The crypto-based funding merchandise market noticed $53.7 million in outflows in the course of the week of Might 1-7, with Bitcoin (BTC)-based merchandise accounting for almost all of it, in response to the weekly report. from CoinShares.

BTC and short-term BTC-based merchandise noticed a complete of $54.9 million in outflows, as famous by the CoinShares report.

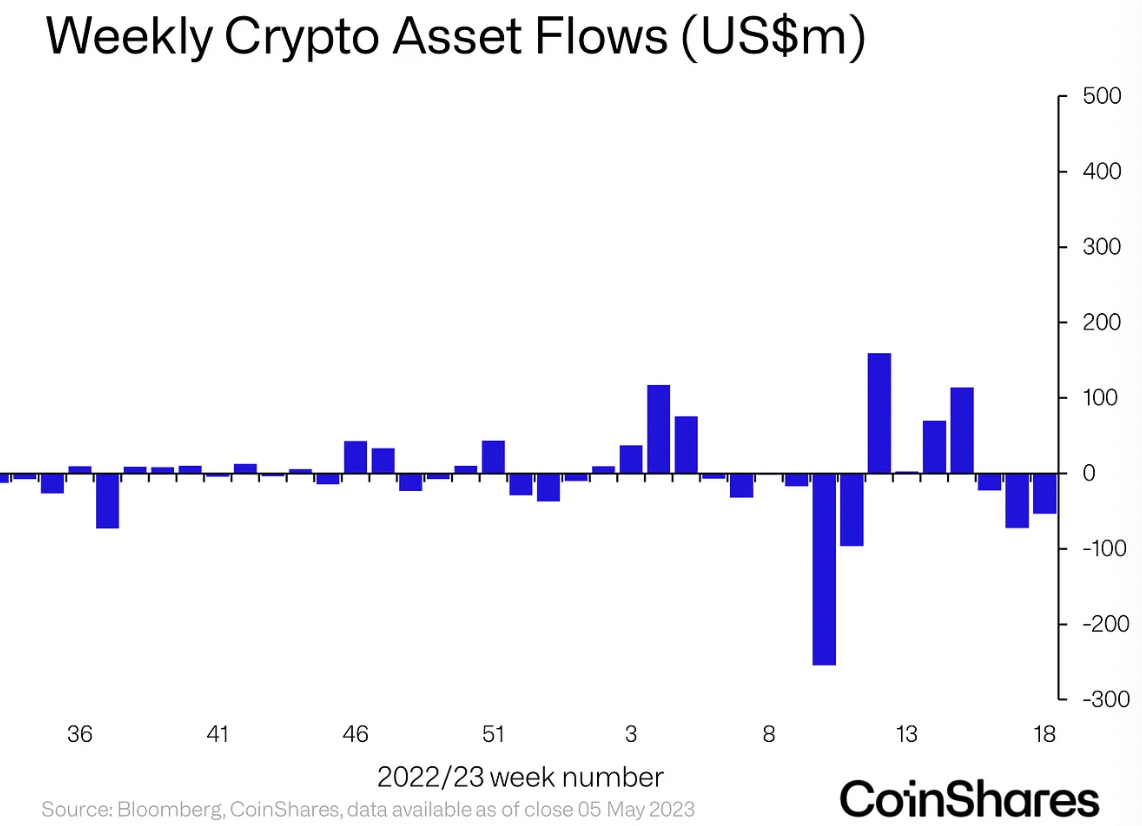

The week of Might 1-7 additionally marked the third consecutive week of releases for the crypto funding merchandise market.

The newest streak of outflows from the market started in February and lasted six weeks in a row. The entire worth misplaced throughout this era reached $408 million, with the biggest recorded in the course of the week of March 6-12 at $225 million.

