The on-chain knowledge reveals a development within the present Bitcoin cycle that’s totally different from the sample adopted in earlier eras.

Extra Bitcoin has left trades within the present cycle thus far

In line with knowledge from the on-chain analytics firm glass knot, earlier cycles have seen the stability on exchanges document a marked improve. “Steadiness on exchanges” right here refers back to the complete quantity of Bitcoin that’s presently within the wallets of all centralized exchanges.

When the worth of this metric will increase, it implies that traders are presently depositing a web variety of cash on these platforms. Then again, a drop implies that pullbacks are occurring out there proper now.

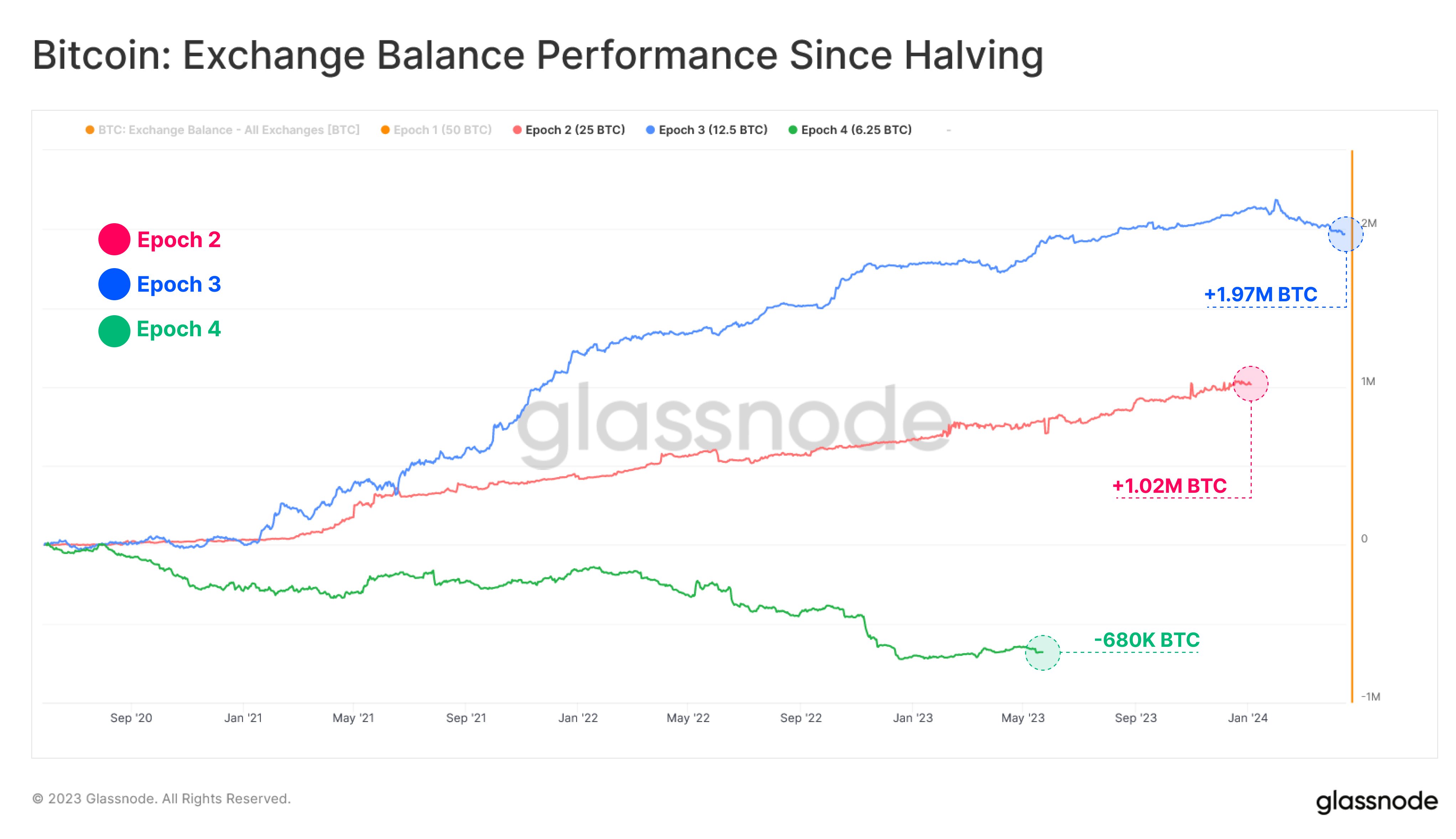

Here’s a chart that reveals how the worth of this Bitcoin indicator has modified over the previous two cycles and within the present time thus far:

Seems to be like the present cycle is displaying a unique development than what was seen earlier than | Supply: Glassnode on Twitter

Glassnode took “halves” as the place to begin for every of the cycles or eras right here. Halvings are periodic occasions the place miners’ block rewards (which they obtain for fixing blocks on the community) are completely halved. These happen roughly each 4 years.

These occasions have far-reaching penalties for the cryptocurrency financial system, as the speed of manufacturing of the asset is restricted following them. This narrative behind the halves can be so sturdy that the peak of bullfights has all the time occurred after them.

From the graph above, it’s seen that in epoch 2, i.e. the second cycle noticed by the asset, the Bitcoin stability on the exchanges skilled a web progress of 1.02 million BTC. The following cycle, epoch 3, noticed the metric improve by 1.97 million BTC, nearly double what the earlier cycle noticed.

