Essential crypto information and worth and efficiency updates on Stellar (XLM), Litecoin (LTC) and Mina (MINA).

Give attention to Stellar, Litecoin and Mina crypto property

It must be remembered that Stellar is an open-source foreign money alternate protocol based in early 2014.

Litecoin is a peer-to-peer cryptocurrency and open supply software program challenge.

Lastly, Mina is a “minimal blockchain” designed to scale back computational necessities with the intention to run dApps extra effectively.

Crypto Stellar (XLM) reveals a downtrend: a lot worse than the pattern of Litecoin and Mina

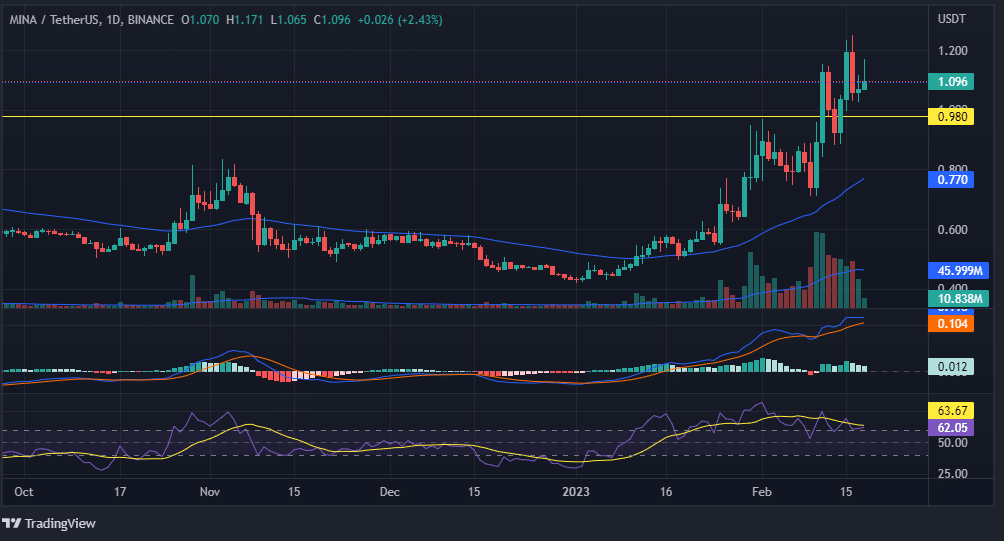

The worth evaluation of Stellar (XLM) reveals that the bearish momentum has taken maintain of the market. Promoting strain is constructing within the XLM market and costs are dropping to decrease ranges.

The truth is, the Stellar token is buying and selling close to $0.0914 and has misplaced 3.26% within the final 24 hours. The previous few days have been favorable for bullish merchants after XLM worth hit highs close to $0.095 and examined resistance at $0.09536 when consumers pushed the value greater.

Nevertheless, at present the bears took over and the value of XLM fell under the $0.095 stage. If this draw back strain continues, we might see a deeper correction bringing XLM/USD nearer to the $0.08871 assist stage.

On the upside, alternatively, if the bulls handle to push costs greater and break via the present resistance at $0.09536, we might see an extra rise in worth with the potential for retesting the following resistance at 0, $10.

Moreover, the 24-hour buying and selling quantity for XLM/USD fell to $129 million and remains to be effectively under earlier ranges, indicating that traders are reluctant to commerce on account of bearish market sentiment.

The market capitalization of the XLM token additionally fell to $2.47 billion, down greater than 3% within the final 24 hours, putting it twenty eighth on CoinMarketCap. Not solely that, the day by day technical indicators for the XLM/USD pair stay bearish and level additional downward momentum.

The stochastic RSI indicator is in impartial territory and stands at 57.82. Nevertheless, if the downtrend persists, we might see the Stochastic RSI transfer into oversold territory. The MACD is in bearish mode and has crossed the sign line, indicating additional downward momentum.

