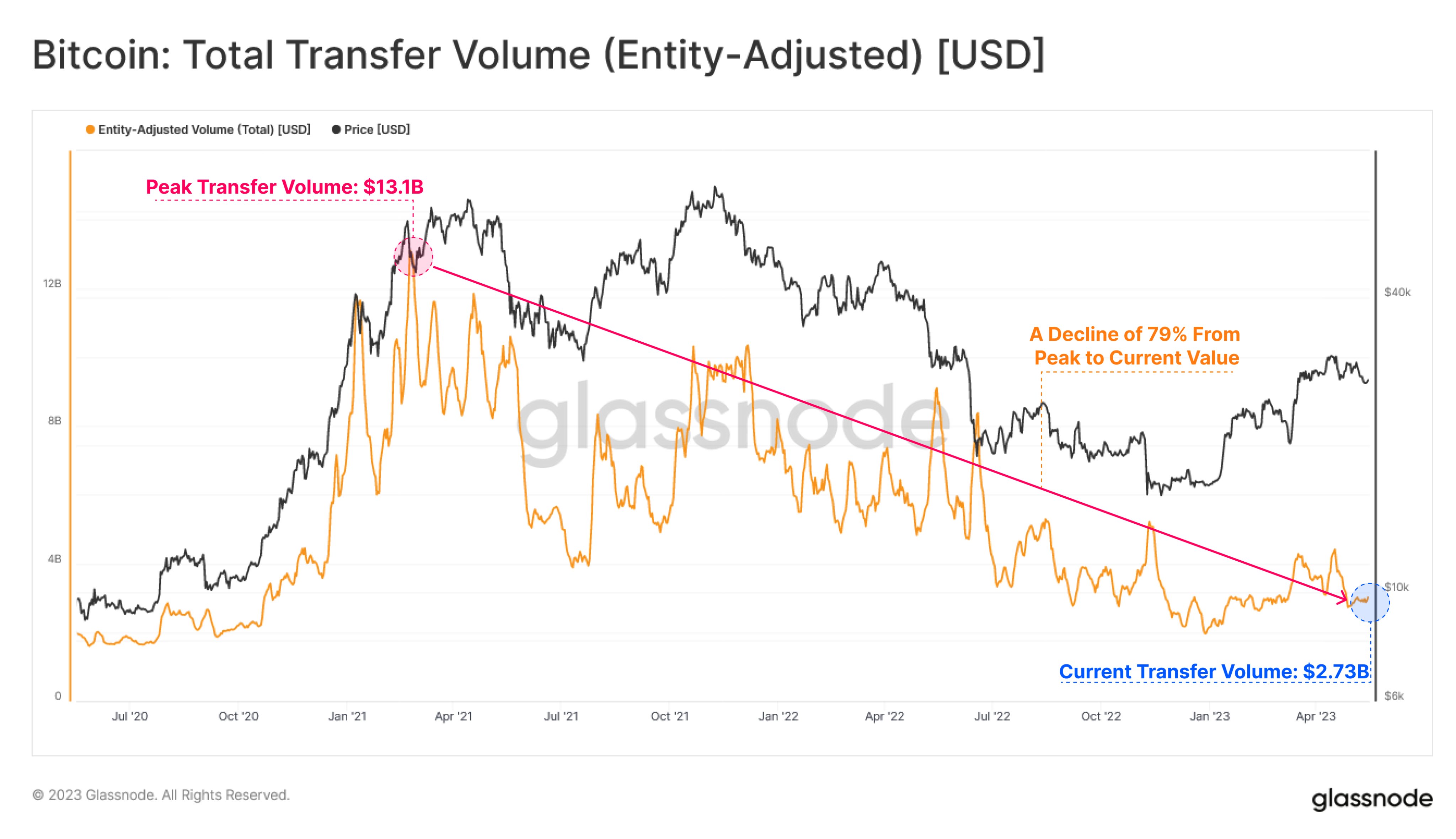

In keeping with knowledge from the on-chain analytics firm glass knot, the whole switch quantity on the BTC community is presently solely $2.73 billion per day. The “whole switch quantity” right here is an indicator that measures the whole quantity of Bitcoin (in USD) exchanged each day on the blockchain.

When the worth of this metric is excessive, it signifies that traders are presently shifting numerous cash on the community. Such a pattern is often an indication that merchants are energetic out there proper now.

However, the low values of the indicator suggest that the blockchain is observing low exercise in the intervening time. Any such pattern might counsel that common curiosity within the coin amongst traders is perhaps low presently.

Now, here’s a graph that reveals the pattern of whole Bitcoin switch quantity over the previous few years:

The worth of the metric appears to have been in an general downtrend since fairly some time now | Supply: Glassnode on Twitter

Notice that the Bitcoin whole switch quantity indicator used right here is the “entity-adjusted” one, which signifies that the transactions counted listed below are these between entities, not particular person wallets.

An “entity” refers to a set of addresses that Glassnode has decided to belong to the identical investor. Adjusting for entities has the benefit that each one transfers made between wallets of the identical holder are faraway from the equation, offering a greater estimate of on-chain exercise.

From the graph above, it’s seen that the whole Bitcoin entity-adjusted switch quantity had reached fairly excessive values when the bull run within the first half of 2021 happened.

This pattern is sensible as a result of robust value actions like rallies are thrilling for the overall investor, so many customers are drawn to the blockchain throughout these instances and add to the switch quantity.

On the peak of this bull run, the indicator had managed to achieve a worth of round $13.1 billion. Since then, nonetheless, the metric has been in a common state of decline.

The bull run within the second half of 2021 additionally noticed a rise in switch quantity, however the metric nonetheless didn’t attain values as excessive as through the rally within the first of this 12 months.

Bear markets have traditionally seen this metric drop to low values (as a result of value tends to indicate annoying sideways value motion for lengthy stretches throughout such intervals), so it is no shock that the indicator additionally plunged through the current bear market.

What could also be sudden, nonetheless, is that regardless of beginning a rally this 12 months, Bitcoin’s whole switch quantity has nonetheless not seen a big improve. The worth of the indicator is presently round $2.73 billion, which is 79% decrease than the height worth of the 2021 bull run.

This lack of quantity would counsel that the cryptocurrency would not have fairly the identical curiosity behind it because it did in 2021, which might be regarding for the sustainability of the rally.

BTC value

As of this writing, Bitcoin is buying and selling round $26,800, down 2% previously week.

BTC consolidates sideways | Supply: BTCUSD on TradingView

Featured picture of Kanchanara from Unsplash.com, charts from TradingView.com, Glassnode.com