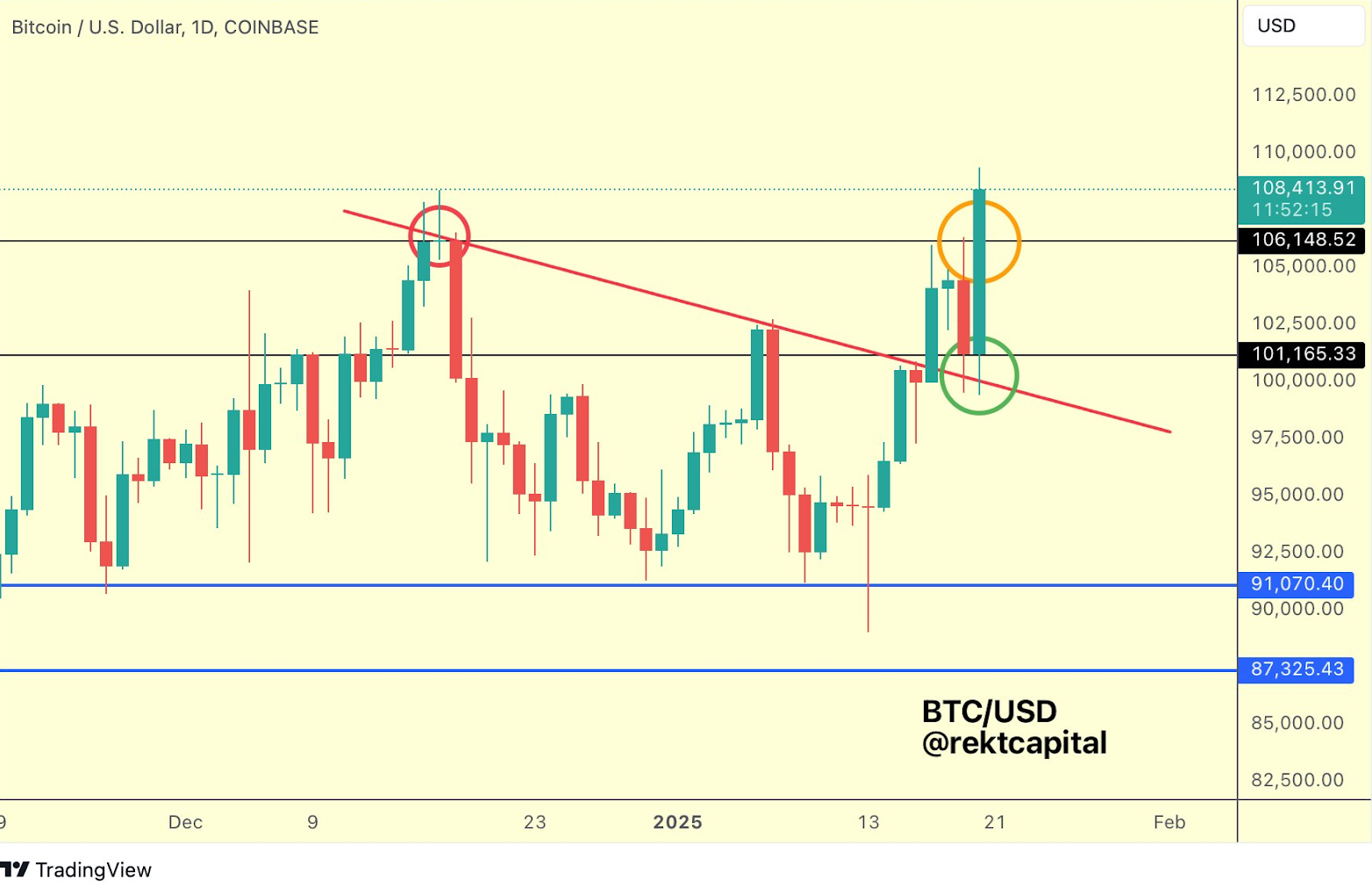

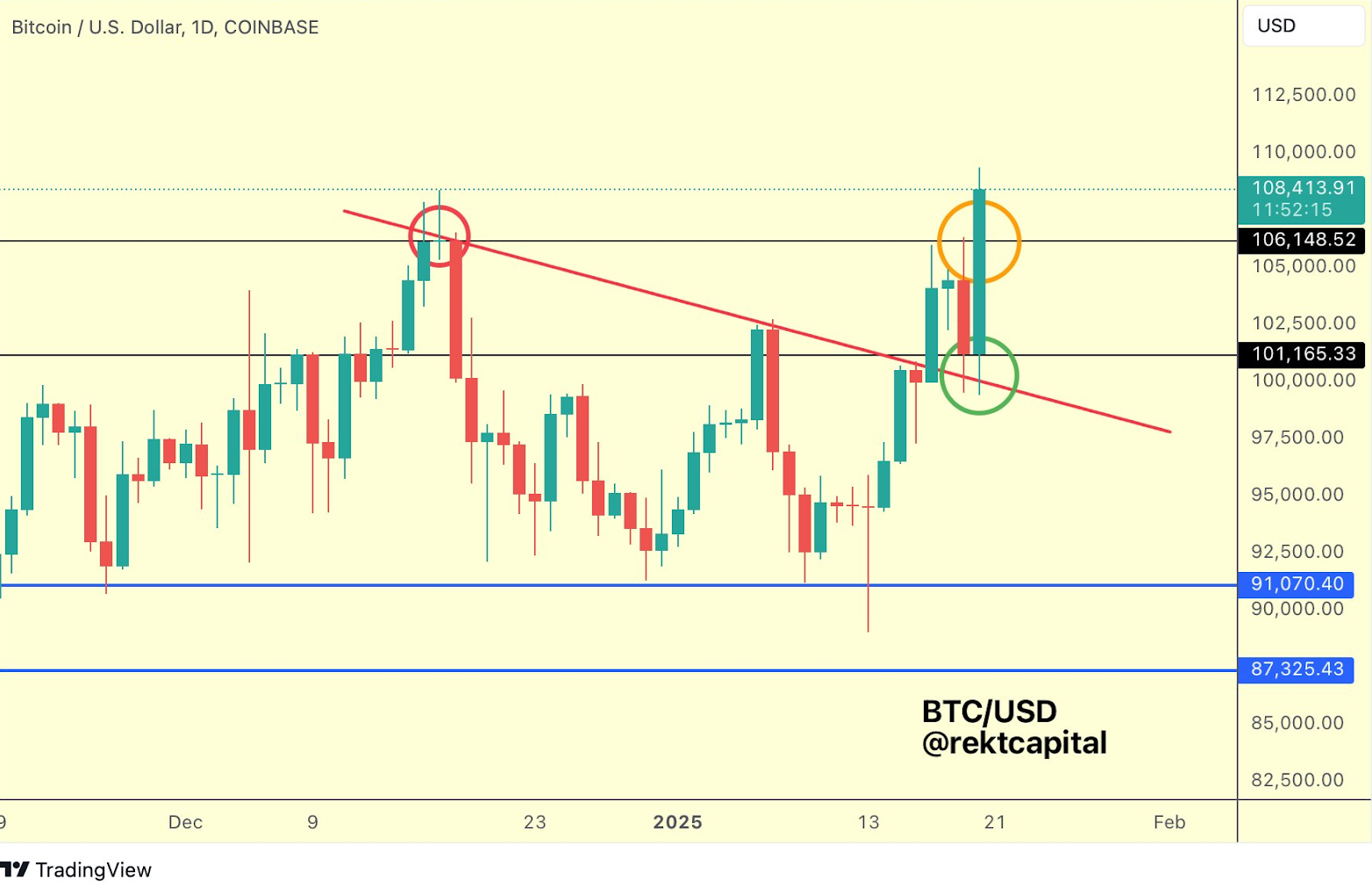

- Bitcoin value is at present testing assist ranges under the $101,000 stage.

- Bitcoin's slight correction suggests much less volatility than earlier pullbacks in 2021 and 2017

- A break above $107,000 might set off a brief squeeze, pushing Bitcoin to new highs.

The value of Bitcoin as soon as once more fell under $101,000, sparking considerations out there. Despite the fact that the market is at present in a state of flux, that doesn’t imply the uptrend is over.

In line with analyst Rekt Capital, Bitcoin is in a parabolic ascending partwhich suggests we are going to see a sequence of value positive factors adopted by corrections.

These ups and downs have been seen in previous Bitcoin markets, equivalent to throughout the 2021 bull run. On the time, Bitcoin skilled a number of value rises earlier than a correction after which a bear market.

What occurred in 2021 and 2017?

In 2021, Bitcoin didn’t endure the everyday retest after a breakout, which means it rose with out revisiting key resistance ranges. However, the 2017 cycle noticed Bitcoin efficiently retest and make sure outdated resistance as new assist earlier than the value continued to rise.

Associated: Bitcoin Dominance Mirrors Mannequin 2020/2021: What Might This Imply?

Proper now, Bitcoin seems to be in the course of its personal value discovery part. The most recent correction is kind of gentle, with a decline of simply 17% over 5 weeks, which is way much less dramatic than the 31% and 34% declines seen in 2021 and 2017. This might point out that the market is turning into much less risky in its corrections.

Bitcoin's subsequent step: new ATHs quickly?

For Bitcoin to proceed its rally, it should break by way of key resistance ranges and set up a powerful weekly shut above them. Bitcoin now faces sturdy resistance between $106,000 and $107,000.

In the meantime, assist is forming across the Vary of $100,000 to $103,000which helps stabilize the value. To succeed in new highs, Bitcoin should shut above $107,000, which might set off a brief squeeze and ship costs larger.

Associated: Bitcoin in 2025: Can optimism match actuality? Precise Value Forecast

Within the coming weeks, the value of Bitcoin will seemingly be decided by whether or not it follows the sample of 2021, the place a breakout occurred with out retesting, or whether or not it strikes extra towards the method of 2017, the place the brand new stress check was essential.

Regardless, the primary level is {that a} agency weekly shut above present resistance might imply Bitcoin is gearing up for brand new all-time highs.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.