Singapore-headquartered Pillow plans to close down all of its providers and apps within the coming weeks, prospects warned on Friday, citing regulatory uncertainty that has claimed the lives of numerous different crypto startups on the earth. over the last quarters.

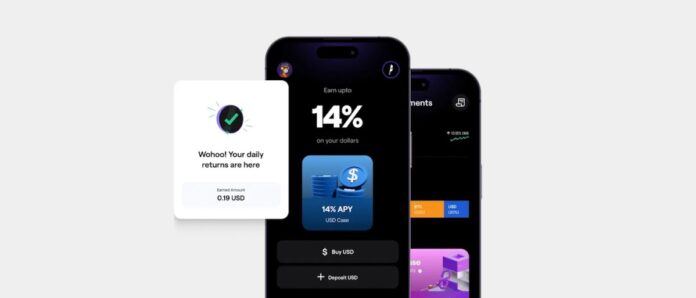

Pillow allowed shoppers to put money into Bitcoin, stablecoins and altcoins, and promised returns of as much as 18% – a determine that fell to 14% because the market started to chill. It had raised about $21 million in whole and counted Accel India, Quona Capital, Elevation Capital and Soar Crypto amongst its backers. Pillow revealed its $18 million Sequence A funding in October final yr.

In a message on Telegram, the two-year-old startup requested prospects on Friday to withdraw all their funds from the Pillow app and stated it will finish all of its present providers on July 31, 2023.

The transfer follows Pillow’s fundamental rival, Flint, which shut down its providers final month as a result of what it referred to as “regulatory hurdles” and “damaging market sentiment”.

Each startups, based and operated in India, counted the South Asian nation amongst their largest markets. The Reserve Financial institution of India, the nation’s central financial institution, has been pushing lenders to cease partaking with crypto startups for over a yr, making it just about inconceivable for web3 startups to function within the nation.

Crypto big Coinbase, one of many largest exchanges on the earth, discovered the onerous means. He suspended help for the UPI cost instrument on its app in India final yr, rendering its eponymous alternate non-functional for any order types lower than 4 days after the buying and selling service launched on the second-largest Web market on the earth.

Coinbase chief government Brian Armstrong claimed final yr that there have been “components throughout the authorities there, together with on the Reserve Financial institution of India, that are not as optimistic about it. . And they also – within the press it has been referred to as a “phantom ban”, principally they’re making use of somewhat stress behind the scenes to attempt to disable a few of these funds, which could undergo UPI.