- Crypto dealer Ali just lately retweeted an previous thread relating to the BTC halving.

- The tweet means that the market is at the moment in a BTC accumulation part.

- In associated information, the value of BTC is buying and selling at $30,731.20 after a 1.37% improve.

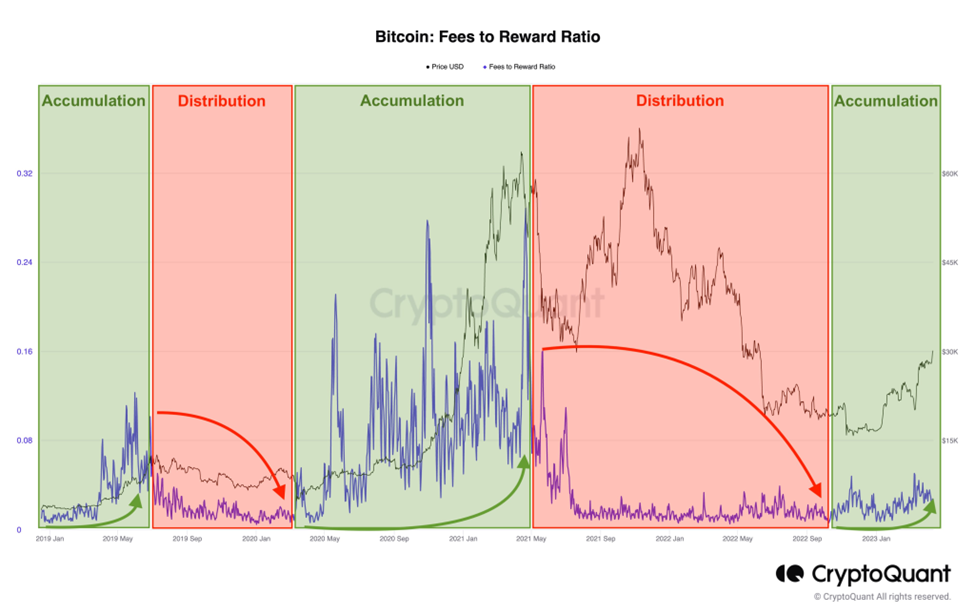

Well-known crypto dealer Ali (@ali_charts) retweeted an previous thread this morning that was in regards to the upcoming Bitcoin (BTC) halving and the totally different market phases that include this necessary occasion.

In response to the retweeted thread, the latest spike within the fee-to-reward ratio means that the market has just lately entered an accumulation cycle – just like that of 2019 and 2020. The thread added that this is a sign of a possible prize. rally for BTC resulting in 2024 halving.

At press time, the market chief’s worth stands at $30,731.20 after a 1.37% improve within the final 24 hours in keeping with CoinMarketCap. The 24-hour achieve added to BTC’s constructive weekly efficiency, bringing the full weekly achieve to 10.25% at press time.

Regardless of the constructive worth growth of BTC just lately, BTC has all the time been outperformed by the altcoin market. At present, BTC’s market dominance is estimated at 46.41%, which is 0.56% lower than its dominance yesterday. Altcoin chief ETH was additionally in a position to outperform BTC within the final 24 hours and because of this is up round 4.60% in opposition to BTC.

Technical indicators on BTC’s day by day chart are bullish at press time. At present, the 9-day EMA is buying and selling above the 20-day EMA. On high of that, the day by day RSI line is buying and selling above the day by day RSI SMA line. BTC’s day by day RSI line can be positively tilted in the direction of overbought territory, which is one other constructive signal for the market chief’s worth.

These technical indicators counsel that the value of BTC has entered a medium-term bullish cycle and should proceed to rise within the subsequent 24-48 hours. If this bullish thesis is validated, the value of BTC may climb to the following resistance stage at round $36,900.

Disclaimer: Views and opinions, in addition to all data shared on this worth evaluation, are printed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held responsible for any direct or oblique injury or loss.