The trade has at all times been conscious {that a} time would come when a rise in charges would make Bitcoin transactions extraordinarily impractical.

Whereas many assumed that the rising value of transactions would happen with mass adoption, it was the rise of ordinals that precipitated the drastic improve in charges.

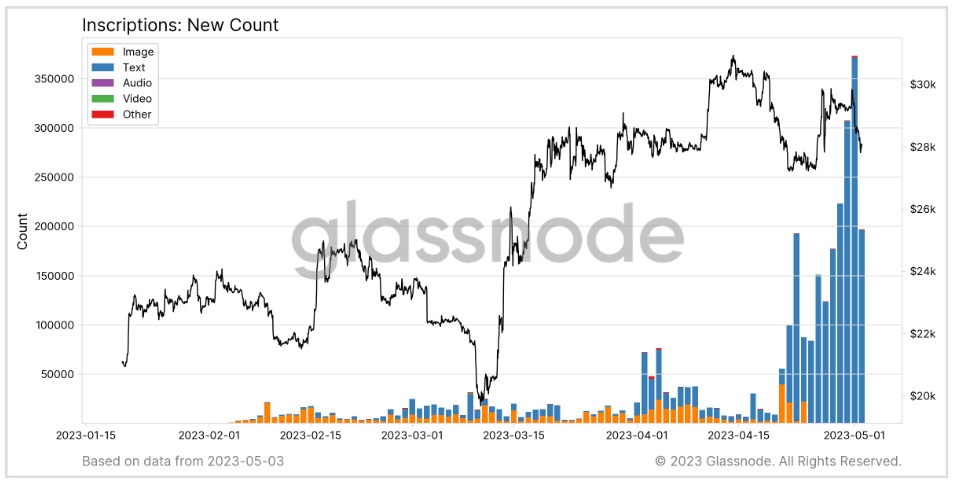

Listings on the Bitcoin blockchain appeared in the beginning of the 12 months and shortly gained recognition. As of Could 1, there have been over 3.2 million Bitcoin listings, with that quantity persevering with to develop because the quarter progressed.

Ordinal signups pushed Bitcoin transactions to their all-time excessive in 2023, with the community finishing over 682,000 transactions in sooner or later.

