Since June 22, Bitcoin has been buying and selling above the crucial psychological stage of $30,000. This worth rise is the results of elevated demand for the digital asset, a requirement that’s additional exacerbated by the low availability of Bitcoin on exchanges.

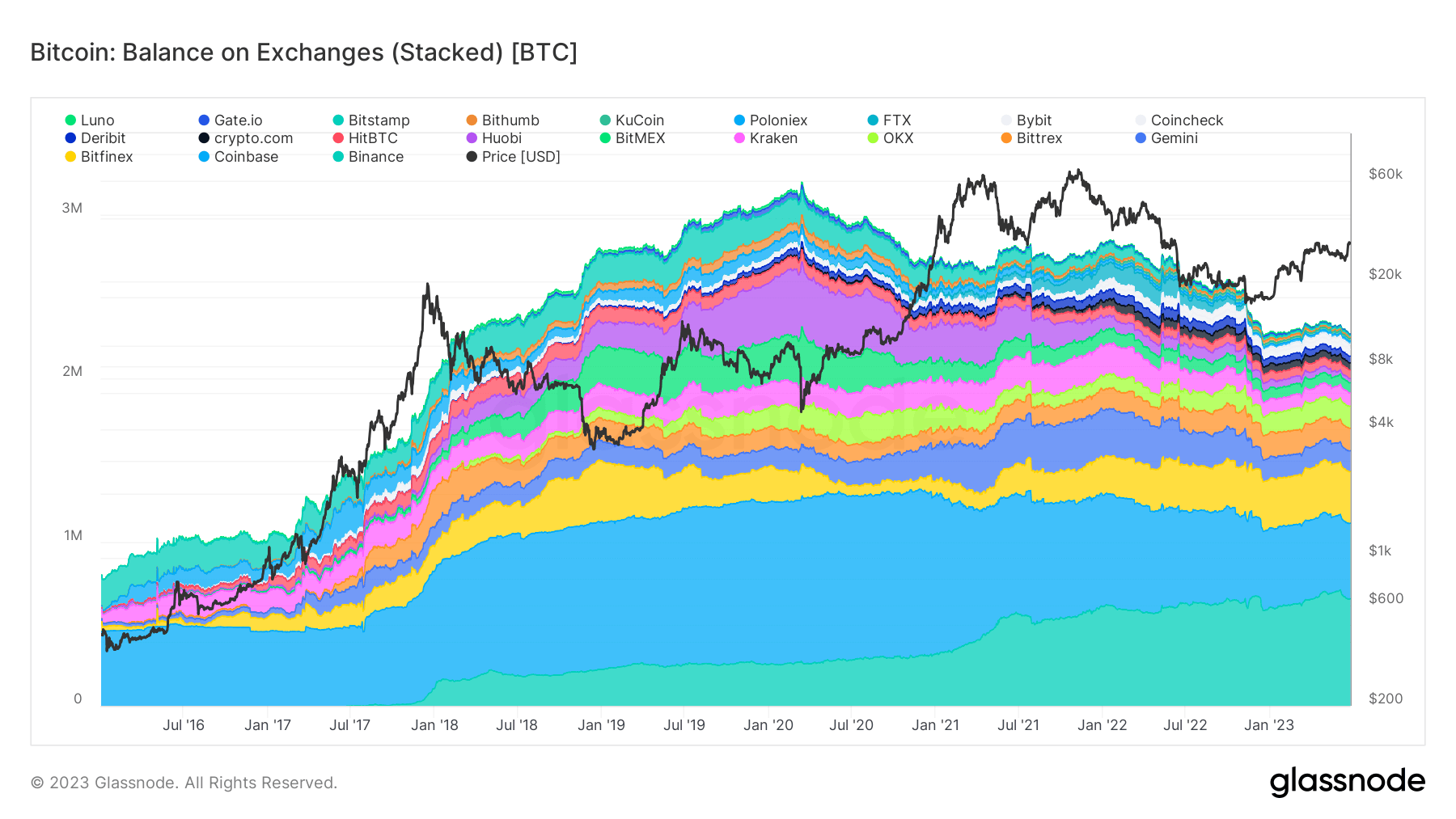

A key metric that highlights this development is the proportion of Bitcoin provide held on exchanges. Glassnode information measures the full quantity of cash held on trade addresses and calculates the proportion of provide on exchanges.