Word that epoch 1 is lacking right here because it was the primary time the asset traded, and due to this fact BTC exchanges have been additionally only a new existence. Which means their supply might solely have elevated right here, because it didn’t exist in any respect earlier than.

In contrast to these cycles, nevertheless, the place the exchanges obtained numerous web inflows, the present period has seen traders withdraw round 680,000 BTC from these platforms.

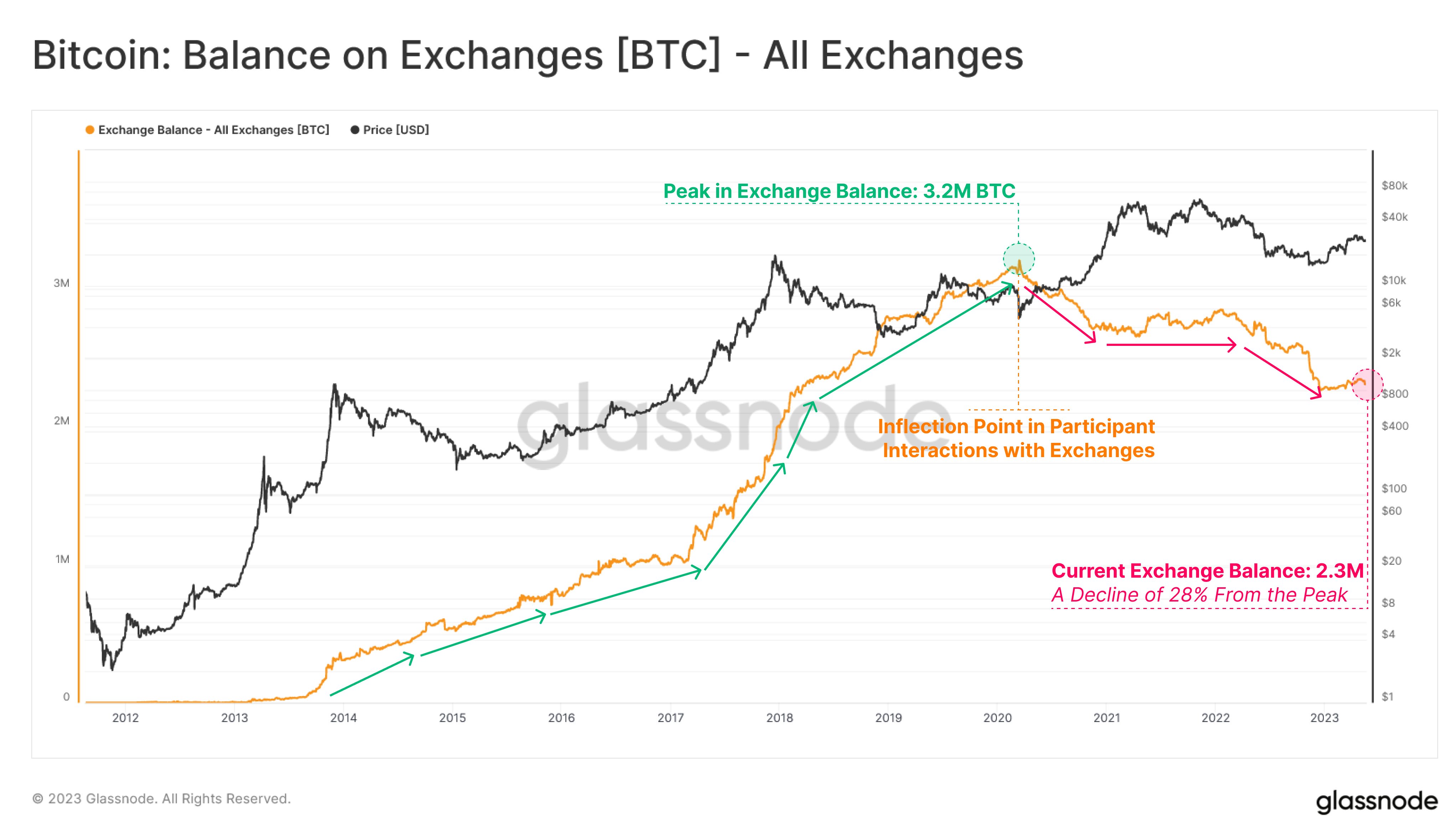

The chart beneath reveals how this drop in Bitcoin stability on exchanges occurred.

The worth of the metric appears to have been taking place in current months | Supply: Glassnode on Twitter

As proven within the chart above, the Bitcoin stability on exchanges peaked at 3.2 million BTC simply earlier than the COVID crash in March 2020.

“On reflection, the Covid disaster emerged as a catalyst for an inflection in members’ interplay with exchanges, marking the inauguration of a macro drop in trade balances,” Glassnode notes.

At present, the worth of the indicator stands at 2.3 million BTC, which suggests a decline of 28% from the height. This cycle is out of the peculiar when it comes to this metric, but it surely’s value making an allowance for that the period is not over but.

Nevertheless, it’s nonetheless unlikely {that a} reversal might happen now to maintain the present cycle in keeping with the sample of earlier cycles, as the subsequent halving is just not that far-off (2024).

BTC value

As of this writing, Bitcoin is buying and selling round $26,700, up 1% prior to now week.

BTC has plunged prior to now day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com