- Bitcoin hits all-time excessive of $94,002, however social sentiment stays impartial.

- Regardless of the detrimental sentiment within the Crowd Fearful Zone, Bitcoin has traditionally skilled value progress.

- MACD signifies strong bullish momentum, however RSI means that Bitcoin may face a correction quickly.

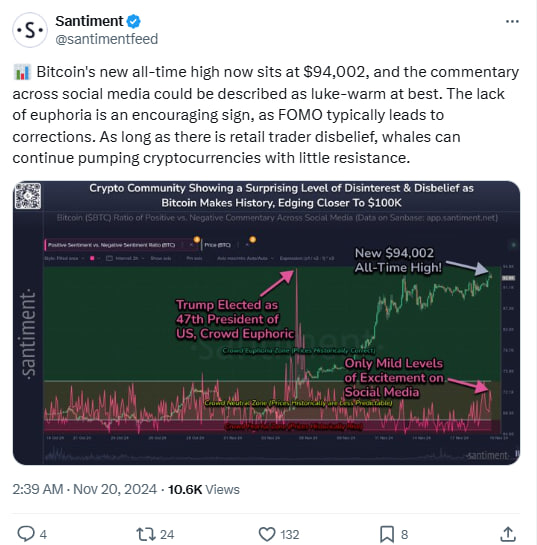

Bitcoin hit a brand new all-time excessive of $94,002. However regardless of this milestone, reactions from social media and the crypto neighborhood have remained surprisingly muted.

Based on Santiment knowledge, Bitcoin's rise to new highs didn’t set off the standard waves of euphoria typically seen throughout value surges. The chart reveals that even with Bitcoin approaching $100,000, sentiment on social platforms has remained comparatively impartial, with solely occasional spikes of positivity.

Moreover, Bitcoin’s transfer into the “impartial zone” in sentiment evaluation may imply decrease volatility and steadier progress. Traditionally, impartial sentiment has typically coincided with much less correct value forecasts, making the market's short-term outlook unpredictable.

“Crowd Worry Zone” Might Sign Constructive Value Motion

One other attention-grabbing level of sentiment evaluation is the habits of Bitcoin costs throughout “Crowd Fearful Zone” intervals. Knowledge exhibits that the value of Bitcoin elevated when social sentiment was fearful or detrimental.

This pattern means that the market can resist conventional sentiment indicators and that Bitcoin value actions can typically problem the broader social temper.

Present State of the Bitcoin Market: An Overview

Based on the newest replace from CoinMarketCap, Bitcoin is buying and selling at $91,679.08, registering a rise of 0.46% over the previous day, the market cap stands at $1.81 trillion, with a buying and selling quantity of $74.93 billion, a slight quantity enhance of 0.83%. .

Additionally learn: Bitcoin goals for $100,000 by year-end, analysts hyperlink sharp rise to Trump's crypto push

Regardless of the declines throughout this era, Bitcoin remained in a decent value vary, sustaining its stability beneath the $92,000 mark.

Technical indicators additionally spotlight the energy of the Bitcoin market. The MACD is displaying a powerful bullish sign, with the MACD line above the sign line, supported by ascending histogram bars. This indicators robust shopping for strain supporting Bitcoin’s value motion.

Nevertheless, the RSI stands at 75.43, signaling that Bitcoin is in overbought territory.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.