Litecoin outperforms Bitcoin and rises to the highest of social rankings

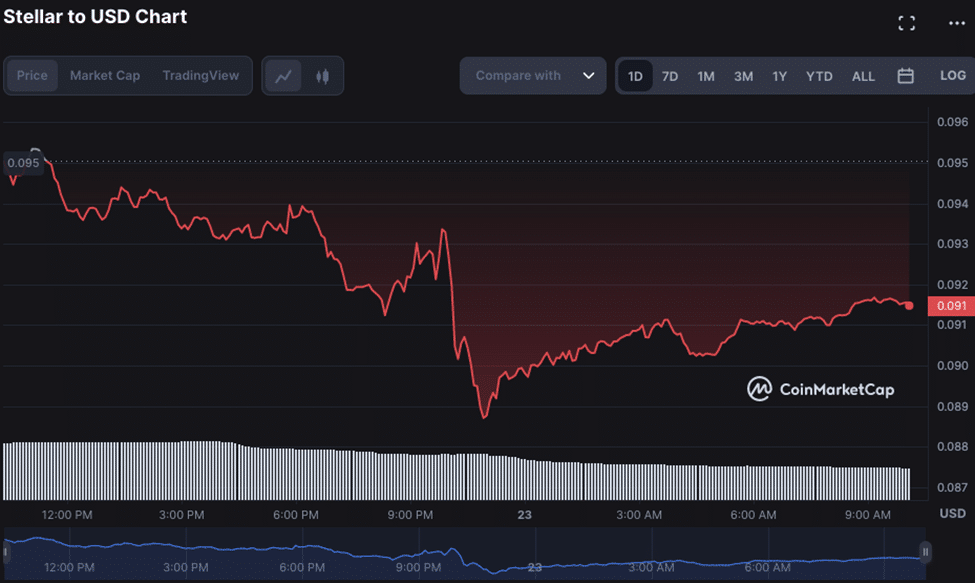

Litecoin (LTC) broke away from the overall market decline after the Fed’s choice resulted in an rate of interest hike.

The choice might have had a detrimental affect Bitcoin (BTC) and lots of others as a substitute, however LTC was capable of establish a 13.78% improve as its personal repercussion.

Usually, a circumstance like this might have been the results of important growth round a challenge. Nevertheless, this was not the case with the cryptocurrency’s native low-cost blockchain cost community.

Certainly, regardless of its silence with updates, LunarCrush reported that no different coin matches LTC by way of social and market exercise. At the moment, social engagements peaked at 29,819,175 whereas mentions had been 4,467.

Subsequently, being on the high of the rating implies that LTC had a superb standing by way of monetary, neighborhood and market measures. It additionally infers that traders seen the foreign money as promising within the close to time period.

Whereas LTC might have gained investor confidence and outperformed BTC, the following plan of action could also be to watch out. This was because of the situation of the channel as proven by Market Worth to Realized Worth (MVRV).

The metric works as an excellent indicator to establish halving market cycle highs and lows and in addition signifies when an asset is undervalued or not. At press time, the 365-day MVRV was 25.95%.

Lengthy-term holders could be considerably unfazed by this place, as the value of LTC was down 82.56% from its ATH.

Nevertheless, the rise within the metric won’t be the identical for traders in search of fast positive factors, because it implied that LTC could be overvalued.

Furthermore, the distinction in lengthy/brief MVRV appeared to lend a hand with the place of the ratio. At the moment the metric was 19.85%. Because it was not on the detrimental axis, because of this the positive factors made within the brief time period might quickly fall.

Give attention to Mina worth change

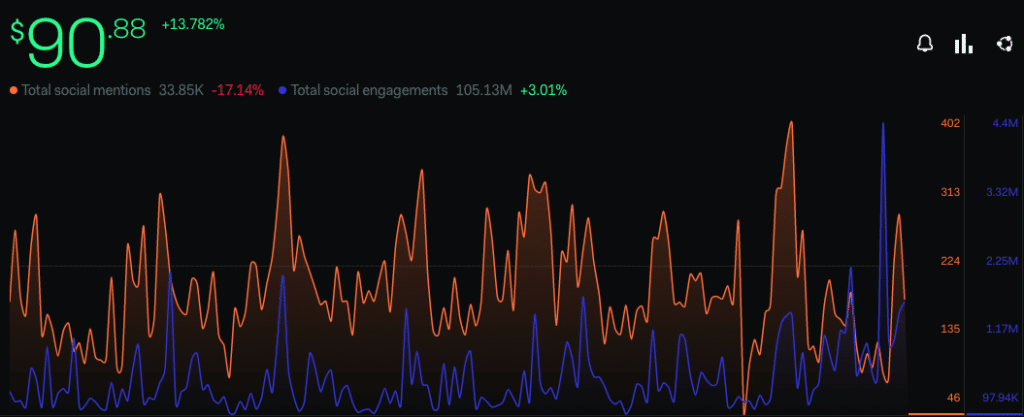

MINEthe continued worth correction has diminished 53% in a month. The V-top reversal practically evaporated the January and mid-February positive factors and despatched costs right down to a Fibonacci low on the 0.786 stage.

Nevertheless, the coin’s worth then bounced off the $0.786 FIB assist at $0.6 and triggered a bullish reversal. MINA’s worth is presently buying and selling at $0.6366displaying a rise of 6.2% in comparison with the earlier interval.

If the shopping for persists, the consumers might retest after the resistance of $0.737 and $0.8.

Furthermore, a few month in the past, on MINA’s day by day chart, traders might clearly see that the foreign money, after struggling a pointy drop, had launched into a sideways pattern for an extended time frame.

They could even have observed that lately the coin confirmed an enormous bullish rally from its foremost assist stage, i.e. from round $0.427. Throughout its bullish rally, it additionally broke via certainly one of its key resistors.

Aside from that, a Golden Crossover is about to happen on the chart, which might push the costs of the foreign money even greater. The MACD indicator confirmed a bullish cross, implying that the bulls have elevated in quantity relative to the bears.

This crossover additionally implies that traders might now witness an increase in foreign money costs. The RSI curve, nonetheless, is buying and selling at 62.05, which is above its 50 level stage.

It may be seen that the worth of the RSI curve will improve much more sooner or later as the value of cash will increase. Subsequently, it’s clearly seen that each indicators, MACD and RSI, are displaying a purchase sign.