- DAI stablecoin holders add positions as crypto costs fluctuate.

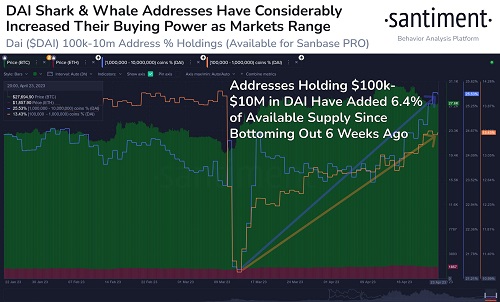

- Addresses with 100,000 to 10 million DAI have added 6.4% of provide over the previous six weeks.

- The general holdings of this cohort had fallen considerably as Bitcoin and Ethereum costs surged in mid-March, in keeping with information from Santiment.

On-chain information exhibits that giant traders, shark and whale addresses with $100,000 to $10,000,000 DAI have just lately added to their positions. Addresses with 100,000 to 1 million DAI maintain over 13% of the provision, whereas these with 1 to 10 million DAI presently maintain over 25% of the provision.

Whales Purchase DAI Stablecoins As Markets Transfer

As crypto markets expertise renewed volatility, market information supplier Santiment has Underline that after the rotation following the Bitcoin and Ethereum value surge in mid-March, sharks and whales added 6.4% DAI.

“Even with the crypto markets rollercoaster in April, main stablecoins like $DAI are being hoarded by sharks and whales. Since $DAI was traded to pump out $BTC and $ETH in mid-March, DAI addresses between $100,000 and $10 million have added 6.4% of provide since then.“Santiment famous.

As of April 23, 2023, addresses with $100,000-1 million in DAI held 13.43% of the stablecoin provide, whereas addresses with $1-10 million in DAI held roughly 25.53% of the stablecoin provide. the present provide. These cohorts have elevated their buying energy since their holdings bottomed round mid-March, in keeping with information from the chain.

THE chart beneath that Santiment shared on Twitter signifies the above state of affairs.

Dai stablecoin whales and sharks. Graphic courtesy of Santiment on Twitter

Dai stablecoin whales and sharks. Graphic courtesy of Santiment on Twitter

What’s Dai (DAI)?

DAI is the native stablecoin of the main lending protocol maker, whose governance token MKR is presently buying and selling round $688. Dai is the primary decentralized and crypto-backed stablecoin, with a 1:1 pegged worth to the US greenback.

One of many advantages of Dai is its use to mitigate value volatility in a crypto market the place digital asset costs can swing wildly at any time. The token can also be extremely composable with dApps, together with industry-leading DeFi initiatives Uniswap and Compound.

What Does Whale Shopping for of DAI Imply for Crypto Costs?

Sometimes, massive whale trades involving stablecoins have preceded a serious buildup of crypto tokens reminiscent of Bitcoin and Ethereum. That is so as a result of shopping for stablecoins reminiscent of DAI, Tether, and USD Coin has usually indicated that whales are positioning cash prepared for buy.

BTC and ETH costs have just lately pulled again from highs above $31,000 and $2,100 respectively, as those that purchased on the prime are apparently promoting off.