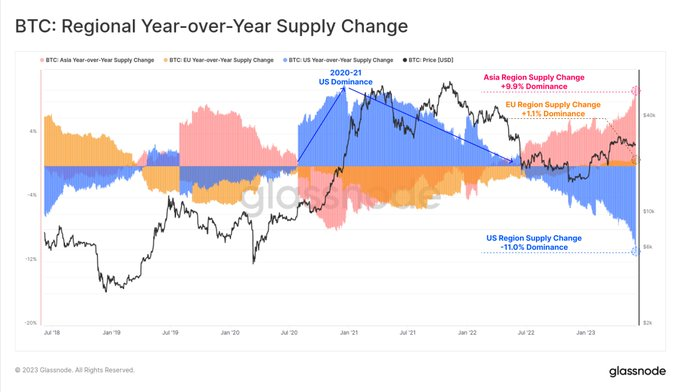

- On-chain knowledge from Glassnode indicated that US entities are holding 11% much less BTC than in 2022.

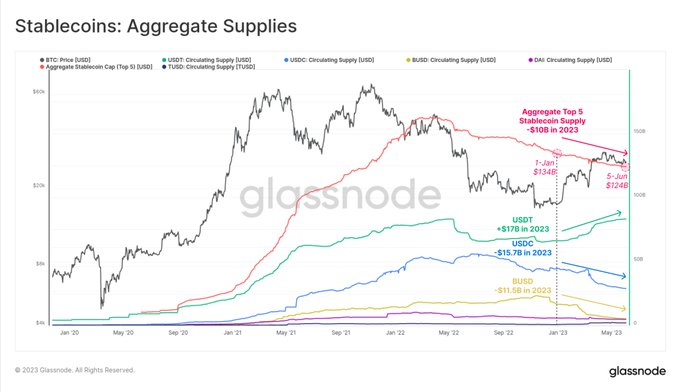

- The information additionally confirmed that USDT provide just lately reached new all-time highs.

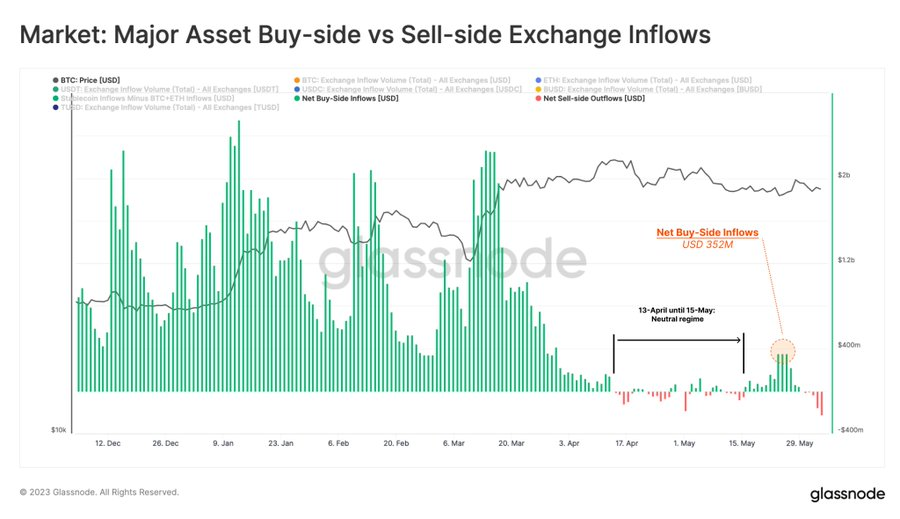

- Glassnode additionally identified that stablecoin inflows considerably outpaced BTC and ETH inflows within the first quarter.

On-chain analytics platform Glassnode shared a number of posts on Twitter right now to spotlight some new traits that may be seen within the crypto area. Glassnode defined in one of many posts that over the previous two years there was a big shift within the provide dominance of Bitcoin (BTC).

On-chain knowledge indicated that US entities have seen a notable 11% drop of their Bitcoin holdings since June 2022. In distinction, traders who actively take part throughout Asian buying and selling hours have seen a substantial improve of 9.9%. % of their Bitcoin holdings. This represents a definite reversal from the uptrend seen within the 2020-2021 cycle.

In the meantime, Glassnode additionally identified in a second put up that vital adjustments are occurring on this planet of stablecoins. The availability of Tether (USDT) has reached new all-time highs, indicating elevated utilization and demand.

However, stablecoins like USD Coin (USDC) and Binance USD (BUSD) have seen their provides shrink to multi-year lows. These developments suggest that US capital is turning into much less energetic within the digital asset area, in keeping with the analytics agency.

Along with this, Glassnode additionally referenced the latest on-chain knowledge change in one other put up. When inspecting on-chain flows on exchanges, the analytics agency discovered that there had been a noticeable lower in demand since April.

Within the first quarter, stablecoin inflows considerably outpaced Bitcoin (BTC) and Ethereum (ETH) inflows, indicating a choice for stablecoins. Nonetheless, the present market correction has resulted in bigger inflows of Bitcoin and Ethereum, that are assumed to be sell-side trades, in comparison with stablecoins.

Disclaimer: Views and opinions, in addition to all info shared on this worth evaluation, are printed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held chargeable for any direct or oblique harm or loss.