The unstoppable surge in Bitcoin costs, which started a day after the US presidential elections, is making a ripple impact on the economic system. The worth has lately elevated considerably, with Bitcoin surpassing $89,000 earlier right now, a 27% enhance from the earlier week. Then there are file inflows into Bitcoin ETFs, pushing funds to interrupt information. This worth motion has additionally reshaped the checklist of the world's largest belongings by market capitalization.

#Bitcoin return the cash! Now the eighth largest asset when it comes to market capitalization.🚀 pic.twitter.com/RAPCJd5gd2

– MEXC (@MEXC_Official) November 12, 2024

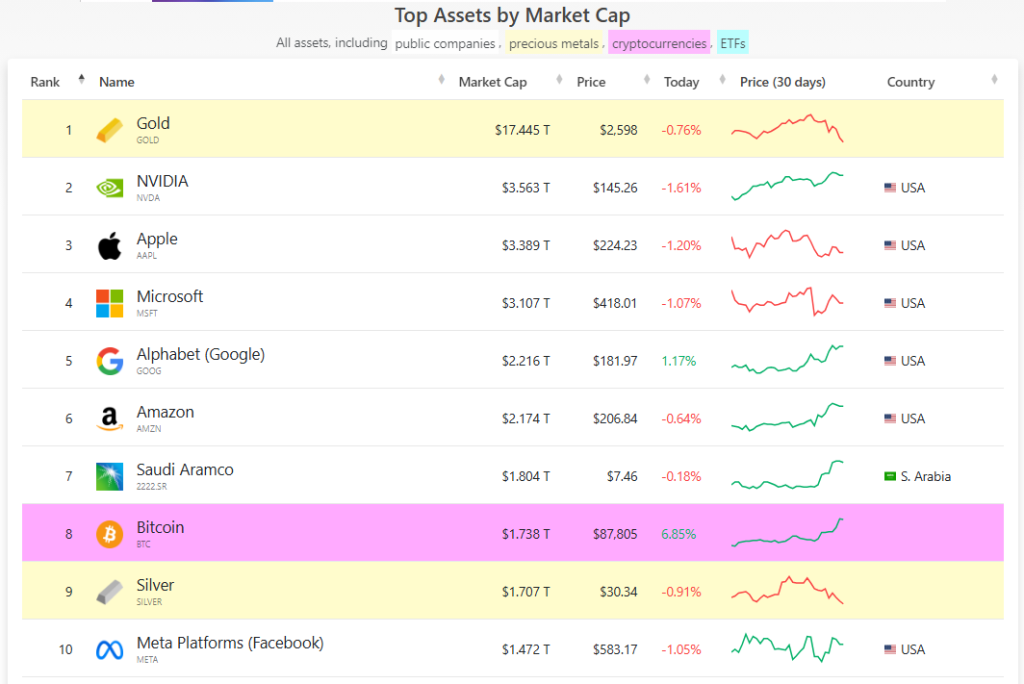

Primarily based on the up to date checklist of high belongings, Bitcoin is now ranked eighth on the “High 10 Property by Market Cap” checklist, with a complete market worth of $1.756 trillion, barely forward of silver, valued at $1.736 trillion. That is the second time the digital asset has surpassed silver within the rankings, pushed by bullish sentiment on Bitcoin ETFs and blockchain typically.

Bitcoin's entry among the many world's main belongings demonstrates the rising public acceptance of the crypto asset and its function as an alternative choice to conventional belongings like gold.

Bitcoin Market Worth Will increase as Worth Surges Above $89,000

Bitcoin continues its stunning rally this week, testing one other all-time excessive at $89,000. On Tuesday, November 12, the digital asset surpassed $89,000, reflecting a rise of 11.3%, whereas silver fell by 2%, permitting Bitcoin to rise to eighth place on the checklist.

With this newest worth motion, Bitcoin is now behind Saudi Aramco, which is ranked seventh. Amazon, Google, Microsoft, Apple, Nvidia and gold spherical out the High 10. Gold stays the world's main asset, with a market capitalization valued at $17.667 billion, eclipsing Nvidia and Apple by round $3 trillion. {dollars} every.

BTC registers a brand new ATH. Supply: Bitstamp

An vital milestone to have fun

Based on The Kobessi Letter, Bitcoin's present market worth and up to date worth motion mirror the digital asset's potential. The remark additional reacted by saying that the worth of gold, which is 10 instances that of BTC, is unbelievable. Nonetheless, he additionally sees even better development potential within the main digital asset.

BTCUSD buying and selling at $87,604 on the day by day chart: TradingView.com

The worth of Bitcoin has been steadily rising lately, thanks partially to Trump's convincing election victory. Trump has a pleasant strategy in direction of the crypto group. With Republicans profitable each homes within the final vote, it will likely be simpler for the brand new president to proceed his pro-crypto insurance policies.

Giant volumes and bullish sentiment amongst institutional traders

Along with the “Trump impact,” Bitcoin can also be recovering because of the bullish sentiment of institutional traders. Many monetary establishments are integrating BTC and cryptos into their wallets, thereby growing the costs of digital belongings. For instance, Bloomberg Senior Analyst Eric Balchunas famous a stable enhance in Bitcoin ETF buying and selling quantity, with iShares Bitcoin Belief (IBIT) having fun with $4.5 billion in buying and selling quantity yesterday.

MicroStrategy is one other firm taking advantage of the Bitcoin rush. Michael Saylor's MicroStrategy holds the most important Bitcoin-based portfolio, with its shares presently buying and selling at $340. On Monday, the corporate introduced that it bought 27,200 BTC, bringing its complete to 279,420.

Featured picture of Siam Bitcoin, chart from TradingView