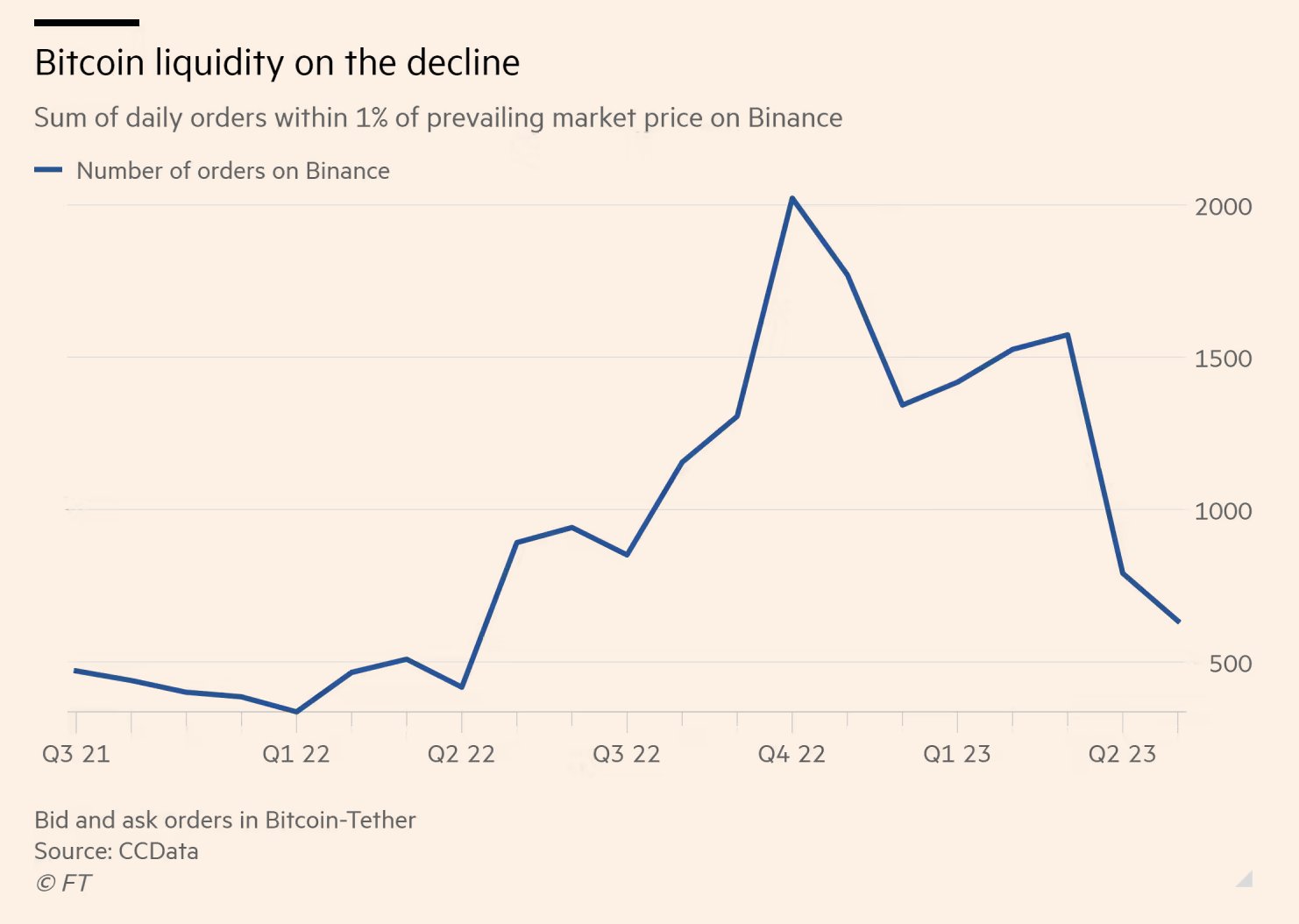

The bear market and the US authorities operation Choke Level 2.0 proceed to go away their mark on the Bitcoin market. Liquidity has fallen in current weeks and months.

Barchart, a number one supplier of real-time intraday inventory and commodity charts, at the moment reviews that this pattern continues at present, market depth for BTC and the market’s hottest stablecoin, the USDT hitting a brand new 15-month low.

Market depth refers back to the skill of the market to soak up massive market orders with out considerably affecting the worth. The metric takes into consideration the scale and whole quantity of open orders, bids and affords.

On the finish of April, in response to CCData, it will have taken an order of simply 462 BTC to maneuver the worth of the asset by no less than 1% in both path. In line with Barchart, that is the bottom market depth for BTC-USDT since Could 2022, when the main cryptocurrency fell massively following the COVID crash.

Market information supplier Materials Indicators shared a chart yesterday displaying that Bitcoin whales are at present being compelled to separate their massive purchase and promote orders into smaller ones as a result of excessive slippage ensuing from low liquidity.

