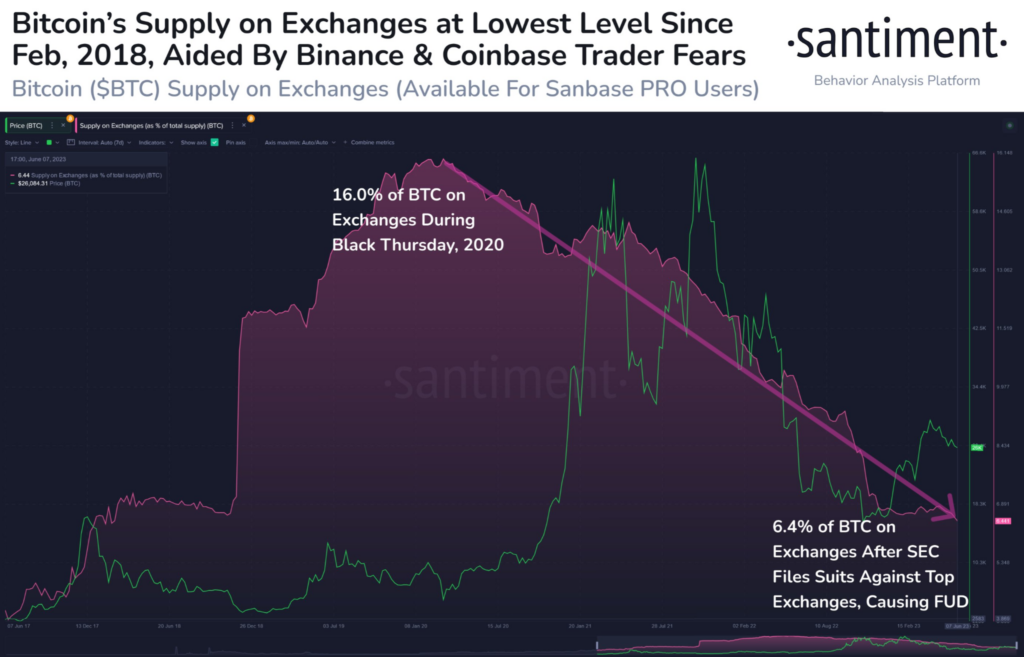

- Santiment lately tweeted that the availability of BTC on exchanges fell to its lowest stage in 2018.

- The corporate attributed this decline within the trade provide to the most recent SEC lawsuits.

- At press time, BTC was buying and selling at $25,965.49 after falling 0.33%.

Latest information from blockchain intelligence agency Santiment exhibits that merchants and buyers desire to maintain their Bitcoin (BTC) off exchanges. Based on a tweet posted this morning, the availability of BTC on exchanges has fallen to its lowest stage since February 2018.

Santiment attributed the decrease provide of BTC on exchanges to uncertainty surrounding Binance and Coinbase on account of current SEC lawsuits towards the crypto giants. In its tweet, the agency predicted that this development will proceed so long as SEC lawsuits loom.

At press time, CoinMarketCap reported that the market chief was buying and selling beneath $26,000 at $25,965.49. That is after the crypto value fell 0.33% up to now 24 hours. BTC’s day by day value efficiency had additionally pushed its weekly efficiency additional into the crimson at -3.65%.

BTC’s market dominance has additionally dropped over the previous 24 hours. In consequence, its market dominance stood at round 47.59%, down 0.15% from the place it was yesterday.

From a technical standpoint, the worth of BTC broke beneath the 9- and 20-day EMA traces on June 7, 2023, the place it continued to commerce at press time. Moreover, the 9-day EMA was positioned beneath the longer 20-day EMA line, which indicated that BTC was in a short-term bearish cycle and its value would proceed to say no within the coming days.

If the worth of the main crypto continues to fall, it might fall beneath the important thing assist stage at $24,992 within the coming week. If the bulls do not buy BTC as soon as it breaks beneath this key value, it could proceed heading in direction of the subsequent main assist at $21,410.

Then again, if BTC is ready to keep above the aforementioned $24,992 assist for the subsequent 3 days, the bearish thesis will likely be invalidated. If that occurs, the worth of the crypto main might look to retake a place above the 9- and 20-day EMA traces at round $26,990 throughout the subsequent 48 hours.

Disclaimer: Views and opinions, in addition to all data shared on this value evaluation, are revealed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held chargeable for any direct or oblique harm or loss.