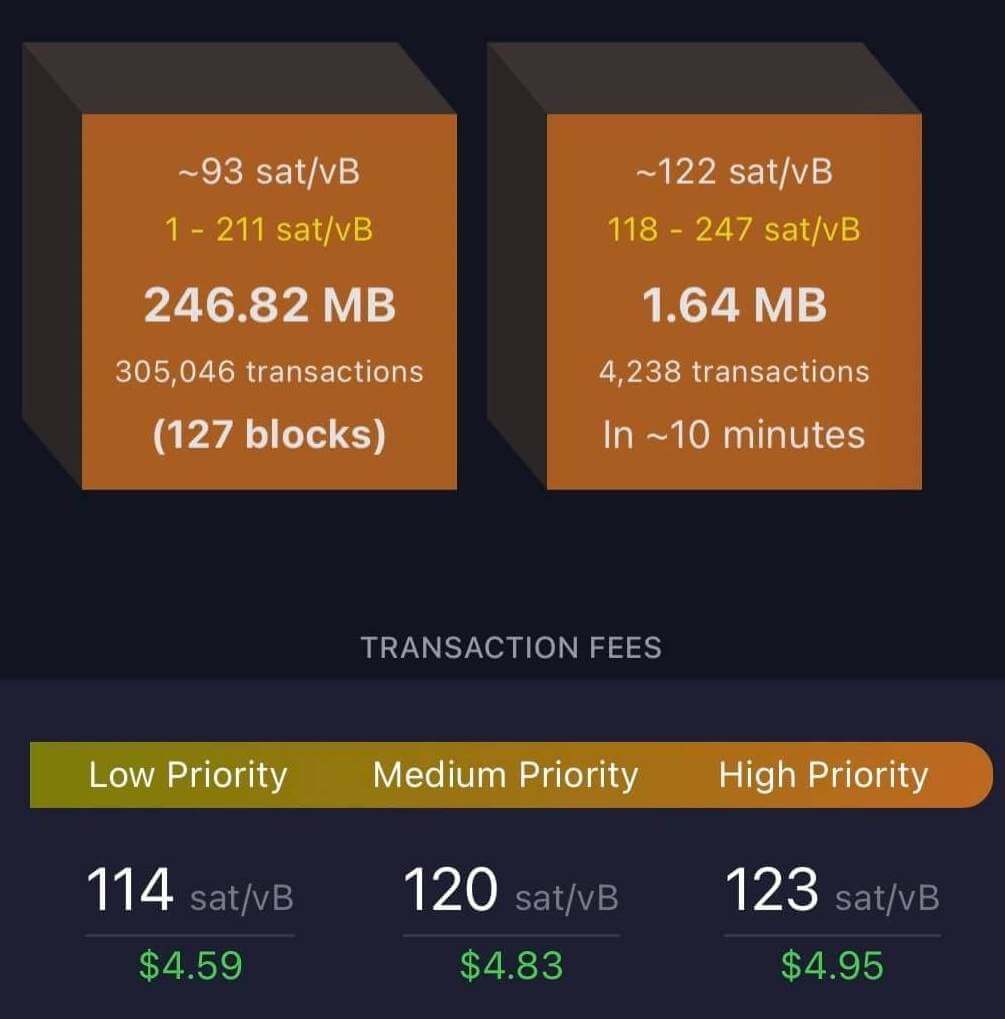

Such a spike in transactions naturally led to elevated reminiscence utilization, with some blocks stuffed with tens of 1000’s of transactions. Information from Mempool confirmed that the common price for low precedence transactions reached $4.59 on Could 2, lowering the distinction between excessive precedence charges to lower than $0.40.

