Following the occasions of the previous week, it's extra a query of “when” than “if” the value of Bitcoin will attain a historic six-figure worth. Cryptocurrency remark channels and waves have been largely busy, with the highest cryptocurrency doubtlessly hitting $100,000 in latest weeks.

A six-figure worth for BTC isn’t solely a powerful milestone for all the crypto business, but in addition one which comes with “adversarial” occasions reminiscent of liquidations for brief merchants. Right here's a sneak peek from the channel on what's subsequent if the value of Bitcoin exceeds $100,000.

What's subsequent for BTC worth after $100,000?

In a latest report, blockchain analytics agency Glassnode shared an summary of the highest cryptocurrency's on-chain efficiency because the begin of its newest rally. Though the $100,000 mark appears inevitable, the blockchain firm expects the Bitcoin worth to lose some momentum after crossing the goal.

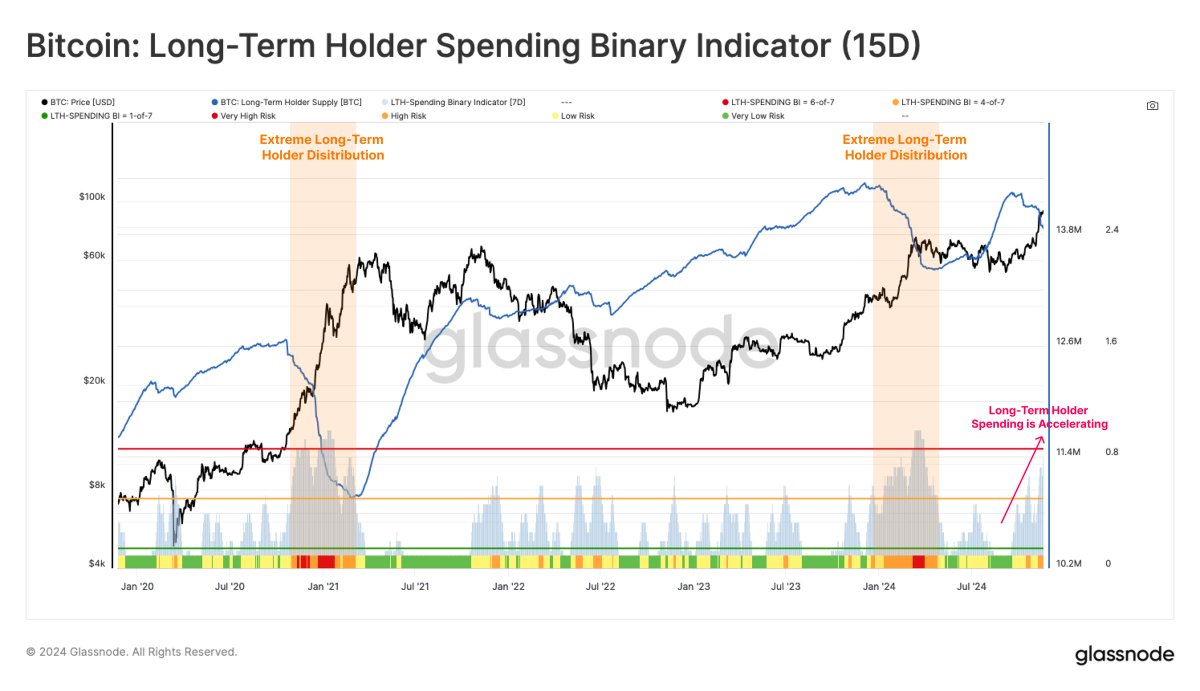

One motive behind this projection is the latest habits of a cohort of buyers referred to as long-term holders (LTH). In line with Glassnode, long-term holders are beginning to dump their property to make earnings and will wait to promote extra cash as worth motion continues to strengthen.

Supply: Glassnode/X

Based mostly on information from the LTH Binary Spending Indicator, which tracks the depth of promoting strain from long-term holders, these giant buyers are more and more distributing their property. This binary spending metric exhibits that LTH stability has decreased in 11 of the final 15 days.

Whereas demand from institutional buyers, notably by way of U.S. spot exchange-traded funds (ETFs), has absorbed 90% of the promoting strain from long-term buyers, Glassnode famous that spending strain from this cohort of buyers has began to exceed ETF internet inflows in latest days. This pattern was additionally seen earlier in February 2024.

In line with Glassnode, if promoting strain continues to outpace ETF demand, it might trigger short-term worth volatility or result in worth consolidation. The on-chain firm stated:

Nonetheless, since November 13, LTH gross sales strain has begun to outpace ETF internet inflows, echoing a pattern seen in late February 2024, the place the imbalance between provide and demand led to elevated volatility available in the market and consolidation.

$1.89 billion will probably be liquidated if Bitcoin worth exceeds this degree

In a November 22 article on X, outstanding cryptocurrency analyst Ali Martinez issued a warning to Bitcoin bears. In line with CoinGlass information, a whopping $1.89 billion is anticipated to be liquidated if the Bitcoin worth hits $100,625.

Supply: Ali_charts/X

On the time of writing, the main cryptocurrency is valued at $99,424, reflecting a 1.4% worth improve over the previous day. Knowledge from CoinGecko exhibits that the value of Bitcoin has seen a way more spectacular run on the weekly time-frame, growing by virtually 10% over the previous seven days.

The worth of Bitcoin on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView