On this article, we’re going to take inventory of the three crypto property Ripple (XRP), Tron (TRX) and Polygon (MATIC).

Let’s have a look at collectively how they’re doing out there and what are the longer term value predictions.

Market evaluation for crypto-assets Ripple (XRP), Tron (TRX) and Polygon (MATIC)

In a single day, Bitcoin broke above the $30,000 mark, fueling hopes of a continuation of the uptrend, however within the meantime, altcoins additionally benefited. temporary rise in costs at the start of the week.

Particularly, ripple (XRP) within the final 24 hours has elevated by 3.77% and at present stands at $0.524 per token. The market capitalization is $27 billion whereas every day volumes are up 80%, surpassing the $1.1 billion mark.

Quite watch TRXTron founder Justin Solar’s favourite crypto, over the previous 24 years, has seen a value enhance of 0.72%, barely lower than the expansion of XRP.

The present worth marks $0.067 per token, whereas the market capitalization is round $6.1 billion.

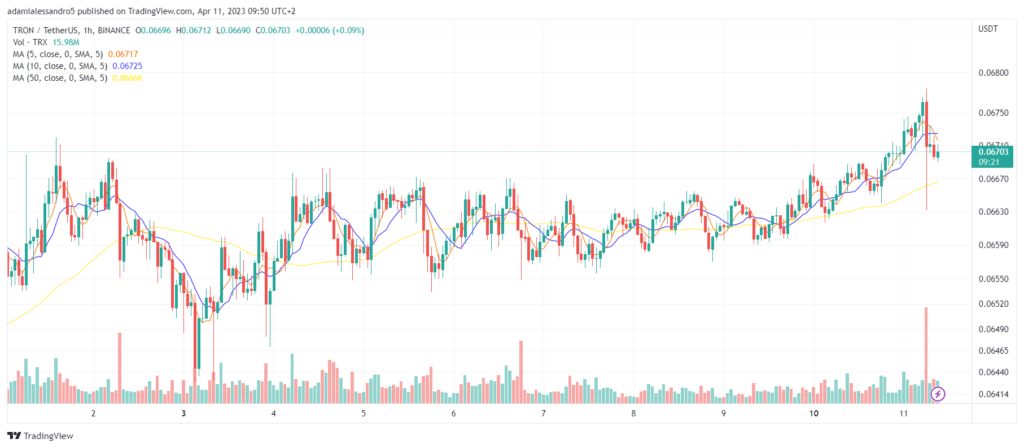

Quantity-wise, the worth is round $225 million within the final 24 hours, up 25%. On this regard, wanting on the TRX-USDT chart on Binance, it’s fascinating to notice that this morning at 6:00 a.m. (CET), there was a dump which took the token from $0.0678 in worth to $0.0670 with volumes larger than 70 million TRX {dollars} traded.

The magnitude of the transfer was 2.19% in only one hour of buying and selling.

Lastly, the evaluation of the crypto polygon (MATIC), the well-known layer 2 of Ethereum, we will see how the worth has elevated by 3.25% within the final 24 hours.

It at present stands at $1.13 per token, with a market cap of $10.4 billion and every day volumes registering +42.88% with $258 million on trades.

Forecasts for Ripple (XRP), Tron (TRX) and Polygon (MATIC)

All 3 crypto property are extremely capitalized and fall into the high 15 out there, so value actions are much less pronounced than for low-cap, low-volume tokens. However, over the previous 24 hours, we have now seen notable value actions.

Ripple (XRP) appears to wish to proceed his approach upwhich began on March 6, 2023: from there 4 weeks within the inexperienced, adopted by 1 week within the mild purple, till at present.

If the worth doesn’t drop sharply by Sunday, the percentages are in favor of a continuation of the upward value development for XRP.

At present, the strongest resistance regionally lies at $0.6229 close to the 223-period transferring common on the 3-day chart.

The long-term drawback for XRP stems from the truth that the group, as most specialists within the cryptocurrency business name it, is continually promoting venture tokens, fueling continued downward strain.

Moreover, XRP over the previous 4 years has been fought by the US SEC, creating investor distrust about the way forward for the Ripple cost system. As of at present, it lastly seems that the SEC is shedding the case, though nothing is confirmed but.

On the Tron entrance, the TRX crypto is one other instance of how a token may be penalized by the actions of his group.

Certainly, whereas Justin Solar has at all times strived to make the ecosystem extra thriving with dApps and on-chain exercise, on the identical time there was a relentless revenue taking up his half.

By itself, the truth that the founders of the venture partially “money out” doesn’t essentially imply that they wish to kill the venture and the native token, particularly if these earnings are reinvested within the venture itself.

Nonetheless, cryptocurrency merchants are hesitant to HODL such a hailed and criticized token, seeing it solely as a income for the creators of the cryptocurrency.

On this case, understanding the topic (Justin Solar), it’s simple that he’s not a saint; so it’s comprehensible that merchants react accordingly?

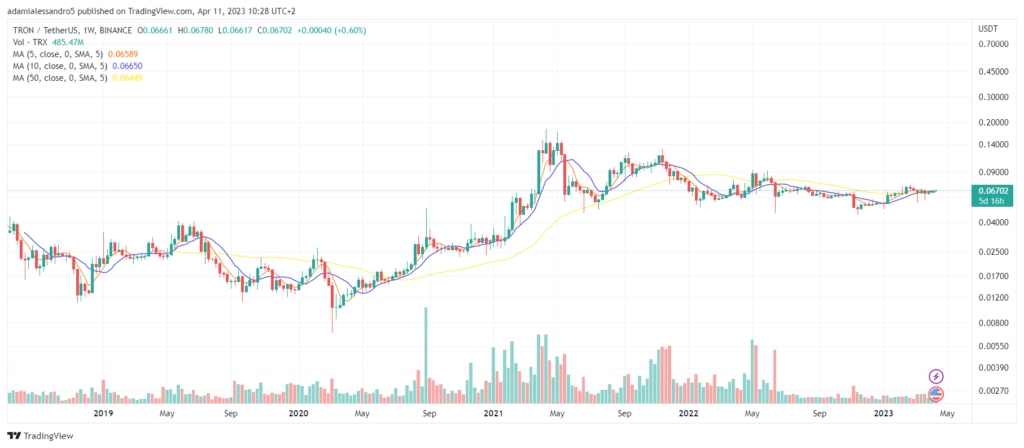

Past that, wanting on the weekly chart of TRX, it’s doable to watch that the worth is in a very lengthy accumulation zonewhich started in January 2022.

The token sits in a buying and selling vary of $0.045 to $0.09, with a 100% width from backside to high of the channel.

Will MATIC be capable of break the all-time excessive for buying and selling pair with BTC?

MATIC appears to be strongest crypto out of the three analyzed.

Since June 2022, the worth has elevated nearly 400%confirming investor curiosity within the Layer 2 area.

In the meantime, Polygon showcased the zkEVM beta fueling FOMO and the potential of the venture that already rivals the world’s high blockchains.

One of the crucial fascinating issues to notice in regards to the crypto MATIC is its value in comparison with the king of cryptocurrencies Bitcoin.

Whereas certainly in opposition to the US Greenback the worth is struggling like the complete crypto business, the identical can’t be mentioned when analyzing the MATIC-BTC buying and selling pair.

In November 2022, the worth of the pair hit the all-time excessive marked in Could 2021, throughout which the worth soared 252% in opposition to BTC.

At present, he’s nonetheless in a area near historic peaksthough the worth seems to be set to drop not less than till April, until there’s a reversal quickly.

It is value remembering that the remainder of the altcoin sector is underperforming relative to BTC returns, and only a few different tokens can boast such a counter worth.

Trying on the MATIC-BTC month-to-month chart, we will instantly see how the worth remained within the “excessive” space of the chart and didn’t decline through the bear market.

Will we be capable of see new highs in BTC for MATIC?

As common, it isn’t straightforward to make predictions however we will say that the percentages work in its favor in comparison with the whole lot else on the earth of altcoins.

Thought of as a case in itself, it seems to be unlikely to hit the highs in Aprilhowever it’s nonetheless fascinating to observe the worth motion of the token to see what’s going to occur if the worth returns above 0.000055 BTC per token, creating the circumstances for a relentless value breakout.