Dylan LeClair mentioned Bitcoin’s current sturdy efficiency comes all the way down to the understanding that non-trust is the one approach ahead.

The analysis analyst identified that, in troublesome geopolitical and macroeconomic circumstances, Bitcoin succeeded in reversing the final pattern of the market – because of the rising consciousness that it has no counterparty threat.

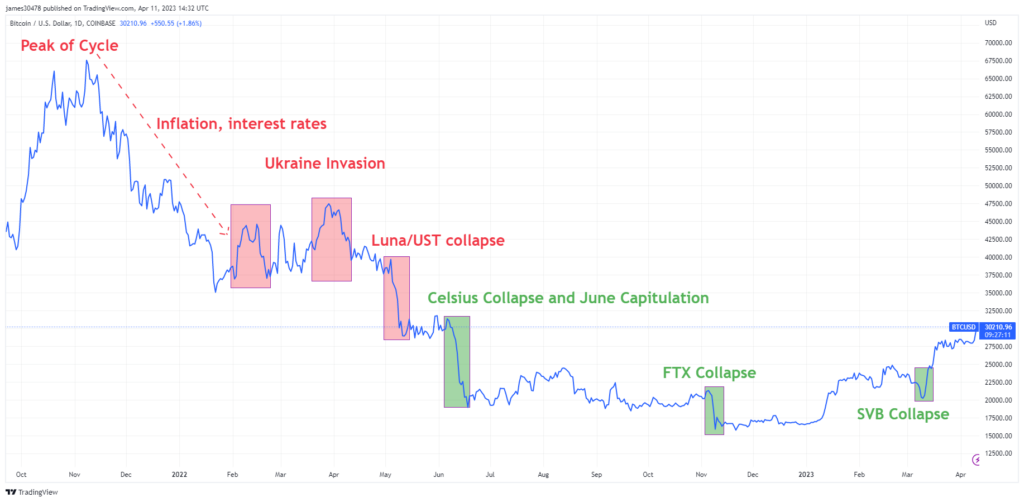

BTC has suffered a pointy decline in worth for the reason that peak in November 2021. Latest occasions, together with a sequence of CeFi bankruptcies, have contributed considerably to suppressing the rally.

Nonetheless, regardless of the misfortune and gloom, Bitcoin broke above $30,000 on April 11, marking a 10-month excessive.

Robust race for Bitcoin

Because the peak in November 2021, Bitcoin has recorded a 78% peak-to-trough loss – reaching a low of $15,500 in November 2022.

Over the previous 18 months, the key cryptocurrency has confronted vital headwinds, beginning with the onset of inflation and the related swing into quantitative easing. Additional uncertainty arose when battle in Japanese Europe erupted in February 2022.

In Might 2022, the UST scandal added additional promoting strain when it emerged that your complete LUNA ecosystem was a fraud from the beginning. The occasion set off a downward spiral, affecting different CeFi platforms and additional exposing components of the trade like an interconnected home of playing cards.

Nonetheless, it was not till the collapse of FTX that the market backside entered. Since then, Bitcoin has risen 94%, with the March 11 interval as financial institution meltdowns unfolding, exhibiting a powerful restoration.

The worst behind us?

Explaining Bitcoin’s run, LeClair mentioned, “Each 4 years, the fraud, the leverage, it is utterly worn out” – leaving the market with majority believers, holding for the lengthy haul.

