- The technique holds 499,096 BTC, price $ 40.9 billion, with a median value of $ 66,357.

- Since November 2024, the technique has added 246,876 BTC, confronted with a lack of $ 3 billion.

- The technique accomplished a convertible ticket provide of $ 2 billion, including 20,356 BTC in 2025.

The domination of the Bitcoin market stays with the technique, the previous microstrategy of Michael Saylor.

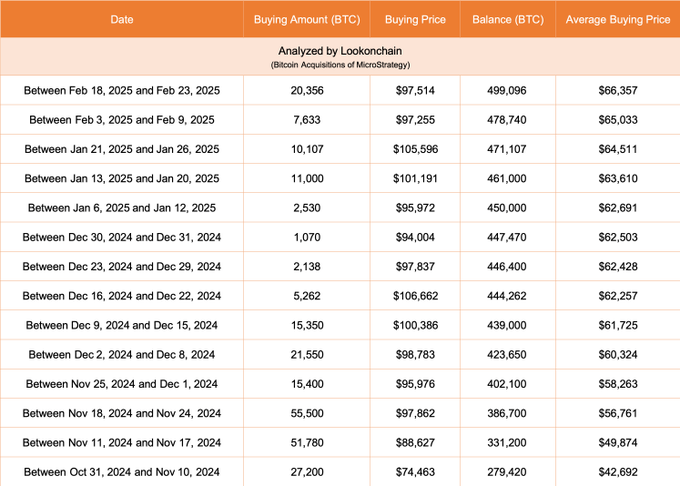

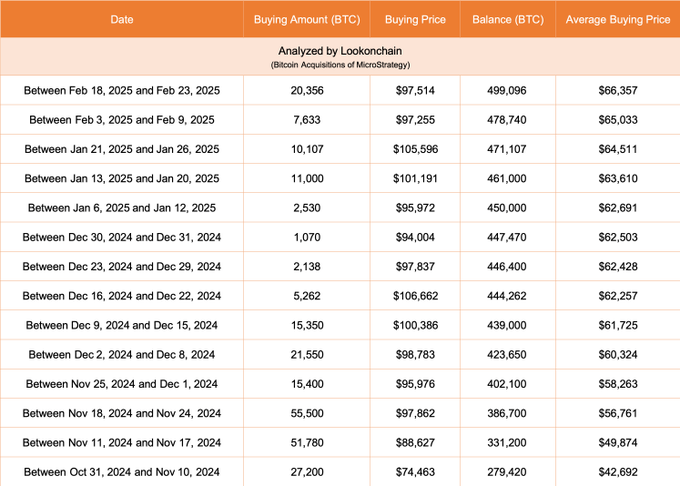

Lookonchain's newest knowledge reveal that in February 2025, the corporate held 499,096 BTC. This Bitcoin cache is estimated at round $ 40.9 billion.

Common Bitcoin of the Technique: $ 66,357 – Latest purchases now underwater

The typical buy value of this reserve is on common $ 66,357 per Bitcoin. Regardless of this total common, the technique is at the moment confronted with a lack of paper throughout its most up-to-date acquisitions.

This case raises questions on its technique and the longer term prospects of its Bitcoin participations.

In relation: Investor alert: The change of tax rule endangers $ 46 billion within the technique of $ 46 billion

Lack of paper of $ 3 billion on Bitcoin purchases since November 2024

Since November 2024, the technique has grown to aggressively its Bitcoin holdings. The corporate added 246,876 BTC at a median value of $ 94,035 per room. This collection of acquisitions value 23.2 billion {dollars} to the corporate.

Nonetheless, the volatility of the inherent costs of Bitcoin indicated that these newly bought belongings have decreased in worth. They’re at the moment price $ 20.2 billion. This worth decreases in a lack of paper of round 3 billion {dollars}.

Superior buying spree: 55,500 BTC added in a single week to $ 97,862

Probably the most intensive purchases occurred between November 18 and November 24, 2024. Throughout this week, the technique acquired 55,500 BTC at a median value of $ 97,862 per room. This choice additional elevated the corporate's whole bitcoin reserves of the corporate to 386,700 BTC.

The unshakable wager of the Bitcoin technique regardless of the market swings

Technique Bitcoin acquisitions have seen ups and downs. The typical costs have fluctuated over time. Particularly, the biggest acquisition of the corporate happened between February 18 and 23, 2025. Throughout this week alone, it added 20,356 BTC at a median value of $ 97,514.

Regardless of the latest slowdown in Bitcoin's market worth, the technique continued so as to add to its reserves. The corporate's bitcoin holdings are nonetheless rising. This present accumulation displays its long-term cryptocurrency technique.

2 billion {dollars} in Enhance Fuelle funding from different Bitcoin acquisitions

Including to its acquisition energy, the technique has simply completed a convertible ticket provide of $ 2 billion.

This infusion will additional strengthen its monetary scenario. This new funding allowed the corporate so as to add 20,356 BTC to its belongings for round $ 1.99 billion. This buy additionally strengthened the worldwide acquisition of the corporate in 2025, producing a BTC return of 6.9% of the 12 months in the beginning of the 12 months.

In relation: Microstrategy strengthens as “technique”, doubles with bitcoin

As of February 23, 2025, the technique amassed 499,096 BTC. These belongings have been acquired for round $ 33.1 billion at a median value of $ 66,357 per Bitcoin. Even with the slowdown in acquisitions in latest weeks, the corporate stays one of many holders of crucial firms in Bitcoin.

Non-liability clause: The data offered on this article is just for informational and academic functions. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for the losses suffered because of the usage of the content material, services or products talked about. Readers are suggested to be cautious earlier than taking motion -related measures.