Bitcoin's value motion over the previous week has been outstanding, marked by a major rise past $100,000.

Though this monumental stage was short-lived, with BTC shortly correcting to round $91,000 earlier than rebounding to round $97,000, it stays a major achievement. Since first breaking the milestone, Bitcoin has crossed the $100,000 mark a number of occasions, indicating that it’s already failing as assist or resistance. The market's capability to take care of these excessive ranges is a testomony to the sturdy underlying demand for BTC.

The truth that Bitcoin has not seen a powerful decline or return to cost ranges under $90,000 after failing to consolidate above $100,000 is a powerful indicator that promoting stress is being happy by an equally sturdy, if not stronger, shopping for curiosity. At this stage, demand stays sufficiently sturdy to thwart any try to decrease costs. Costs round $94,000 confirmed sturdy assist, with a number of declines to those ranges earlier than rebounding.

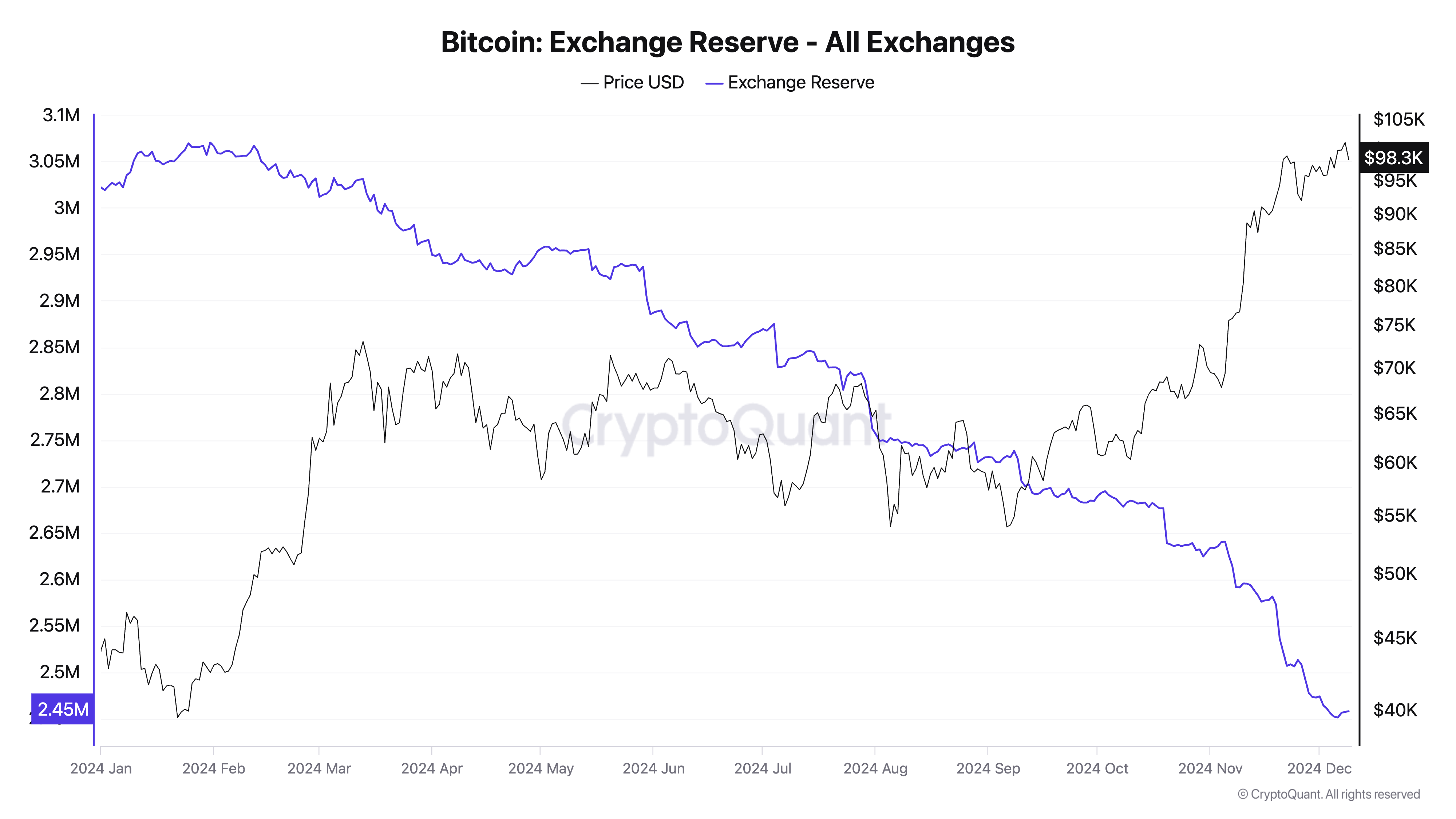

This stability between provide and demand is obvious when wanting on the relationship between international change reserves and internet international change flows. International change reserves – Bitcoin held on centralized platforms – have been steadily declining over the long run and now stand at round 2.45 million BTC.

This development displays a transparent desire amongst market individuals to maneuver Bitcoin into private wallets or chilly storage, demonstrating confidence within the long-term worth of Bitcoin. Declining reserves scale back the availability of Bitcoin out there for rapid sale, which usually helps value stability or upward motion.

