Key factors to recollect

- Crypto costs rise sharply, with Bitcoin up 20% in previous three weeks

- The submitting of a variety of excessive profile Bitcoin ETFs has prompted optimism out there

- Beneath the hood, liquidity stays weak and a few worrying developments are rising, nevertheless

- Regulatory points are nonetheless current, with Coinbase and Binance going through a murky future

- The macroeconomic scenario additionally stays unsure, with the prospect of a lagged influence through financial coverage tightening looming on the horizon.

It would not be just like the crypto markets obtained too excited. Over the previous two weeks, positivity has returned to the house, led by precursor filings of a Bitcoin money ETF by two of the world’s largest asset managers, Blackrock and Constancy.

Moreover, Constancy was a part of a cohort of main buying and selling operators, together with Schwab and Citadel, to help the brand new EDX change, which affords buying and selling for Bitcoin, Ether, Litecoin and Bitcoin Money.

Bitcoin is up 20% over the previous three weeks, surpassing the $30,000 mark, whereas Ether is up 16% over the identical interval, approaching the $2,000 mark once more. A take a look at the concern and greed The Index, an fascinating metric that measures basic sentiment within the house, exhibits it falls squarely within the “greed” sector with a rating of 61 (0 represents excessive concern, 100 represents excessive greed) .

And but, a glance below the hood betrays a sure concern. First, if ETF submitting is driving the current ramp, because it seems to be, is a 20% soar warranted? The SEC has declared the current filings “insufficient,” in line with the WSJ, advising the Nasdaq and the CBOE (which filed the paperwork on behalf of the asset managers) that there are usually not sufficient particulars relating to the ” surveillance sharing agreements”. The SEC beforehand mentioned that sponsors of a Bitcoin belief are required to enter right into a supervisory sharing settlement with a regulated market of serious measurement.

And but, a glance below the hood betrays a sure concern. First, if ETF submitting is driving the current ramp, because it seems to be, is a 20% soar warranted? The SEC has declared the current filings “insufficient,” in line with the WSJ, advising the Nasdaq and the CBOE (which filed the paperwork on behalf of the asset managers) that there are usually not sufficient particulars relating to the ” surveillance sharing agreements”. The SEC beforehand mentioned that sponsors of a Bitcoin belief are required to enter right into a supervisory sharing settlement with a regulated market of serious measurement.

Whereas the apps could also be up to date and reclassified (and the CBOE has certainly reclassified theirs since, with the Nasdaq prone to comply with quickly), the event hints at simply how tough it was to land the coveted ETF spot. on the road. There isn’t any assure these will probably be authorized, regardless of the large names concerned – the SEC has even denied a request from Constancy previously, rejecting it in January 2022.

In reality, it appears inevitable that spot Bitcoin ETFs will sooner or later be freely traded, however a 20% soar on a single deposit previously two weeks is an enormous ramp contemplating what else has occurred in house, and the state of markets, which we’ll now discover.

Liquidity

Liquidity continues to lag, an element that can’t be overstated – and certainly one which the eventual approval of spot ETFs ought to assist.