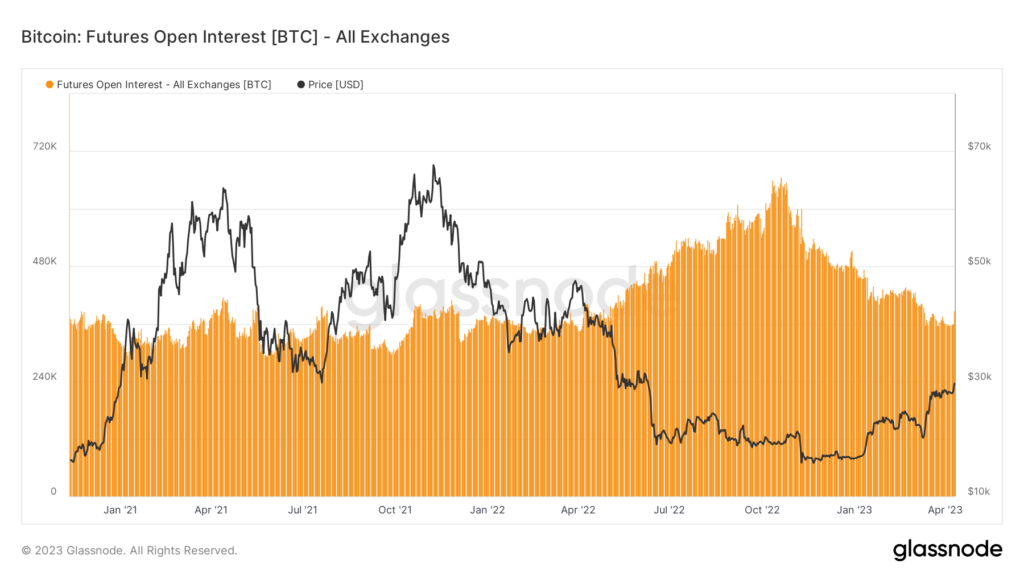

The Glassnode open curiosity chart under helps LeClair’s assertion. It exhibits the variety of open spinoff futures contracts sliding from a peak of round 600,000 in November 2022 to round 400,000 at the moment – roughly in step with historic ranges.

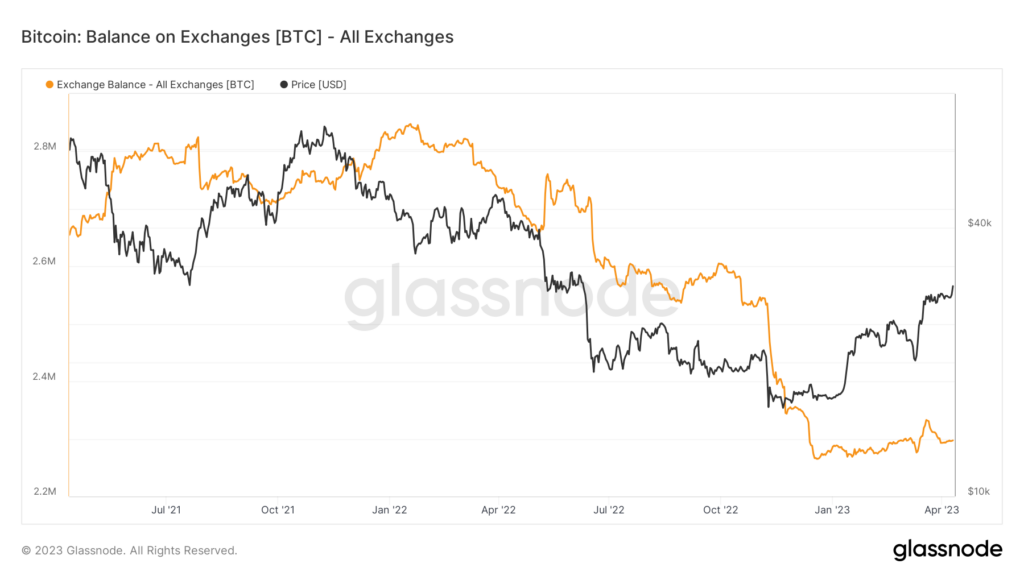

Likewise, the quantity of Bitcoin held on exchanges has decreased considerably over the previous couple of years, signifying a long-term hodling pattern.

LeClair mentioned what’s taking place right here is that folks have realized they wish to maintain a decentralized asset that does not require belief.

“They do not wish to belief a stablecoin. They do not wish to belief any encryption protocol or developer. They wish to maintain a decentralized financial asset with out counterparty threat.

forexcryptozone analyst James Van Straten echoed LeClair’s evaluation, including that on-chain metrics counsel we’re above the worst. Nonetheless, stagflation will proceed to be an element.

Nonetheless, we’re approaching the top of the speed cycle with the chance of a closing 25 foundation level hike. The pause interval will show fascinating, with expectations of rising unemployment and falling equities – if that occurs, Bitcoin’s resilience, as a hedge, will likely be retested.