Knowledge from on-chain analytics agency Glassnode revealed the all-time total revenue margin for Bitcoin miners; here’s what it’s.

Bitcoin miners made a revenue of 37% on their whole funding

In a current tweet, glass knot printed the most recent information on the present state of affairs of miners concerning their revenue, prices and income. First, to calculate the earnings of those chain validators, the analytics firm took the sum of the “thermocap” and the transaction charges that this cohort earned all through their lifetime.

The thermocap is an indicator that measures the cumulative sum of issuance multiplied by the spot value of Bitcoin. In less complicated phrases, this metric tells us the full worth of block rewards that miners have earned over the lifetime of the community.

To seek out the prices incurred by this group, Glassnode used its “problem regression mannequin”. It is a mannequin for locating the price of producing Bitcoin, and it’s based mostly on “mining problem”.

Mining problem is a characteristic of the BTC blockchain that controls how laborious miners discover mining on the community. Such an idea exists as a result of the chain needs to maintain its block manufacturing fee (the speed at which miners hash blocks) fixed.

At any time when the computing energy related by miners (the “hashrate”) adjustments, their means to mine naturally adjustments with it. For instance, miners can carry out their duties sooner in the event that they join extra machines to the community.

Nonetheless, as already talked about, the community doesn’t need miners to develop into sooner (or slower) than the usual fee, so it adjusts the problem to neutralize this modification. Within the case of this instance, the chain problem would improve in response, thereby slowing the miners all the way down to the specified pace.

The issue regression mannequin assumes that problem encompasses all the prices that miners should pay, as it’s immediately associated to the quantity of computing energy these validators have related to the community.

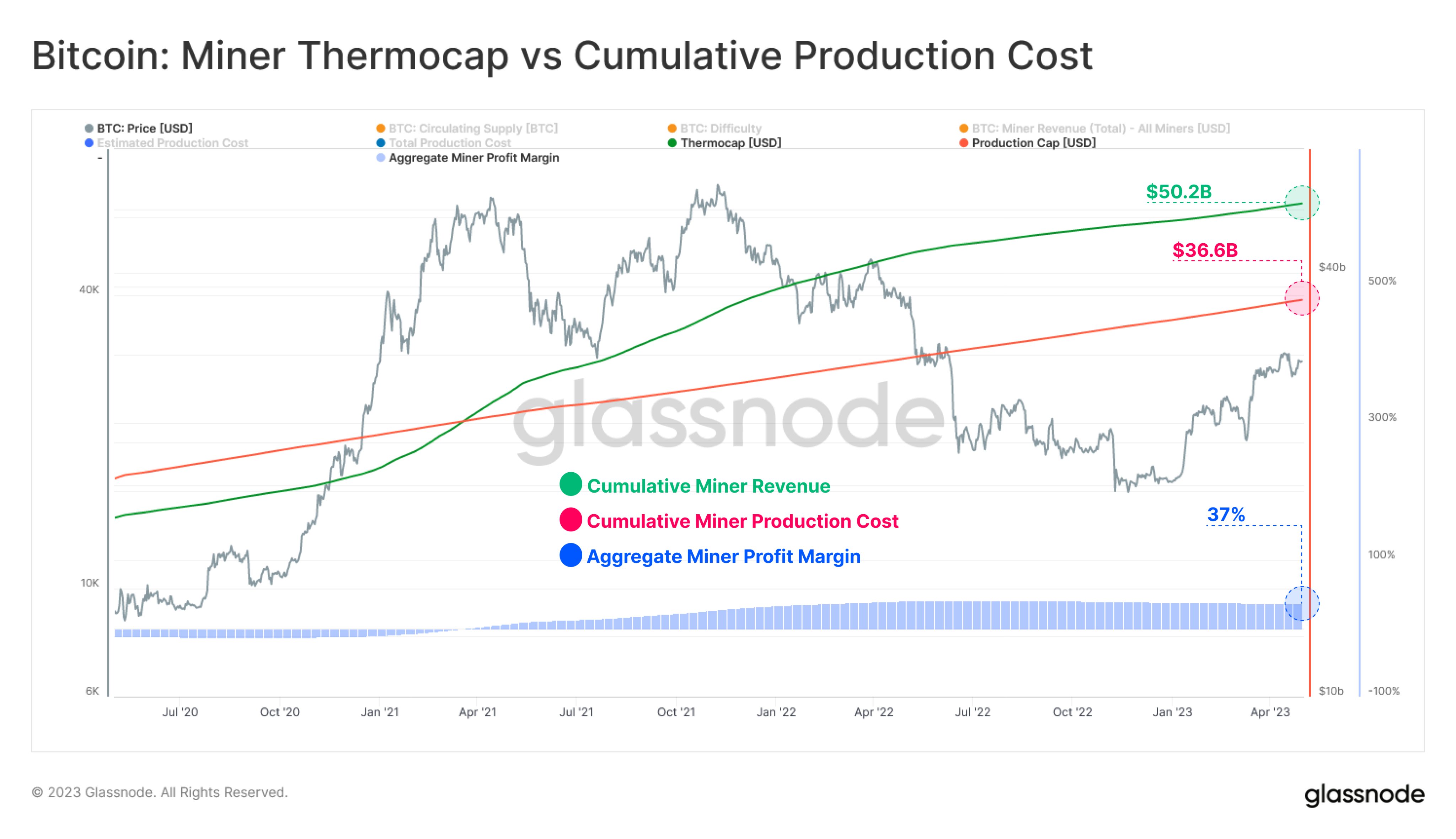

Now, here is a chart that reveals what the cumulative miner income and cumulative manufacturing prices for Bitcoin miners at the moment appear like:

The prices, revenues, and the income of the miners | Supply: Glassnode on Twitter

Because the chart above reveals, Bitcoin miners have earned lifetime income of round $50.2 billion, whereas their cumulative value of manufacturing is round $36.6 billion.

Revenues exceeded prices for this group, that means BTC miners made good points. In numbers, miners made an unprecedented cumulative revenue of $13.6 billion. This determine represents a achieve of 37% on the investments of those chain validators.

BTC value

As of this writing, Bitcoin is buying and selling round $28,700, up 4% prior to now week.

Seems like the worth of the asset has surged prior to now day | Supply: BTCUSD on TradingView

Featured picture by Brian Wangenheim on Unsplash.com, charts by TradingView.com, Glassnode.com