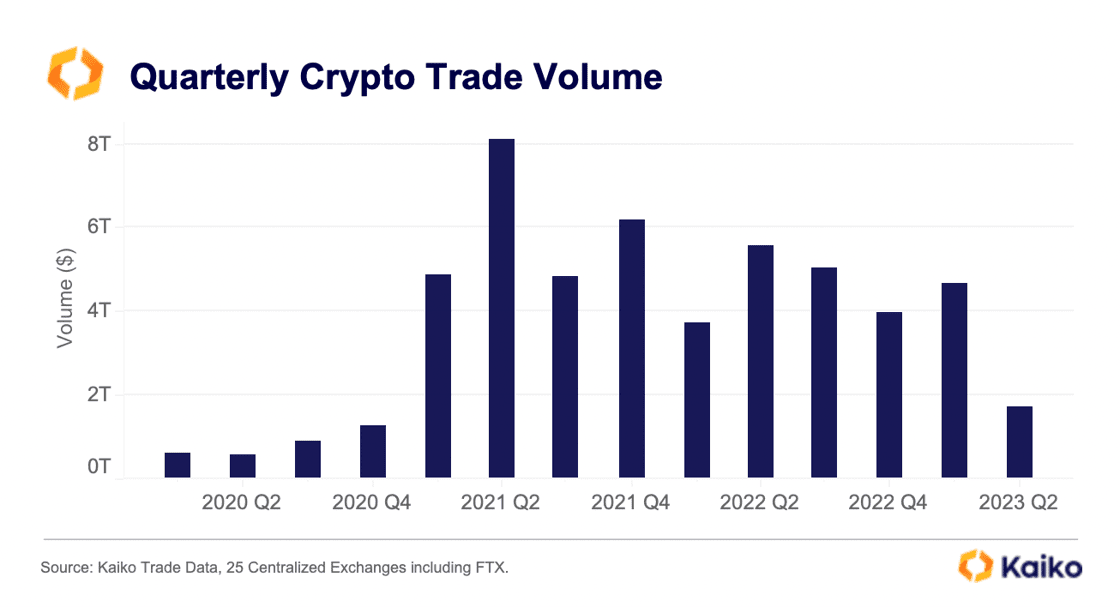

Taking a look at Kaiko’s data-centric exchanges on the shut of Q2 2023, quantity over the previous three months has fallen once more, hitting the bottom quantity since 2020, earlier than Bitcoin and crypto launched into their ups. of inexorable costs and are taking the monetary world by storm.

However with decrease liquidity, each upward and downward actions are exacerbated. This may occasionally have contributed to Bitcoin’s robust rise over the previous few weeks, in addition to year-to-date, with a present surge of 83%.

However liquidity and volumes being so low ought to be alarming for market members. A lot of the breakthroughs made in the course of the pandemic, by way of bitcoin taking its place alongside real asset courses from a enterprise perspective, have slowed and even reversed, at the very least from a market perspective. liquidity.

As additional proof of this, within the chart under, I’ve introduced the whole stablecoin steadiness on the exchanges, which has fallen by 60% previously six months, an outflow of $26 billion.

