- The dry has dropped or interrupted prosecution and surveys in opposition to a number of cryptography corporations, together with Binance and Coinbase.

- Most instances have been rejected in February and March 2025.

- In the meantime, the Ripple affair stays energetic earlier than the courtroom of attraction.

In latest weeks, the American Securities and Alternate (SEC) fee has paused or rejected a number of prosecution and surveys involving giant cryptocurrency corporations. This marked a giant change within the regulatory utility.

This determination comes after the management adjustments inside the company and the creation of a cryptographic working group to rethink the appliance priorities.

Corporations equivalent to Binance, Coinbase, Kraken and United are among the many folks affected. The selections, introduced between February and early March, recommend a coordinated strategy to strategy.

Dry trial wave: abruptly arrested

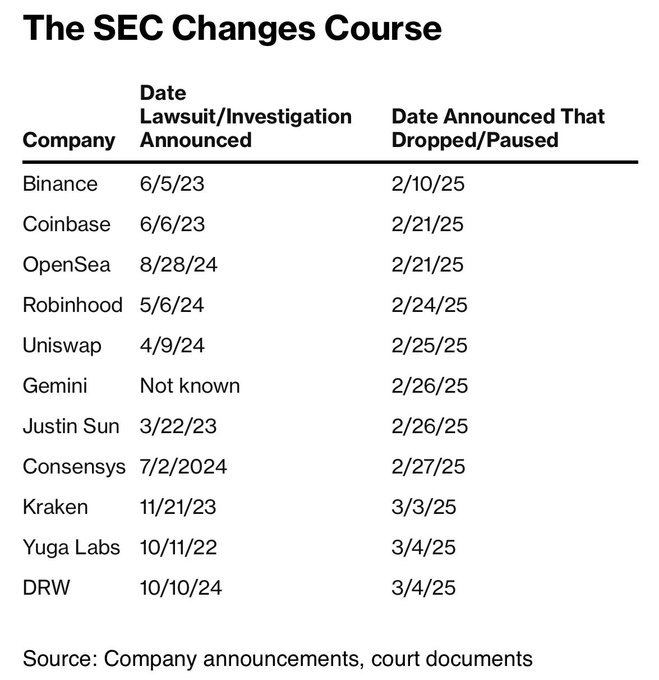

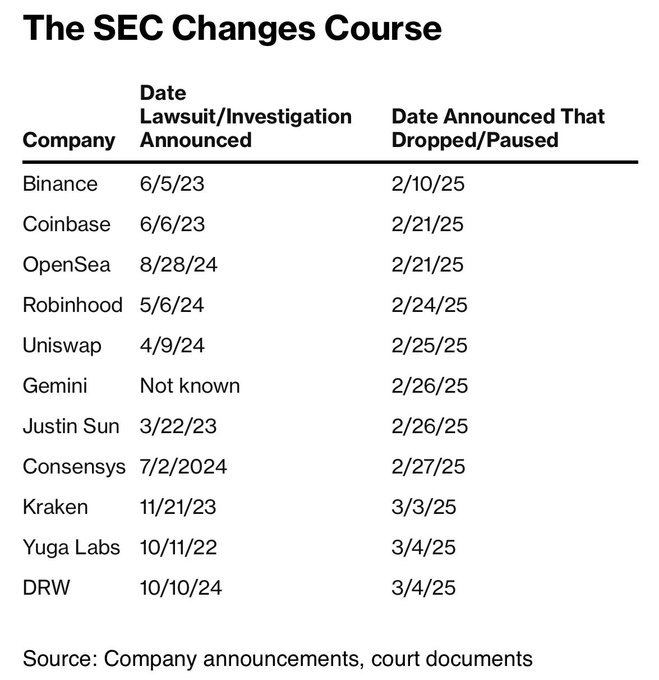

The SEC had beforehand filed prosecution and launched surveys in opposition to varied crypto corporations for alleged violations of titles. Binance and Coinbase have been continued in June 2023, whereas Uniswap, Kraken and Opensea have been examined in 2024.

Nonetheless, latest bulletins verify that these actions have been deserted or suspended. The layoffs adopted a scheme, the case of Binance fell on February 10, Coinbase and Opensea on February 21 and different suites by early March.

Extra particularly, surveys in opposition to cryptographic corporations which have ended embody instances in opposition to Opensea, Robinhood, Uniswap, Gemini, Justin Solar of Tron, Connsys, Kraken, Yuga Labs and DRW.

In relation: Case Ripple dry and ETF influence on the worth – the place is XRP directed?

In January, the appearing president of the Sec, Mark Uyeda, appointed Commissioner Hester Peirce to guide the brand new working group on cryptography. The unit ought to supervise cryptography instances not linked to fraud, contributing to a extra relaxed utility technique.

The latest authorized reversions of the SEC are aligned with this alteration, with pending prosecution underneath the surveillance of the working group.

Wave case: all the time within the dry crosspiece

Regardless of the latest dry determination to delete or droop prosecution in opposition to Binance, Coinbase and different crypto corporations, the present case in opposition to Ripple stays energetic. The dry didn’t embody Ripple within the wave of layoffs, elevating questions amongst XRP fanatics.

In relation: The CEO of Ripple applauds dry for having deserted the Coinbase trial: time for XRP to shine?

A earlier speech talked about that, not like a number of the licensed proceedings, the Ripple case has already made progress in courtroom. A choose judged in 2023 that XRP automated gross sales don’t rely as securities transactions. Nonetheless, the SEC referred to as the events of this determination, specifically regarding institutional gross sales. The case continues to be not settled.

With out new deposits within the Ripple name to come back in April, folks turn into that the dry may fully abandon the decision. This assumption is predicated on their altering regulatory strategy. As well as, there aren’t any allegations of fraud in opposition to Ripple. This makes a decision extra probably.

Non-liability clause: The knowledge introduced on this article is just for informational and academic functions. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for the losses suffered because of the usage of the content material, services or products talked about. Readers are suggested to be cautious earlier than taking motion -related measures.