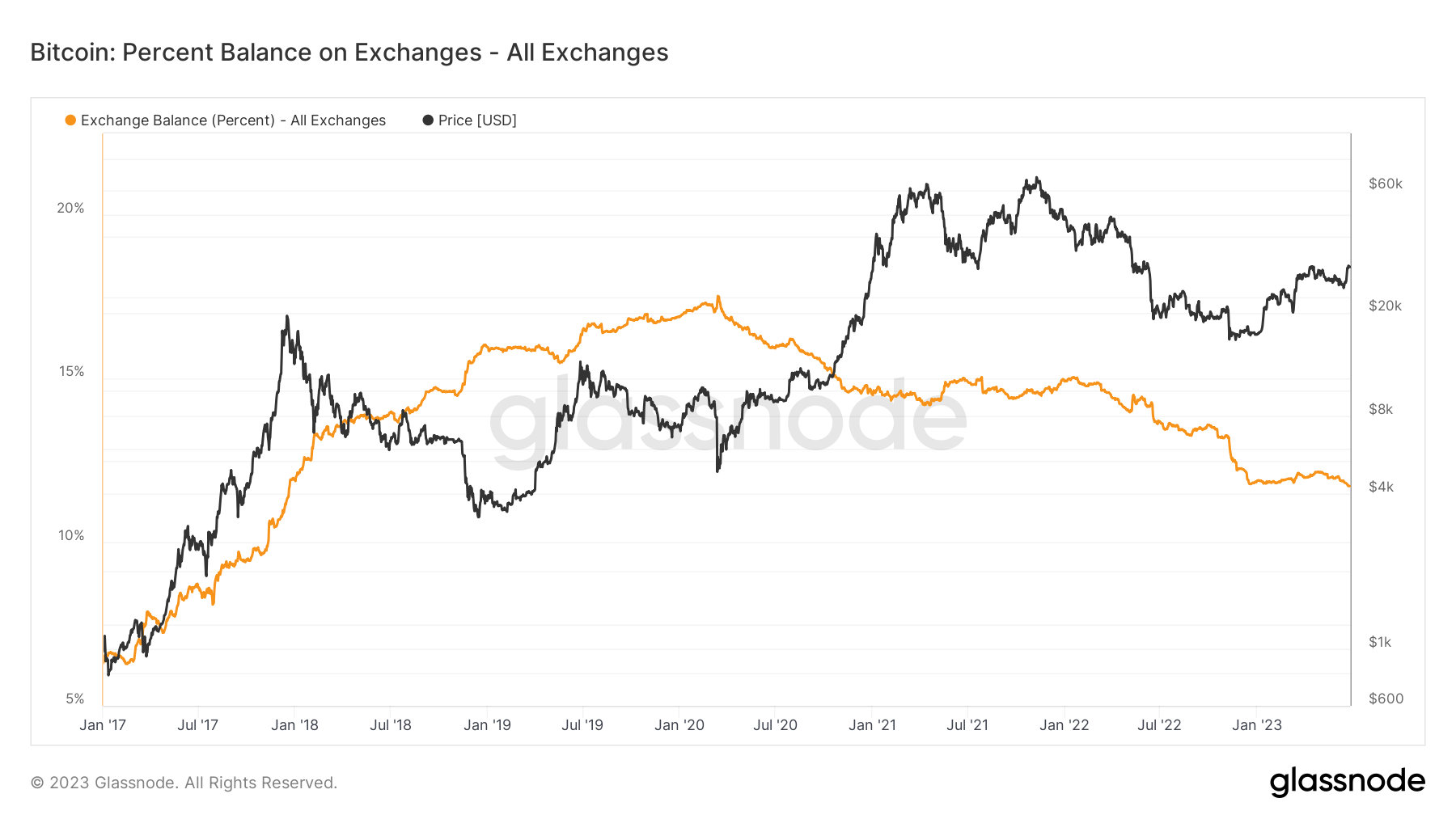

When a considerable amount of Bitcoin is held on the trade, it usually signifies that traders are able to promote their holdings, suggesting bearish sentiment. Conversely, a lower within the quantity of Bitcoin on exchanges could indicate that traders switch their belongings to non-public wallets for long-term holding, signaling bullish sentiment.

Moreover, the quantity of Bitcoin on exchanges has a direct impression on market liquidity. Excessive liquidity signifies that there are numerous market individuals and patrons will shortly soak up any giant promote orders. Nonetheless, if the quantity of Bitcoin on exchanges decreases considerably, it might result in decrease liquidity. Because of this giant promote orders might considerably have an effect on the market worth, resulting in elevated volatility.

Subsequently, monitoring the quantity of Bitcoin held on exchanges can present precious perception into potential market actions and investor sentiment.

