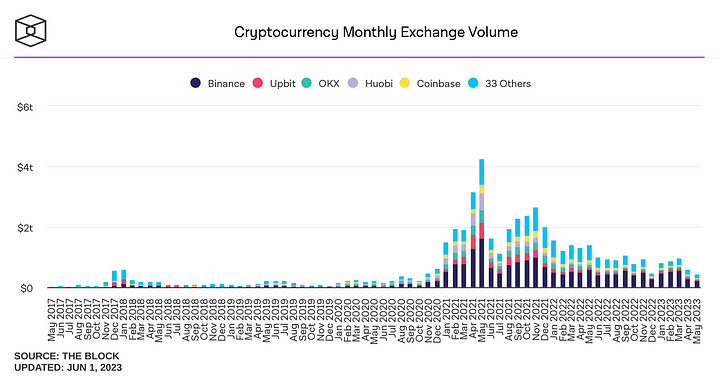

- In Could, inside spot buying and selling quantity within the crypto market hit a brand new low, Blofin says.

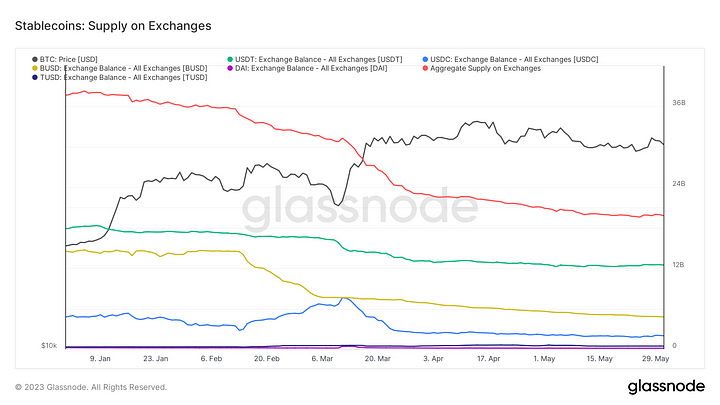

- The market skilled a extreme lack of liquidity in June as a consequence of continued strain and investor desire for promoting volatility.

- Present market efficiency displays low realized volatility and decreased buying and selling quantity.

In response to latest evaluation by Blofin, in-house spot buying and selling quantity in Could hit a brand new low in comparison with December 2020. This decline in buying and selling exercise could be attributed to the rising affect of synthetic intelligence ( IA) within the monetary markets.

In June, the crypto market skilled a extreme lack of liquidity as a consequence of continued strain on liquidity, altering market narratives, and declining ranges of uncertainty. Investor desire for different methods, resembling volatility promoting, additionally contributed to low market volatility.

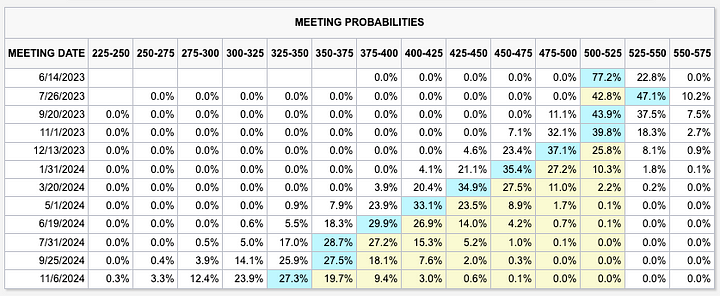

The article means that whereas the uncertainty surrounding the June fee hike might introduce some liquidity, the crypto market will proceed to face a scarcity till the top of the rate of interest hike cycle.

Sluggish buying and selling quantity has resulted in persistent low realized volatility for conventional crypto property. Regardless of some deviations from the standard patterns, the present market efficiency aligns with the shut relationship between the crypto market and the macro economic system.

Moreover, the rise of AI has led speculative liquidity to favor US shares over the crypto market. Whereas BTC’s macro fundamentals stay stagnant, investing in shares like NVDA can generate fast good points when monetary studies come out.

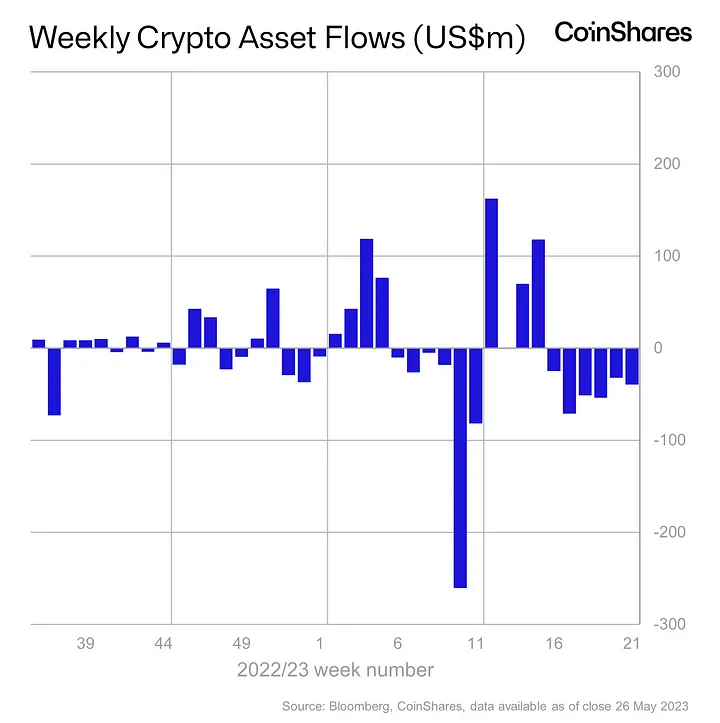

In the meantime, Bitcoin’s volatility declined, resulting in a 5% decline in Could. Rational liquidity suppliers, together with establishments and excessive internet price traders, are lowering their positions within the crypto market as a consequence of difficulties in incomes extra returns. This has led to consecutive weeks of exits and a drop in property beneath administration for crypto fund managers.

The evaluation factors out that for the reason that crypto market is presently experiencing a scarcity of liquidity, traders are on the lookout for alternatives in different markets. Volatility promoting has turn into a serious income stream for crypto traders, resulting in a cycle of volatility suppression.

As well as, the rise within the variety of choice sellers has lowered bid costs and implied volatility. Choice market makers have shifted to relative volatility patrons, which impacts market volatility. The length of the liquidity crunch is unsure and macroeconomic occasions are offering restricted reduction. Traders’ enterprise enthusiasm has waned and liquidity points are anticipated to persist via the top of the rate of interest hike cycle.