- BNB futures hit a five-month excessive regardless of falling costs, hinting at a reversal available in the market.

- Resilient BNB rebounded from a 90-day low and sparked renewed curiosity.

- The rise in buying and selling quantity fueled optimism about BNB’s future.

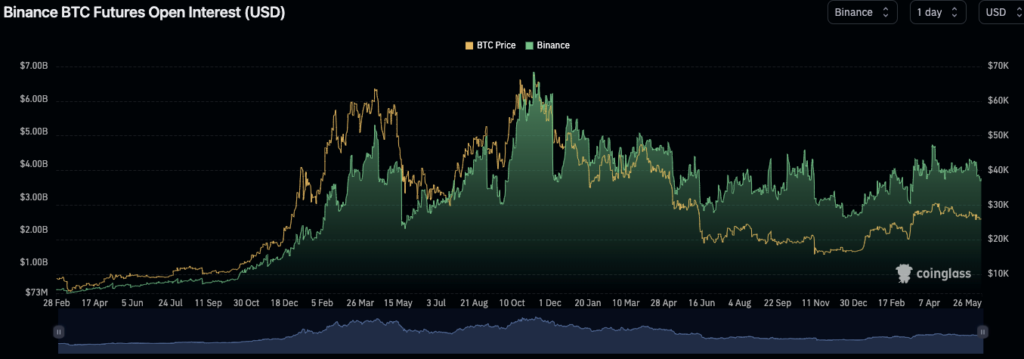

Earlier at this time, the Binance token (BNB) noticed an sudden twist in its monetary saga. Regardless of a decline in its worth, open curiosity in its futures soared to a five-month excessive. This enhance in open curiosity, the tally of lively and unsettled futures contracts, was tracked by Coinglass, revealing a staggering 27% enhance in a single week and an 8% enhance within the final day alone.

Binance’s native token, BNB, suffered a serious blow early on Monday, with its market worth dropping to $221. This nearly mirrors the token’s low level on July 13, 2022, marking a steep 25% drop for the reason that US SEC introduced a lawsuit towards Binance on June 5, 2023.

Nonetheless, amid the downward spiral, BNB managed to rebound from a 90-day low at $222.07 after falling from a 24-hour excessive at $238.49. The market noticed the bulls take management because the token discovered help at this stage and rebounded to $236.74 on the time of writing. This speedy rally echoes BNB’s resilience within the face of robust bearish sentiment.

BNB’s market cap fell 0.38% to $36,795,635,711. In the meantime, the 24-hour buying and selling quantity rose considerably by 78.87% to $847,447,451, indicating renewed curiosity from traders. This enhance in buying and selling quantity might point out that many see the latest drop as an opportune time to speculate, particularly those that have lengthy believed in Binance and its ecosystem.

BNB/USD technical evaluation

The Relative Energy Index ranking of 37.89 and pointing up signifies that the market is now in a modest uptrend.

This motion exhibits that the unfavorable momentum of the BNB is fading and {that a} reversal is feasible shortly.

Including to the bullish outlook, the Chaikin Cash Stream (CMF) has began to rise, trying to enter the constructive sector with a studying of -0.20. This motion signifies that the shopping for strain is constructing, which may change the temper of the market.

In conclusion, regardless of a latest worth decline, open curiosity in BNB futures has hit a five-month excessive, signaling heightened investor curiosity and a possible reversal in market sentiment.

Disclaimer: The views, opinions and data shared on this worth prediction are revealed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be answerable for any direct or oblique damages or losses.