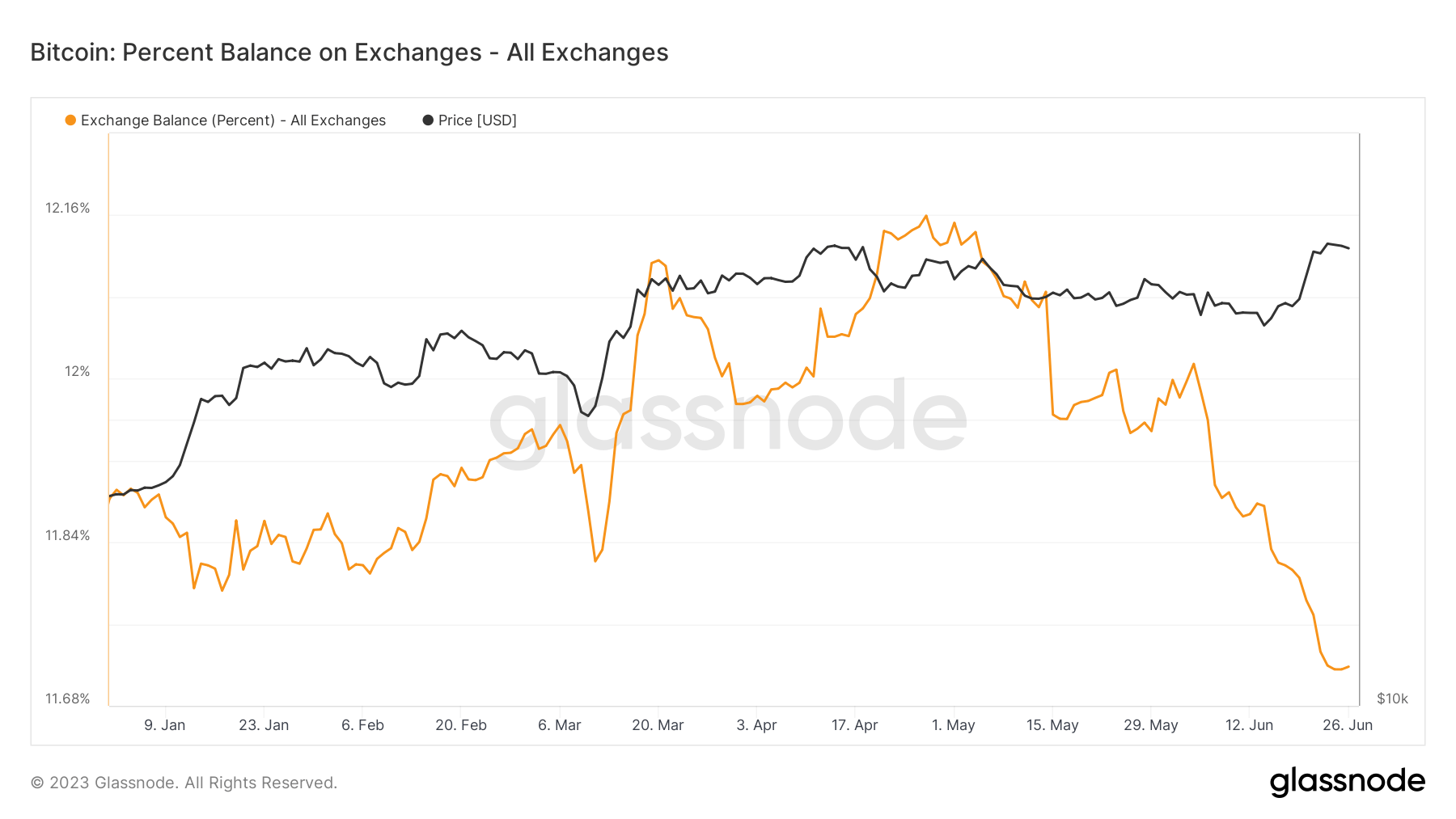

The proportion of Bitcoin provide held on exchanges has been on a downward trajectory since late April, when it hit a year-to-date (YTD) excessive of 12.16%.

Nonetheless, a broader perspective reveals that the quantity of Bitcoin held on exchanges has been declining since March 2020, when it hit an all-time excessive of 17.51%.

The proportion of Bitcoin provide held on exchanges has now fallen to a five-and-a-half-year low of 11.71%, reaching ranges final recorded in December 2017. This development signifies a change in investor conduct , with extra holders choosing storage. their off-exchange Bitcoin, maybe in anticipation of future worth appreciation.

Submit Bitcoin commerce stability drops to 5-year low as worth hits $30,000 appeared first on forexcryptozone.