Bitcoin (BTC) is at the moment going by means of a tumultuous time, as crypto dealer and analyst Ali Martinez factors out. With a eager eye on market traits, Martinez took to Twitter to share his perception that Bitcoin’s worth is about to drop additional.

In line with his evaluation, Bitcoin seems to be succumbing to downward strain from a number of key help ranges, signaling a better chance of a big correction. Martinez means that the alpha coin could possibly be on a trajectory in the direction of a key demand wall.

Because the crypto group eagerly awaits the longer term route of prime crypto, this anticipated downturn has the potential to reshape the cryptocurrency market panorama.

Discover that #Bitcoins appears to lose all main help areas. This will increase the chance of a correction on the subsequent main demand wall between $23,200 and $24,000, the place 850,000 addresses beforehand purchased 340,000 $BTC. pic.twitter.com/IvBLJKiSVw

—Ali (@ali_charts) Could 24, 2023

Bitcoin Help Ranges Shaken: Main Correction Potential

Confronted with an evolving panorama of the cryptocurrency market, the primary cryptocurrency, Bitcoin, is going through a worrying state of affairs as famous Martinez’s tweet. It seems that BTC is at the moment experiencing declines in all main help areas, rising the possibilities of a considerable correction.

Buyers and fans are bracing as Bitcoin’s trajectory seems to level in the direction of a vital demand wall situated between the $23,200 and $24,000 ranges.

Supply: IntoTheBlock

Inside this significant space is a exceptional transaction historical past, the analyst identified, the place a staggering 852,000 traders acquired roughly 341,000 BTC, with an estimated worth of $8,946,930,000. This accumulation of BTC on the demand wall signifies a considerable degree of curiosity and potential help, making it a significant threshold for market members to look at.

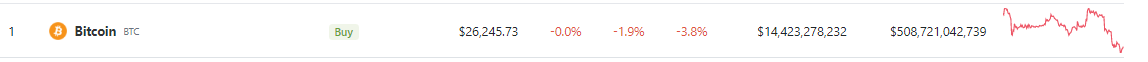

Bitcoin’s present worth stands at $26,245, as reported by CoinGecko. Nonetheless, latest developments have resulted in a drop of practically 2% prior to now 24 hours alone. From a broader perspective, the previous week has seen a gradual decline of three.8%, illustrating the unstable and ever-changing nature of the digital asset market.

Supply: Coingecko

BTC Dilemma: Ready for an Imminent Resurgence or Fall

The present state of Bitcoin presents a dichotomy, with two opposing views. Some see it resting cautiously on a slender ledge across the $27,000 mark, able to resume its ascent. Nonetheless, others see it as clinging precariously, its grip slipping, and anticipate an inevitable decline within the mid-20s or probably even decrease.

BTCUSD weakens to the $26,253 degree at this time. Chart: TradingView.com

Antoni Trenchev, co-founder and managing companion of crypto lender Nexo, expressed this sentiment in a Baron’s reporthighlighting the 2 distinct views surrounding Bitcoin’s future.

Bitcoin’s latest underperformance in opposition to conventional inventory indices provides to rising apprehension. Regardless of elements such because the US debt ceiling disaster exerting a extra instant affect on shares, Bitcoin has lagged behind the Dow Jones Industrial Common and the S&P 500 in latest days. This discrepancy raises considerations and presents a worrying signal for market members.

-Featured picture from Crunchbase Information