Bitcoin and the remainder of the cryptocurrency market recorded sturdy features after Ripple scored a victory towards securities regulators on July 13.

As of 20:30 UTC, Bitcoin (BTC) had gained 4.3% over 24 hours, reaching a market worth of $31,594.31 and a market capitalization of $613.8 billion. This transformation represents an over-year excessive, because the asset has not seen comparable costs since June 2022.

Ethereum (ETH), in the meantime, gained 6.9% over 24 hours to a market capitalization of $239.8 billion. Its value briefly exceeded $2,000.

These features had been seemingly influenced by the end result of a authorized case between Ripple and the US Securities and Change Fee through which the courts dominated that Ripple’s XRP gross sales should not securities. XRP itself gained 73% over 24 hours to succeed in a market capitalization of $42.6 billion, making it the 4th largest cryptocurrency at current.

At the very least two main crypto exchanges – Coinbase and Gemini – have determined to listing or plan to listing XRP after Ripple’s authorized victory. These choices might additional assist the worth of the XRP token.

Three cash named in unrelated SEC circumstances towards Coinbase and Binance are additionally among the many largest gainers in the present day: Cardano (ADA) rose 19.5%, Solana (SOL) rose 17.3% and Polygon ( MATIC) elevated by 17.8%. These features are maybe attributable to a extra normal optimism that it’s attainable for crypto corporations to win lawsuits towards regulators.

Varied different belongings additionally posted features. Stellar (XLM), which has early ties to Ripple however is in any other case an impartial mission, noticed features of 62.4%. The broader crypto market gained 6.5% over 24 hours to a complete market capitalization of $1.3 trillion.

Liquidations attain $236 million

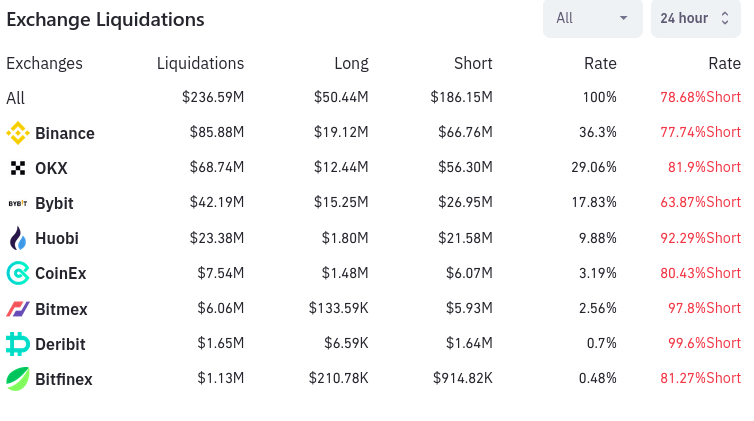

In the meantime, the crypto market noticed $238.37 million in liquidations over a 24-hour interval. This complete consists of $52.01 million in lengthy liquidations and $186.36 million in brief liquidations. Round 66,800 merchants had been liquidated in complete.

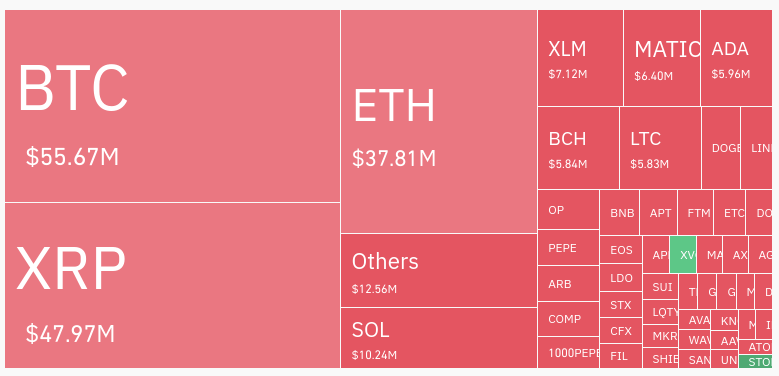

Three belongings have skilled essentially the most liquidations. Bitcoin noticed $55.67 million in liquidations, Ethereum noticed $37.81 million in liquidations, and XRP noticed $47.97 million in liquidations.

Binance was accountable for $85.88 million in liquidations, whereas OKX was additionally accountable for $68.74 million in liquidations. Collectively, these two exchanges had been accountable for roughly two-thirds of all liquidations within the cryptocurrency market.

Varied different exchanges, together with Bybit, Huobi, and CoinEX, had been accountable for the rest of those liquidations, as listed under:

The day’s occasions characterize uncommon optimistic information amid the crypto business’s newest bear market. Though the broader implications of the Ripple affair should not but clear, the most recent developments appear to have generated optimism amongst cryptocurrency traders.