“In case you’re questioning why yellow is shopping for BTC right here and never mega brown whales, it is most likely not retail vs. sensible cash. It is as a result of liquidity between right here and 29,100 $ is so skinny that slippage on a whale-sized order could be vital, so they’re actually compelled to make smaller orders,” the specialists defined through Twitter, sharing the chart beneath.

Bitcoin stronger than final bear market

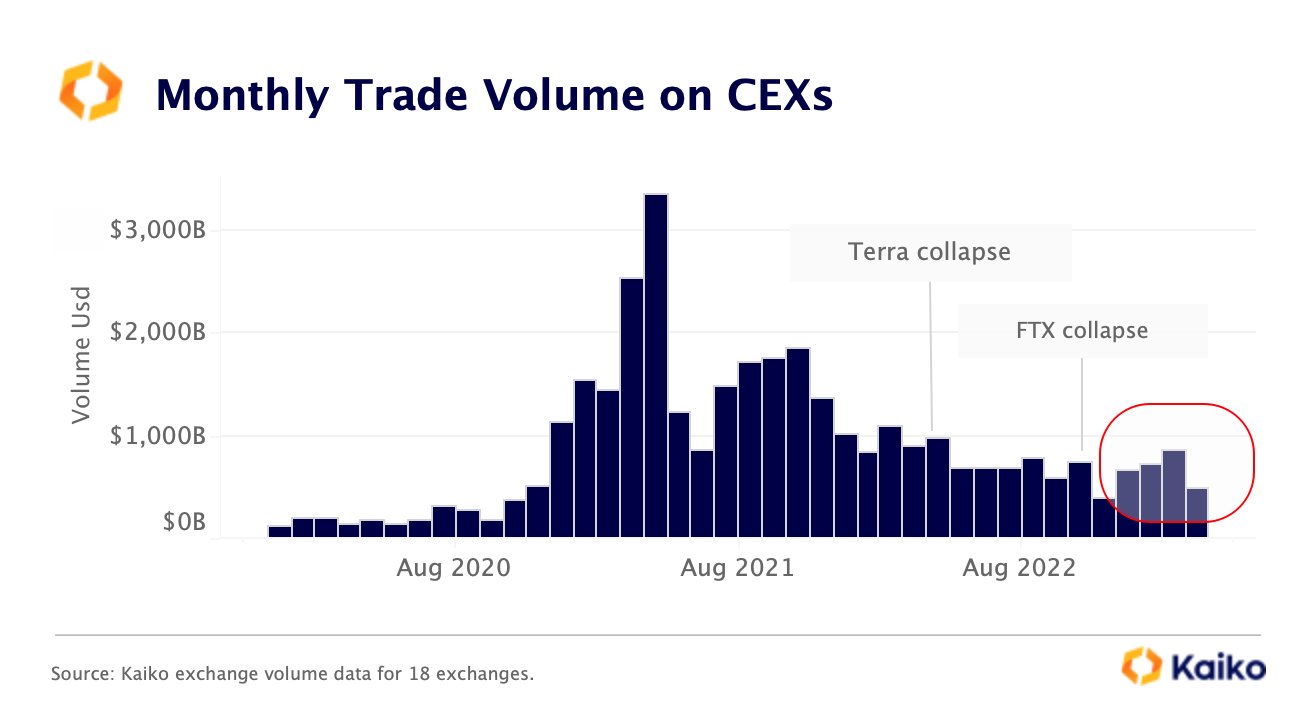

The information supplier just lately shared comparable information, though it additionally affords a glimmer of optimism. Two days in the past, Kaiko mentioned buying and selling volumes on central exchanges declined in April after rising for 3 consecutive months and surpassing pre-FTX ranges in March.

On the brilliant facet, nevertheless, the crypto market as a complete is considerably bigger than it was earlier than the 2020 bull market. Moreover, quarterly buying and selling quantity on Coinbase, the most important US change, s has stabilized above $140 billion over the previous three quarters. Regardless of this, nevertheless, it’s nonetheless half of the 2021 common.

When it comes to liquidity, nevertheless, Kaiko additionally notes deterioration, with Bitcoin and Ethereum approaching 1-year lows with 2% market depth. A pattern Kaiko is seeing proper now’s that perpetual futures are more and more driving value motion.

“Perp-to-spot quantity is the best in almost 2 years, and value discovery is going on in derivatives markets,” notes Kaiko Researcher Conor Ryder. On the query of which path the Bitcoin value is shifting in, Ryder says:

There was an enormous buildup of lengthy positions in mid-April, however as quickly because the funding flipped, destructive costs peaked. OI (Open Curiosity) on a downtrend as with value, funding stays blended, so no clear pattern. However the chart exhibits how a lot futures really drive costs proper now.

As of press time, Bitcoin value stands at $29,220.

Featured picture from iStock, chart from TradingView.com