Digital asset funding merchandise globally confronted web outflows of $147 million final week, in keeping with the most recent CoinShares weekly report.

That is the primary week of web outflows within the final 4 weeks following a interval of regular inflows.

Regardless of the outflows, digital asset merchandise noticed a 15% enhance in buying and selling volumes, even because the broader crypto market noticed diminished exercise.

James Butterfill, head of analysis at CoinShares, attributed the leak to stronger-than-expected financial knowledge launched in the US. He famous:

“Stronger-than-expected financial knowledge final week and diminished odds of serious fee cuts are probably the explanation for weaker investor sentiment.”

Regionally, Canada and Switzerland maintained an upward pattern, recording inflows of $43 million and $35 million, respectively. Conversely, the US, Germany and Hong Kong noticed important capital outflows, with $209 million, $8.3 million and $7.3 million, respectively.

Traders concentrate on Bitcoin and Ethereum

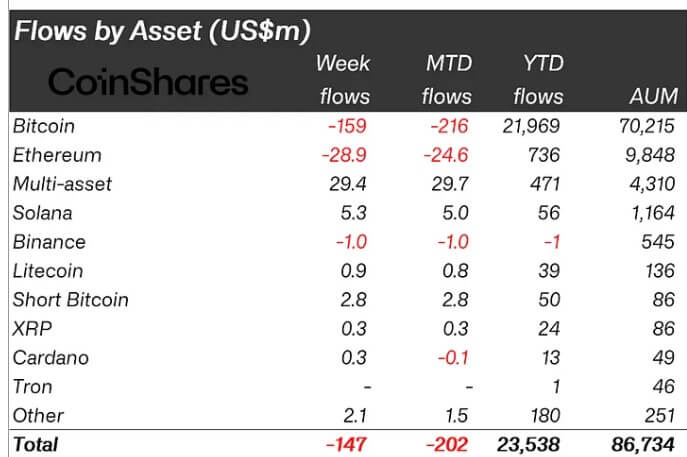

The report notes that Bitcoin stays a precedence, with outflows of $159 million for Bitcoin-related merchandise, coinciding with current worth fluctuations.

Nonetheless, brief Bitcoin merchandise noticed inflows of $2.8 million, reflecting bearish sentiment in direction of Bitcoin worth motion.

In response to forexcryptozone In response to the information, Bitcoin is buying and selling at round $63,000, a rise of two% within the final 24 hours. Final week, the main digital asset fell to a low of lower than $60,000 earlier than rebounding to its present worth.

Ethereum, which had simply ended a five-week outing streak, returned to outflows totaling $29 million final week. Butterfill mentioned investor curiosity in Ethereum stays subdued. In distinction, Solana was the one altcoin to draw notable inflows, reaching $5.3 million for the week.

On the identical time, multi-asset funding merchandise, providing publicity to a number of digital belongings, defied the overall pattern with web inflows of $29.4 million.

That is the sixteenth consecutive week of optimistic flows, bringing their whole to $431 million. Butterfill added that multi-asset merchandise have change into buyers' favorites since June, accounting for 10% of worldwide crypto fund managers' belongings below administration.