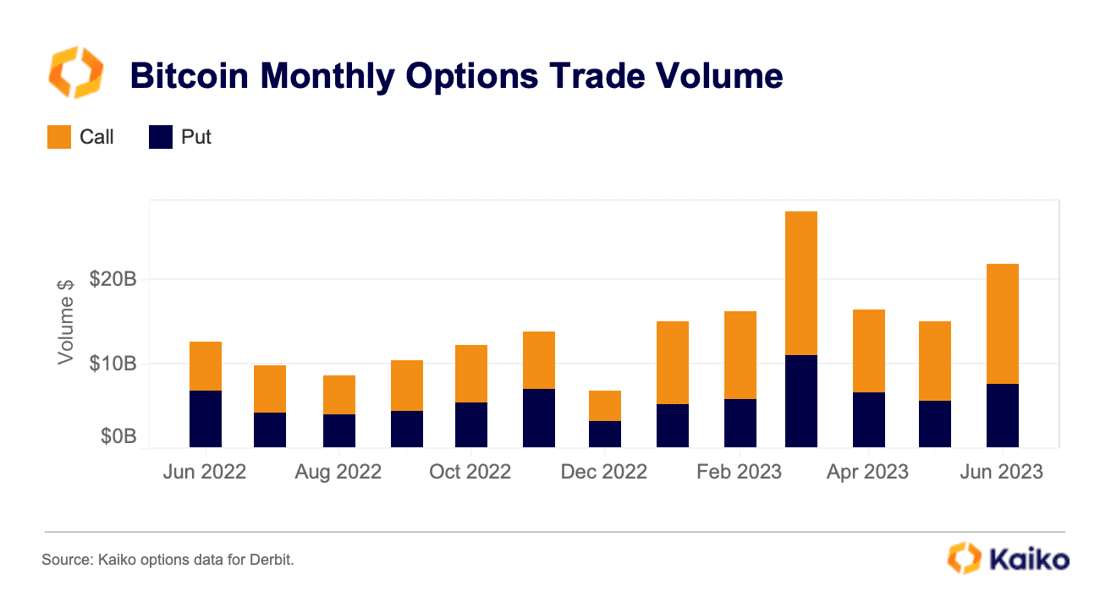

That mentioned, there are pockets of optimism that time to a brighter future if/when these money ETFs are authorized. Relating to the quantity of the derivatives markets, it has been slightly fixed. In truth, it’s considerably up from the second half of 2022. This may occasionally imply that the spot market has been extra affected by regulatory repression. Both approach, it is a much less terrible image than what we see in spot markets.

Regulation

Proper now, relating to crypto-specific threat, it actually comes right down to regulation. We mentioned ETF filings, however June additionally introduced two watershed moments: formal prices towards Coinbase and Binance.

The 2 instances are extraordinarily completely different, discover. The Binance Lawsuit could not be much less stunning, with the change continuously circumventing pointers and legal guidelines. The costs quantity to a protracted checklist of various offences, together with buying and selling towards purchasers, manipulating buying and selling quantity, encouraging customers to bypass geo-restrictions, and securities violations.

It’s this final cost that’s on the heart of the lawsuit towards Coinbase, nevertheless, and probably the most essential of the lot. That is additionally why the Coinbase go well with is way more intriguing. Bear in mind, the allegations come from the SEC, the identical physique that presided over Coinbase’s IPO in April 2021. Why did the SEC float an unregistered inventory change on a US change? You inform me.

However let’s get again to fundamentals: what all of this implies for the crypto markets. Whereas Bitcoin seems to be carving out a spot for itself within the eyes of the legislation, a slew of different tokens have been designated as securities by the SEC. Regardless of this, they’ve risen sharply for the reason that Bitcoin ETF information. Does that make sense?

Conclusion

In the end, crypto goes to crypto. Costs transfer, and making an attempt to establish the explanations is usually a mad sprint. The previous month, nevertheless, appears like we have seen extraordinarily aggressive value will increase regardless of some unhealthy regulatory information.

Additionally, the macro image hasn’t modified a lot, even with the pause on the final Fed assembly. Feedback from Fed Chairman Jerome Powell made it clear that this was a pause slightly than a coverage reversal.

“Wanting ahead, nearly all committee members contemplate it doubtless that additional price will increase will probably be acceptable this 12 months,” Powell mentioned when the break was introduced.

The market believes it. I’ve pulled out the Fed futures odds within the following chart, which exhibits that there is at the moment an 86% probability of a 25 foundation level hike on the subsequent Fed assembly in three weeks , with solely a 14% probability that charges will stay unchanged. I introduced this alongside the identical possibilities conveyed by the market precisely one month in the past (Bitcoin is up 20% since then), exhibiting {that a} softer forecast doesn’t clarify the excessive value (the chance that no rise is definitely decreased).

Like I mentioned, crypto goes crypto. However with property as notoriously risky as what we see on this sector, it could be sensible to cease and ask whether or not the sudden wave of positivity is warranted. When contemplating the liquidity image and regulatory points, there are numerous causes to be hesitant.

Then, when the macro picture is overlaid, the picture turns into cloudier once more. Let’s not neglect that we’re within the midst of one of many quickest price hike cycles in fashionable historical past, with charges rising from zero to over 5%, and the prospect of them rising even additional down the highway. this month.

Financial coverage operates with a lag, and the magnitude of this tightening is big. The sentiment might appear to have modified dramatically, however there’s nonetheless a protracted solution to go.