There are actually lower than 50,000 blocks to go earlier than the Bitcoin halving is triggered.

A tweet from Bitcoin wooden identified the milestone, including that it places the halving date on April 22, 2024.

Primarily based on this timeline, the occasion will happen in 342 days. Nonetheless, this could fluctuate relying on whether or not blocks shut earlier or later than the designated ten-minute interval.

The Bitcoin group is ready for a halving

The Bitcoin halving refers to a built-in 50% block mining reward halving that happens each 210,000 blocks, usually each 4 years.

This subsequent halving would be the fourth in Bitcoin historical past, decreasing the block reward from 6.25 BTC to three.125 BTC. There are 33 halves scheduled within the protocol, with the ultimate streak occurring at 2140 when the block reward zeroes out.

With a hard and fast most provide of 21 million cash, the halvings gradual the variety of cash launched into circulation – thus hard-wired a shortage mechanism into the protocol. In concept, this course of impacts the dynamics of provide and demand, appearing as a tailwind on costs.

This expectation has come to fruition based mostly on previous knowledge, concocting a story that halvings are bull market catalysts.

Nonetheless, it needs to be stored in thoughts that having three knowledge factors just isn’t statistically rigorous. Moreover, macroeconomic uncertainty has not been a think about earlier halvings.

Previous halvings

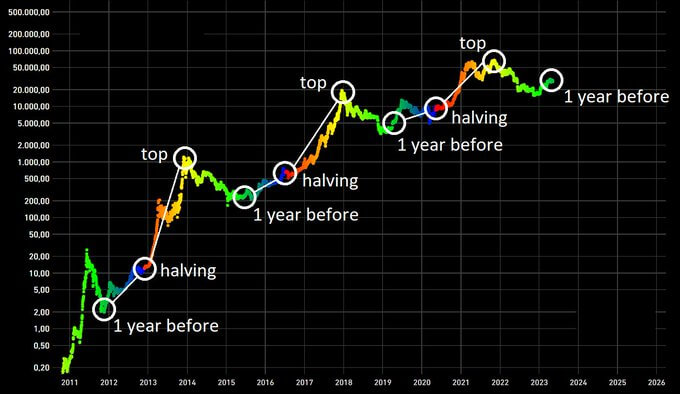

Bit Harington plotted the value of Bitcoin on a logarithmic scale, scoring factors for 1 yr earlier than, the halving itself, and the post-halving excessive.

The primary half – occurred on November 28, 2012, decreasing the block reward from 50 BTC to 25 BTC.

- The value 1 yr earlier than was round $2.

- On the time of the halving was $12.35.

- On the peak, round January 2014, the value was round $1,000.

This equates to a 7,997% enhance from the halving to the post-halving peak.

The second half – occurred on July 9, 2016, decreasing the block reward from 25 BTC to 12.5 BTC.

- The value 1 yr earlier than was round $270.

- On the time of the halving, it was $650.

- On the peak, round December 2017, the value was round $19,800.

This equates to a 2,946% enhance from the halving to the post-halving peak.

The third half – occurred on Could 11, 2020, decreasing the block reward from 12.5 BTC to six.25 BTC.

- The value 1 yr earlier than was round $8,500.

- On the time of the halving, it was $9,756.

- On the peak, round November 2022, the value was $69,000.

This equates to a 607% enhance from the apex halving after the halving.

In all three circumstances, the value rose in 1 yr earlier than, till the halving, till the height after the halving. As anticipated, with the value of BTC now within the 5 digits, the share enhance from the halving to the highest after the halving has diminished.

If Bitcoin follows the identical sample this time, the value needs to be above $27,000 on the high of the market. COO at Onramp Jesse Myers locations the best worth between $120,000 and $240,000.