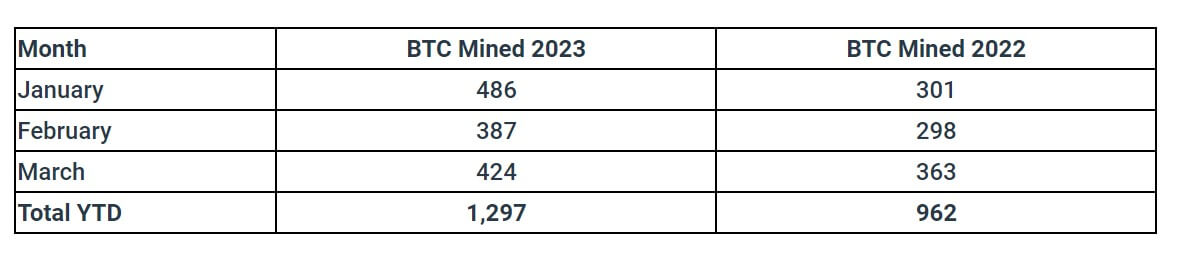

Bitcoin (BTC) mining firm Bitfarms mentioned its manufacturing of BTC elevated by 35% to 1,297 BTC within the first quarter of the 12 months in comparison with what it produced throughout the identical interval of the 12 months. final.

In an April 3 assertion, Bitfarms detailed how Bitcoin’s improved value efficiency has helped it strengthen its steadiness sheet and scale back debt.

Bitfarms BTC manufacturing will increase 17% YoY

In accordance with Bitfarms, its Bitcoin manufacturing elevated 17% on year-over-year metrics in March to 424 BTC regardless of the power curtailment points it confronted in Quebec and Paraguay.

“13.7 BTC mined day by day on common, which equates to round $390,000 per day and round $12.1 million for the month.”

In March, the BTC miner reported promoting 394 BTC at a median promoting value of $24,700 per BTC for $9.7 million. Bitfarms added that it had decreased its debt by $2 million, leaving a steadiness of $21 million as of March 31.

The corporate defined that the climate situations in Quebec and Paraguay had an impression on its operation, resulting in energy cuts.

In the meantime, the miner mentioned he had 435 BTC in custody, or round $12.4 million. He additionally holds $29 million in money and money equivalents and has a $22 million line of credit score for pay as you go deposits to use to future miner buy agreements.

The CEO of Bitfarms mentioned that the corporate “improved (its) monetary state of affairs in March 2023, reflecting steady manufacturing and a rise within the value of BTC”.

“424 new BTC mined, up 9.6% from March 2022 and 16.8% from February 2023.”

The agency’s mining director, Ben Gagnon, added:

“(Bitfarms) has efficiently piloted a brand new function in our proprietary administration system to trace real-time power consumption based mostly on a person miner. Actual-time monitoring helps optimize machines and needs to be rolled out company-wide in April.