- COMP is up 155% prior to now 30 days and TVL has adopted swimsuit.

- Bulls’ try and revive demand at $72.12 was neutralized by promoting strain.

- COMP might pull again to $65.56 relying on the pattern of the EMAs and the Stoch RSI.

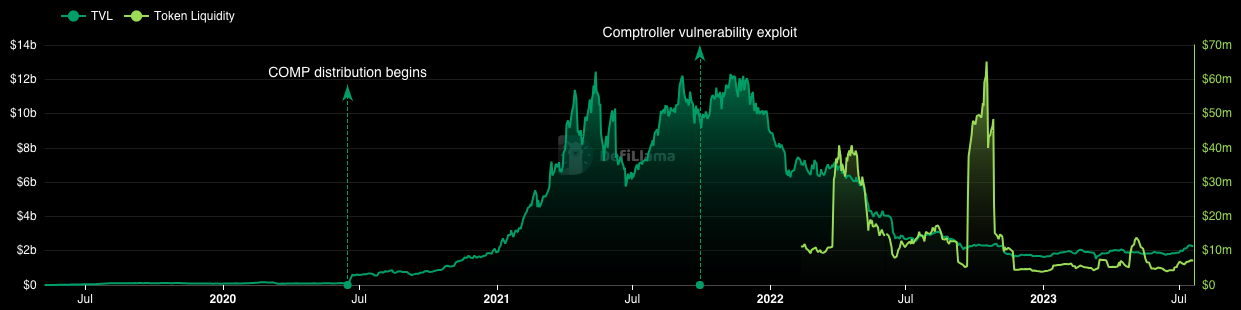

Over the previous 30 days, the entire worth locked (TVL) of Compound Finance (COMP) has elevated by 22.09%. In keeping with TVL aggregator DefiLlama, Compound’s TVL development was a lot greater than that of Lido Finance (LDO) and Aave (AAVE) over the identical interval.

TVL and value spikes

For context, TVL exhibits the entire worth of locked or staked belongings in decentralized functions (dApps) operating underneath a DeFi protocol. Subsequently, the elevated TVL of Compound implies that buyers have perceived the protocol as extra dependable.

Like TVL, liquidity in Compound has additionally adopted the identical path. The expansion in liquidity means that there was a rise in token swaps and the necessity for slippage was not extraordinarily excessive.

Likewise, the worth of COMP has elevated extremely over the past 30 days. In keeping with CoinMarketCap, COMP has grown over 155% over the mentioned interval. However with TVL outpacing market cap, COMP may nonetheless be thought of undervalued.

COMP dangers a downtrend

From a technical standpoint, the uptrend of COMP began with sturdy shopping for demand at $52.58. After hitting $76.42 on July 15, the worth fell as revenue taking took priority over shopping for strain. Between the autumn, the bulls tried to revive demand at $72.12. However the effort was stifled by gross sales strain.

On the time of this writing, the Superior Oscillator (AO) was -0.15. Sometimes, a optimistic AO implies that the 5-period transferring common (MA) was above the 34-period transferring common (MA). However for the reason that indicator was adverse, it implies that the sluggish MA was greater than the quick MA.

Subsequently, COMP, whose 24-hour efficiency was up 4.32%, might quickly succumb to a downtrend.

Moreover, the Stochastic Relative Power Index (RSI) was 76.17. As an indicator measuring the momentum of an asset, the Stoch RSI is taken into account overbought when it reaches 80. Conversely, when the indicator reaches 20, it’s oversold.

At press time, the RSI confirmed that COMP could also be on the verge of an excessive excessive. If the Stoch RSI hits 80, merchants might have to be careful for a pullback.

Additionally, the exponential transferring common (EMA) indicated that COMP is perhaps about to finish its bullish streak. On the time of writing, the 20 EMA (cyan) was above the 50 EMA (yellow).

However this crossover occurred round $55.59 on July ninth. Since then, the 50 EMA has continued to method the 20 EMA. If the 50 EMA flips the 20 EMA, then COMP might don’t have any selection however to retrace and goal $65.56.

Disclaimer: Views and opinions, in addition to all info shared on this value prediction, are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held chargeable for any direct or oblique injury or loss.