Digital asset funding merchandise noticed $2.2 billion in inflows final week, reflecting a broader market uptrend pushed by Donald Trump's latest victory within the US presidential election that simply ended. finish.

In the course of the first half of the week, inflows peaked at $3 billion, bringing complete belongings underneath administration (AUM) to a report excessive of $138 billion. Nonetheless, Bitcoin's report value efficiency through the interval resulted in an outflow of roughly $866 million, leading to a web influx of $2.2 billion.

In accordance with CoinShares, this influx introduced the entire for the reason that September rate of interest reduce to $11.7 billion, bringing the year-to-date complete to $33.5 billion.

James Butterfill, head of analysis at CoinShares, defined that:

“This latest enhance in exercise seems to be as a consequence of a mixture of looser financial coverage and the clear victory of the Republican Occasion within the latest US elections.”

US-Bitcoin ETFs proceed to dominate

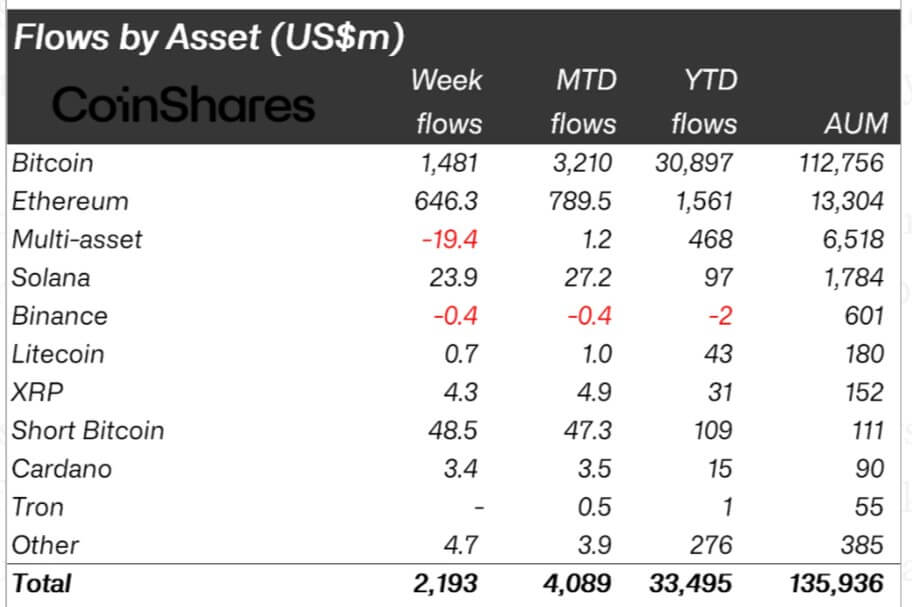

Bitcoin’s dominance remained sturdy, with $1.48 billion in inflows. These substantial flows could also be linked to the spectacular efficiency of U.S.-based spot exchange-traded fund (ETF) merchandise, which proceed to draw the eye of retail and institutional merchants.

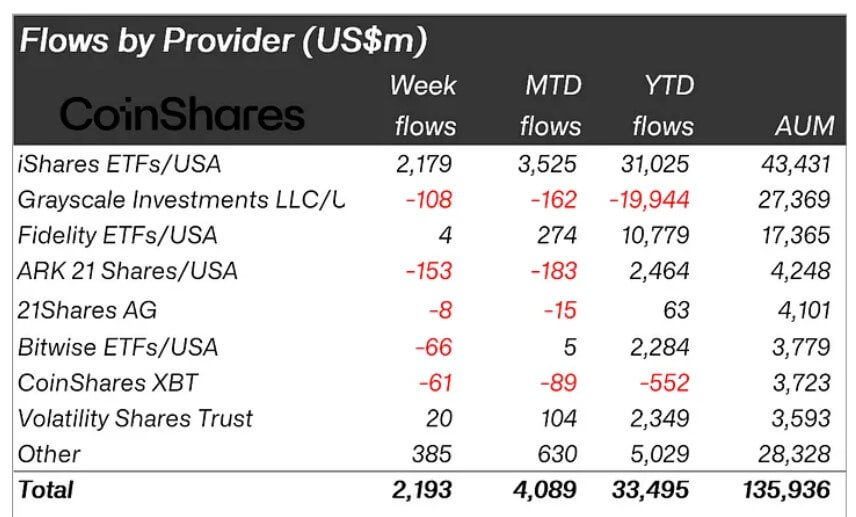

In accordance with CoinShares knowledge, BlackRock's IBIT and Constancy's FBTC noticed inflows of $2.1 billion and $4 million, respectively. In distinction, outflows of $153 million from the Ark 21 Shares fund outpaced these from Grayscale, which stood at $108 million for the week.

In the meantime, Bitcoin's report value efficiency above the $90,000 mark attracted bearish merchants, who invested $49 million briefly Bitcoin merchandise.

Moreover, bullish market sentiment seems to be influencing curiosity in Ethereum, which additionally attracted important inflows of $646 million (or 5% of its belongings underneath administration). Butterfill linked this inflow to election outcomes and a proposed Beam Chain community improve.

Different belongings together with Solana, XRP, and Cardano noticed extra modest inflows of $24 million, $4.3 million, and $3.4 million, respectively.