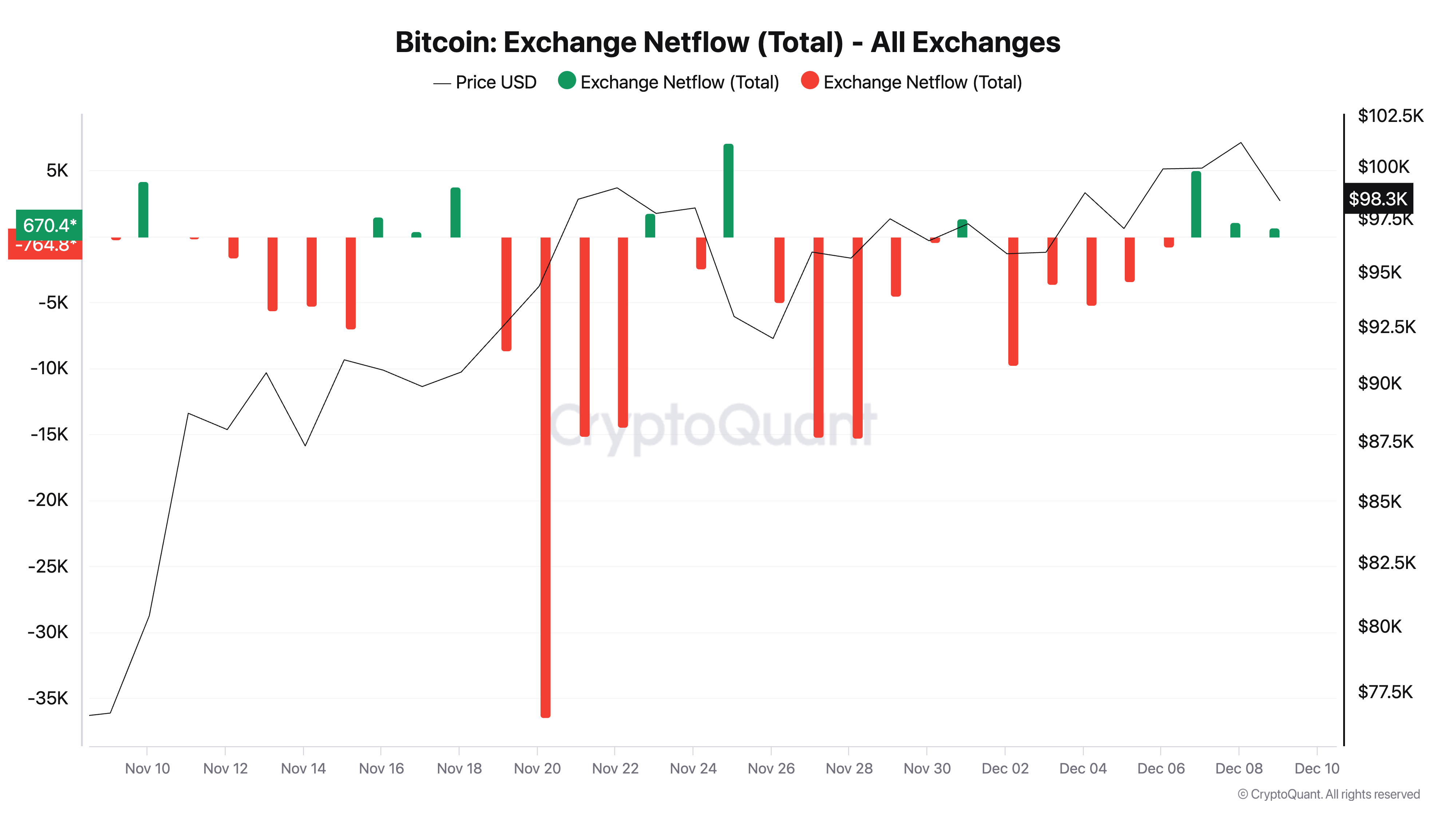

Then again, internet international change flows paint a barely completely different image within the brief time period. Internet flows, which measure the distinction between Bitcoin inflows and outflows to exchanges, have proven occasional spikes in inflows over the previous week. These spikes recommend that some traders are shifting Bitcoin again to exchanges, more likely to take income following the current value rally or to cowl their positions.

Nonetheless, these capital inflows haven’t translated into important downward stress on costs. This corresponds to a precedent forexcryptozone evaluation, which discovered {that a} appreciable portion of the downward value motion comes from the derivatives market.

This means that many of the Bitcoin deposited on exchanges is absorbed by patrons, stopping any substantial value decline. The distinction between dwindling long-term reserves and sporadic short-term inflows highlights a balanced market the place the forces of provide and demand are balanced.

