- Bitcoin's rally in September, the place the crypto rose 21%, was largely pushed by Chinese language stimulus plans.

- Market contributors are disenchanted as a result of the Chinese language authorities's restoration plans haven’t met their expectations.

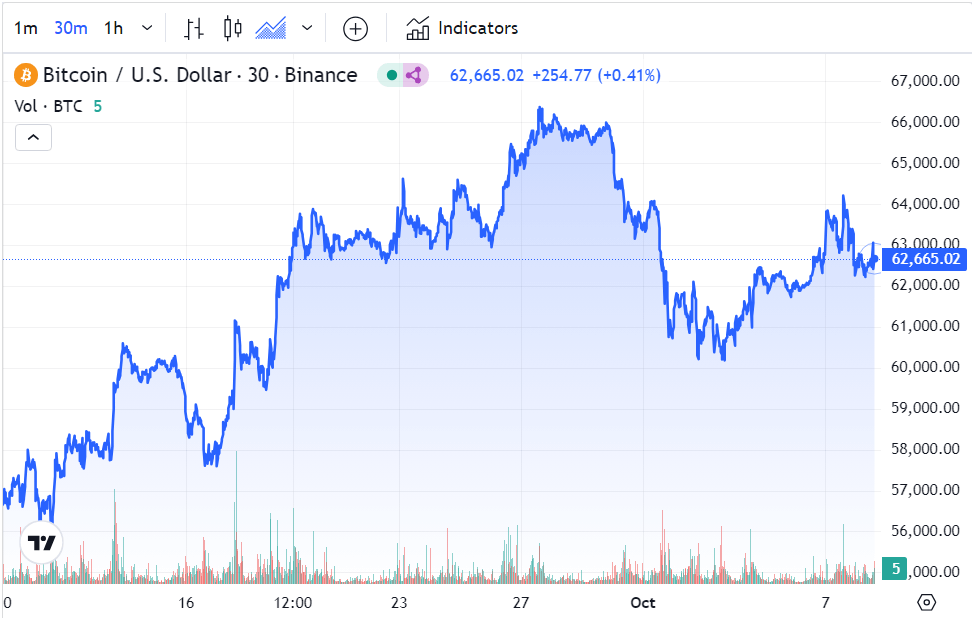

- Bitcoin has failed to remain above $64,000 because the market searches for a catalyst regardless of “Uptober” expectations.

The newest Bitcoin rally, which started in early September and is believed to have been largely pushed by Chinese language stimulus plans, has began to expire of steam. The biggest crypto by market cap briefly crossed the $66,000 mark on September 27 however was unable to maintain the rally. As of October 2, it has fallen to $60,000 and is buying and selling at $62,700.

Chinese language stimulation

Whereas September is traditionally a bear month for cryptos, Bitcoin carried out favorably final month, largely due to the Individuals's Financial institution of China's (PBOC) stimulus program in response to slowing financial progress and declines. Fed fee.

The PBOC reduce charges on medium-term loans and 7-day repo to spice up financial exercise, a transfer identified to enhance sentiment round dangerous property. Mortgage charges and minimal down cost necessities for all housing sorts have additionally been lowered to assist China's actual property market.

The federal government was nonetheless anticipated to be keen to proceed its restoration efforts by means of a multibillion-yuan spending plan; Nonetheless, the federal government introduced it might spend 100 billion yuan of its 2025 finances plus one other 100 billion to assist the development sector, removed from expectations.

Bullish Pattern Catalysts for the Crypto Market

The deal with Chinese language stimulus comes at a time when the crypto market is ready for a catalyst to spur a rally. The Fed's 50 foundation level rate of interest reduce in September ought to herald a rally, however October has been disappointing as Bitcoin struggles to interrupt above the $64,000 degree and institutional flows into US Bitcoin (and Ethereum) Spot ETFs Decline.

Bitcoin fell round 1% after the federal government's stimulus plans had been introduced, however recovered considerably in the course of the London buying and selling session.