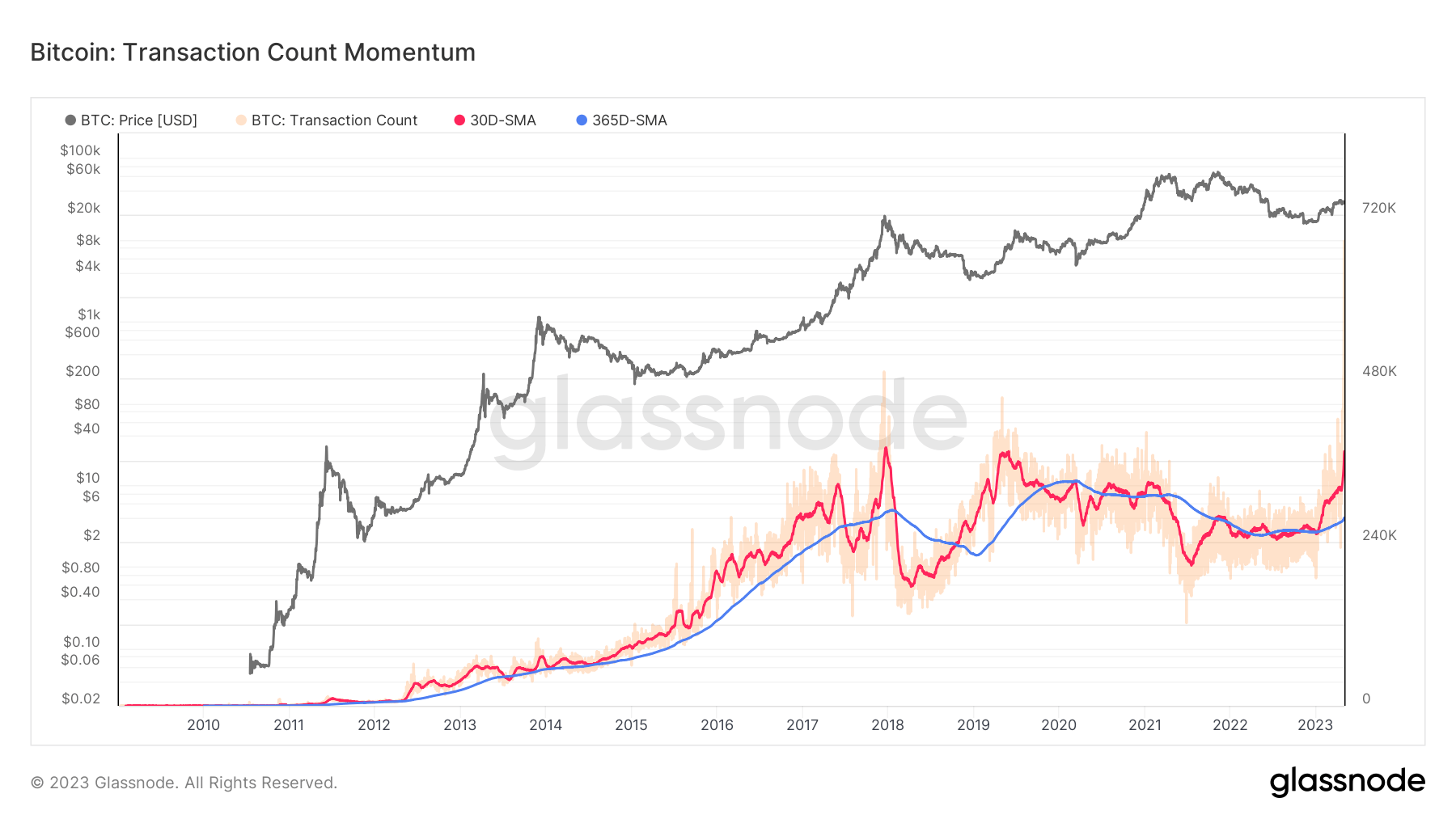

The rise in recognition of ordinals and the rise in charges they’ve precipitated have reignited the talk about Bitcoin’s diminishing block rewards. As the price of mining Bitcoin will increase as extra miners enter the house, there’ll come a time when the reward will not be ample to encourage block manufacturing.

One of many proposed options to this drawback is a rise in miner charges, which might incentivize miners even when block rewards don’t cowl the price of mining. Nonetheless, for a price improve to be possible, there must be much more exercise on the Bitcoin community.

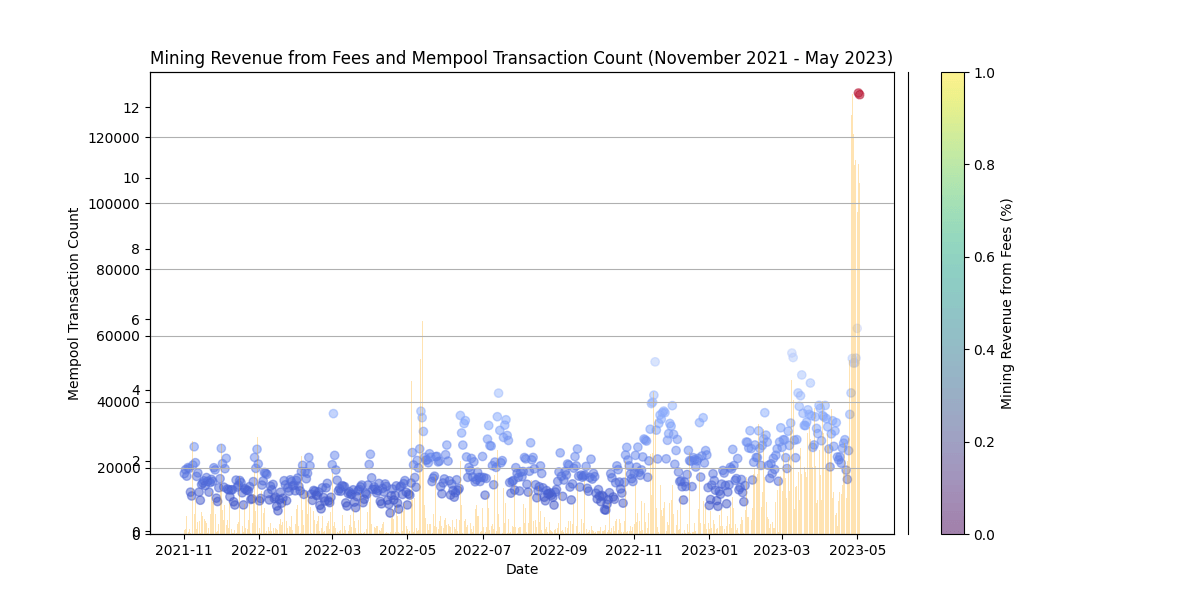

To date, listings have dramatically elevated the share of miner income from royalties. Information analyzed by forexcryptozone confirmed that round 12% of miner income at present comes from charges, a stage beforehand seen solely in bull markets.