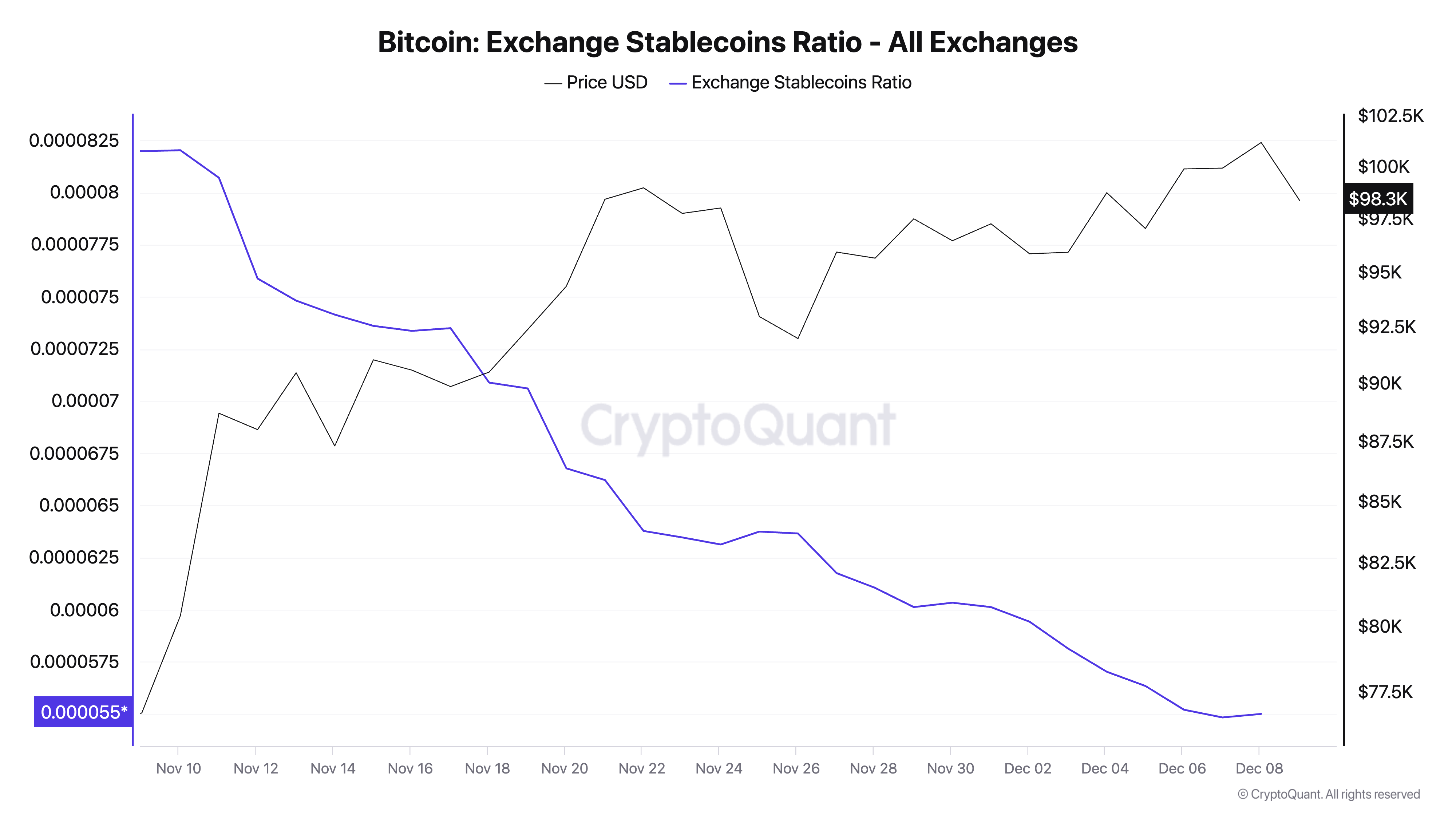

The numerous shopping for stress is additional confirmed by wanting on the stablecoin change ratio. Beforehand analyzed by forexcryptozoneThis metric measures the quantity of Bitcoin reserves relative to stablecoin reserves held on exchanges. A decrease ratio signifies the next proportion of stablecoins, which means exchanges are properly capitalized and have buying energy.

With the stablecoin ratio of exchanges presently at an all-time low, we will see that the market is flush with liquidity and able to take up any promoting stress from exchanges. Having a major variety of stablecoins out there on exchanges permits the market to assist demand for Bitcoin even within the face of elevated promoting exercise, like we noticed when BTC surpassed $100,000.

The low ratio of stablecoins enhances the developments in international change reserves and internet flows. Whereas reserves present a structural decline in out there Bitcoin and internet flows spotlight short-term promoting makes an attempt, the abundance of stablecoins confirms that there’s sufficient capital on the sidelines to soak up these gross sales.

Collectively, these indicators paint an image of a market properly supported by liquidity, even when it goes by means of intervals of profit-taking. This liquidity has probably stored Bitcoin between $95,000 and $99,000 regardless of its incapacity to reclaim $100,000 but.

The lower in international change reserves suggests a discount in gross sales liquidity in the long run, thus making a threat of provide compression. On the identical time, the presence of stablecoins signifies that purchasing curiosity will not be solely current however important sufficient to thwart makes an attempt to promote.

Internet flows act as a real-time measure of short-term sentiment, and the truth that inflows didn’t lead to a value break additional confirms the energy of demand. This creates a suggestions loop through which promoting stress is mitigated by the liquidity supplied by stablecoins, whereas declining reserves make sure that even modest demand can have a major influence on costs.

The put up Bitcoin Holds Steady Close to $100,000 as Promoting Stress is Absorbed appeared first on forexcryptozone.