- The cryptocurrency market stays resilient regardless of a wave of unhealthy information in 2022

- Bitcoin is buying and selling above $30,000, up 80% year-to-date

- HODL seems to be the key to Bitcoin’s success as Bitcoin hoarding in private wallets will increase

2022 has been a horrible bear marketplace for cryptocurrency traders since November 2021. Bitcoin, the principle cryptocurrency, went from $69,000 to $15.5,000 in a couple of months.

Different cryptocurrencies adopted.

Over the previous yr, the business has been hit with a wave of unfavorable information. Simply consider the collapse of FTX, which seems to be the most important fraud in current historical past.

Moreover, the $2 trillion bear market was the most important within the (comparatively quick) historical past of the cryptocurrency market. Moreover, a number of crypto lender bankruptcies have been introduced.

Lastly, greater than 300 lawsuits and regulatory instances have spooked traders.

Nonetheless, the market rebounded. It’s extremely resilient and rewards traders who imagine in it. For instance, Bitcoin is buying and selling above $30,000, up +80% year-to-date.

Bitcoin hoarding in private wallets is a constructive signal

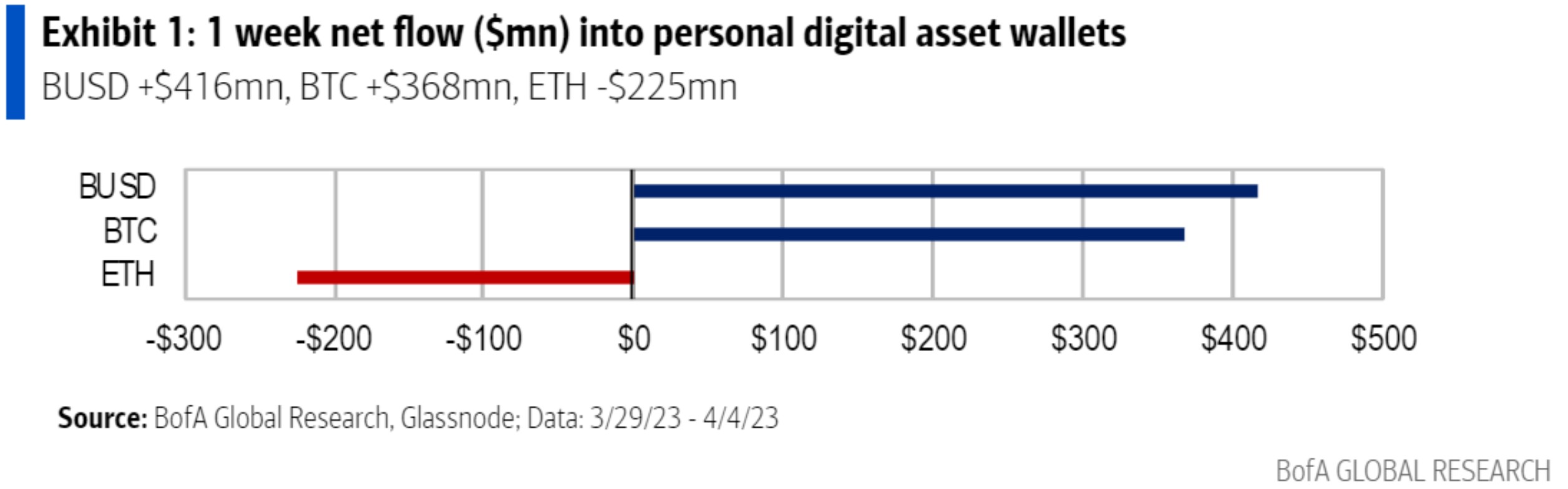

Current analysis from Financial institution of America reveals constructive developments for the cryptocurrency business. HODL appears to be the key to Bitcoin’s success. In accordance with the analysis, hoarding in private digital asset wallets elevated after the worth of Bitcoin surged above $30,000.

That is merely spectacular contemplating that Bitcoin was launched lower than twenty years in the past. To place it into context, a bitcoin was priced at 5 cents in 2010.

This says rather a lot concerning the volatility of the cryptocurrency market and the way booms, busts, mania and desperation are the norm.