Bitcoin listings have drawn criticism from all corners of the crypto market. Nonetheless, each events appear to agree that they’ve highlighted the necessity for a high-speed settlement resolution for BTC, specifically the Lightning Community.

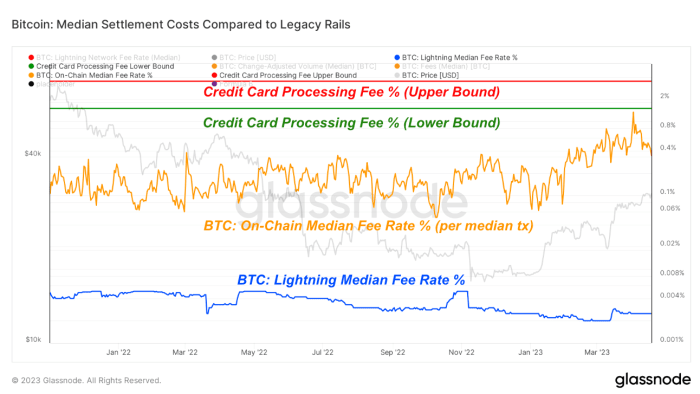

The fee protocol permits quick transactions between collaborating nodes whereas preserving charges extremely low. Evaluation by Bitcoin Journal confirmed that the median price for a Bitcoin flash transaction was round 0.003%. This determine is effectively beneath the decrease restrict of the common bank card processing price in america, which is round 1%.

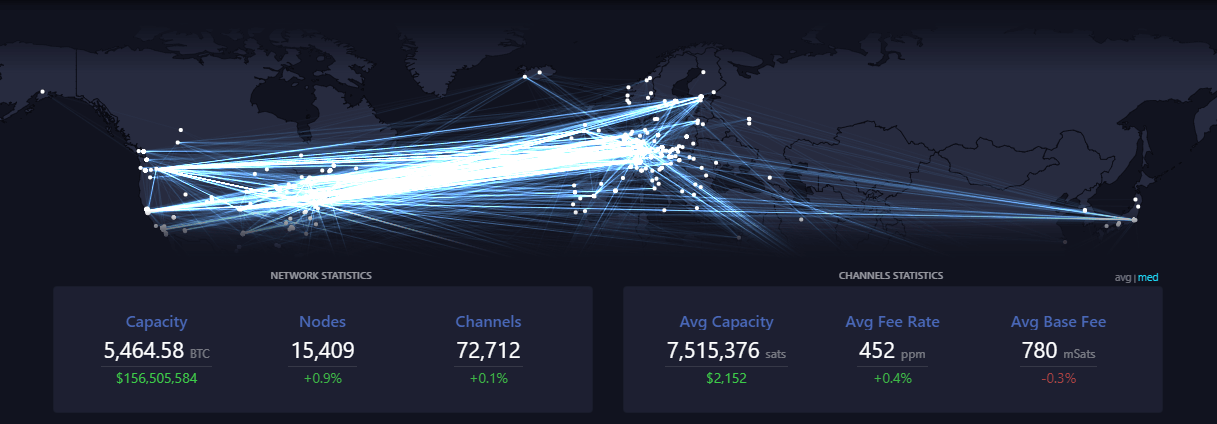

Whereas the recognition of ordinals will definitely decline over time, the community is linked to a different challenge that consumes much more block house. With a capability of 5,400 BTC, 15,400 nodes and over 72,700 channels, the Lightning Community presents itself as the proper resolution for Bitcoin funds.

The article Bitcoin Transactions Rising highlights the significance of Lightning Community and appeared first on forexcryptozone.