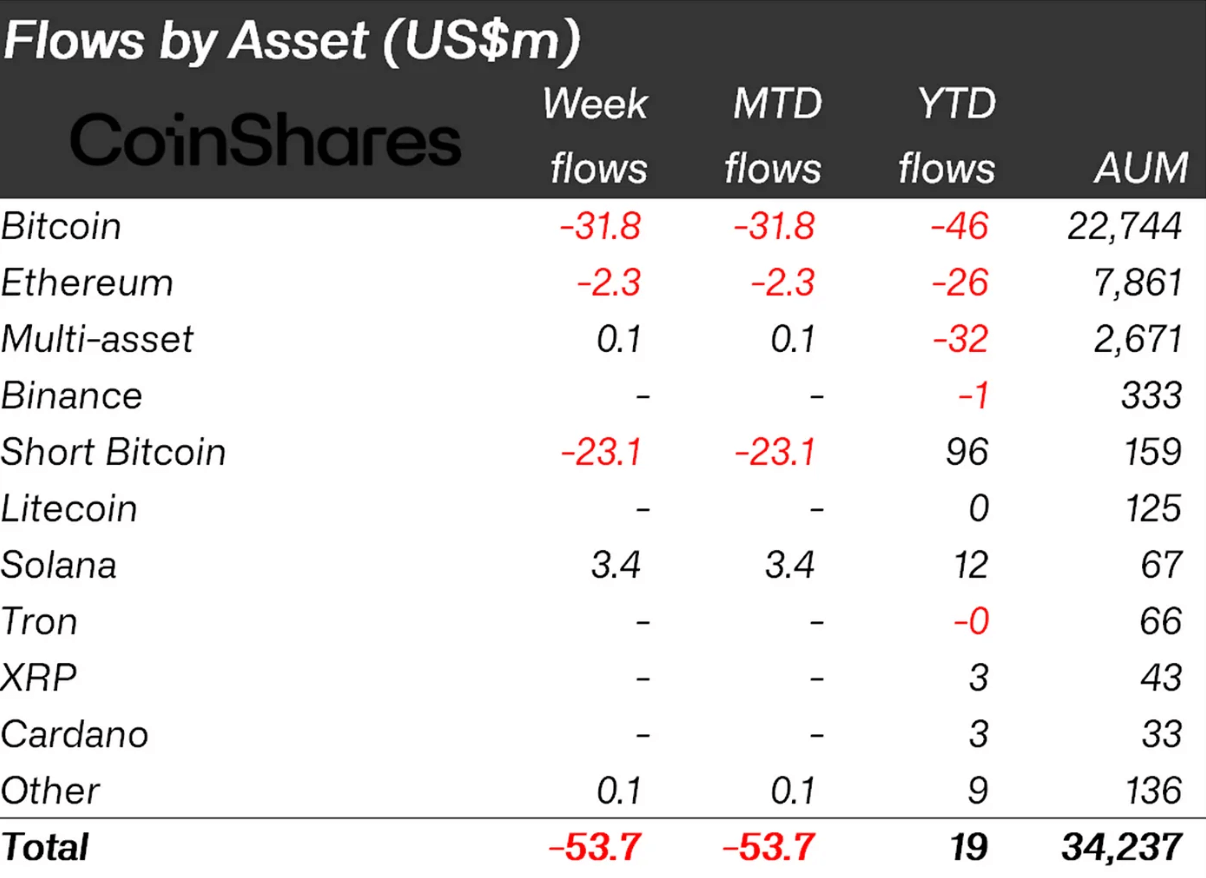

Move per asset

BTC and Brief-BTC primarily based merchandise had been virtually completely accountable for the weekly outflows. In seven days, BTC misplaced $31.8 million, whereas brief BTC merchandise noticed $23.1 million in withdrawals.

That is significantly uncommon for brief BTC merchandise. Even when the market was on its six-week exit streak, brief BTC merchandise noticed entries virtually each week. Acknowledging the irregularity, the CoinShares report mentioned it was the “largest weekly brief bitcoin outflow ever, at US$23 million.”

Moreover BTC, Ethereum (ETH) additionally ended the week on the unfavorable, recording $2.3 million in withdrawals. In flip, Multi-Asset and Solana-based (SOL) merchandise noticed inflows price $100,000 and $3.4 million, respectively, bringing the general market rating to -53.7 million. {dollars}.

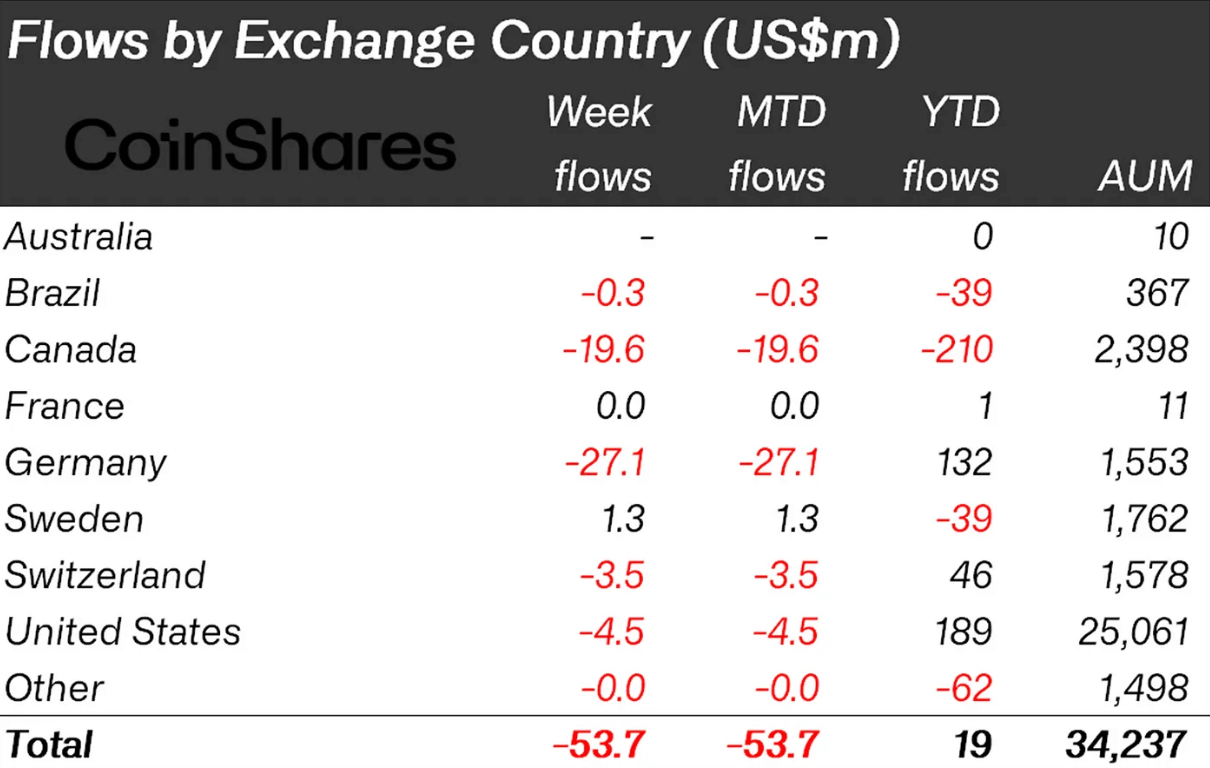

Move by nation

Taking a look at asset actions on a geographic foundation, Germany and Canada stand out as recording the biggest outflows of the week. Germany recorded withdrawals of $27.1 million, whereas Canada recorded outflows of $19.6 million. The 2 nations accounted for 86% of the overall quantity of releases for the week.

The USA, Switzerland and Brazil additionally contributed to the withdrawals, recording $4.5 million, $3.5 million and $300,000 in outflows, respectively. In distinction, solely $1.3 million in admissions had been dropped at the market by Sweden.

When the actions are filtered in response to suppliers, solely Goal Investments affords entries of 1 million {dollars}. 3iQ, CoinShares, and ProShares noticed $19.4 million, $13.4 million, and $5.4 million in outflows, respectively.