On this article we’re going to see what are the most recent information about Each day Bitcoin Commerce is and analyze potential future eventualities associated to the value of the principle cryptocurrency out there.

Will Bitcoin handle to cross the fateful threshold of $30,000? Will we see a brand new low within the coming months under the November 2022 low with a goal under $15,000?

Let’s discover out collectively.

Bitcoin Each day Buying and selling Value Replace

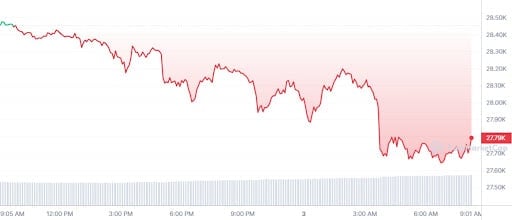

Over the previous 24 hours, Bitcoin has misplaced 2.33% failing to $30,000 escape try within the earlier days.

As of this writing, the value of Bitcoin is $27,790, volumes for the previous 24 hours are round $13.7 billion and are up 30%, which is totally regular provided that over the weekend, the actions of monetary market contributors lower significantly.

Market cap at $537.5 billion and market dominance at 46.2%.

Analyzing the value motion of Bitcoin’s day by day exchanges, we will say that we’re at present compressed right into a vary of $26.5,000 to $29,000with decidedly low volumes.

On Binance, this volumetric development is extra pronounced than on different cryptocurrency exchanges: this doubtless occurred because of the finish of the 0-fee promotion on the BTC-USDT buying and selling pair.

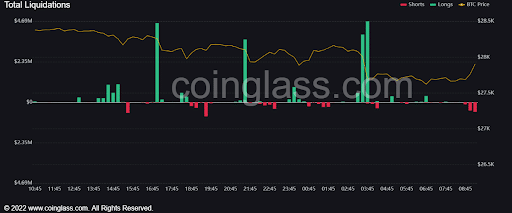

As for the derivatives market, open curiosity on Bitcoin futures reached the $11 billion mark: Binance, CME, Bybit, OKex and Bitget share the biggest quantity share in these markets.

On the liquidation entrance, there was extra lengthy liquidations than brief liquidations within the final 24 hours, though the numbers should not very important, so there may simply be a reversal.

Bitcoin Future Value Evaluation and Prediction

Bitcoin is at present in a zone of excellent equilibrium.

Worry of a continuum of restrictive insurance policies from the Federal Reserve is spooking traders, who may see rates of interest rise once more, resulting in a devaluation of riskier monetary shares reminiscent of crypto shares and property.

Then again, the chance of a US debt disaster advantages Bitcoin, which appears to have established itself over time as a “retailer of worth” assetthat means it is ready to keep the face worth of the funding in occasions of market uncertainty and worry.

That is meals for thought when contemplating that Bitcoin, together with all the remainder of the altcoins, represents one of the crucial risky property with appreciable inherent danger.

This account of the final interval has benefited Bitcoin, which took the chance to report a rally from March 11, 2023. Since that day, there was a worth improve of just about 50%.

Bitcoin is at present in a well-defined buying and selling vary: a breakout of $30,000 or a breakdown of $26,500 may set off a definite development.

If a breakout of considered one of these ranges doesn’t happen, Bitcoin is more likely to proceed lateralization part at low volumes.

If there’s a break to the upside, the primary potential goal is the $35,000 degree, a degree that served as assist in early 2022 earlier than triggering the bear market that has guided us all through yr.

Within the occasion of a draw back breakout, the possible targets are progressively: $25,000, $20,000 and at last $15,000. An extra drop under these costs would affirm the continuation of this crypto winter.

Nevertheless, there isn’t any worrying information in the mean time: Bitcoin stays above the 50-period shifting common on the day by day chart.

Wanting on the weekly horizon, it’s attention-grabbing to notice that following the rally that began on March 11, the key cryptocurrency remained above the ten and 5 interval shifting averages.

Often, a rally adopted by a brief interval of sideways is extra more likely to be a continuation of the development somewhat than a reversal.

One thing to contemplate although is that the macroeconomic situation appears to be one of the crucial difficult of the final decade: warfare, debt disaster, inflation and restrictive central financial institution insurance policies are decided components within the worth motion on day by day Bitcoin exchanges.

We can’t do an evaluation with out bearing in mind these variables which may utterly reverse the scenario.

To sum up, the present scenario is securee. an upward or downward motion of Bitcoin accompanied by excessive volumes may set off sure eventualities, however these should essentially combine with the worldwide macroeconomic scenario.

Bitcoin day by day buying and selling: evaluation of the most effective addresses

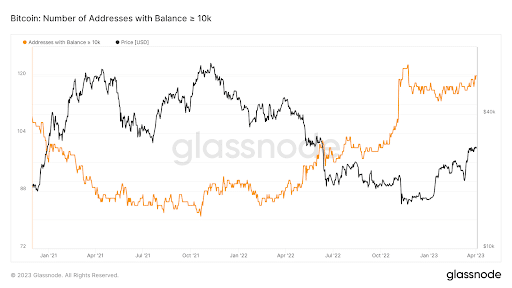

One of the attention-grabbing issues to notice about day by day Bitcoin buying and selling is the evolution of high addresses within the bitcoin protocol.

As we all know, it is vitally vital to trace and analyze the motion of addresses containing a number of BTCs (generally known as “whales”) with a view to have a clue concerning the worth motion of the cryptocurrency.

In keeping with information from Glassnode, concerning the variety of addresses with a stability of greater than 10,000 cash, we will see that:

- since Q2 2022, there was a pointy improve within the variety of these entities;

- the variety of such entities has elevated alongside falling BTC costs;

- since November 2021, the month during which there was the final all-time excessive in BTC costs, there was a rise of greater than 30 items of such addresses.

Regardless that most specialists agree that we’re nonetheless in the midst of a bear market, the information for addresses with extra items appears to counsel that an accumulation is in progress.

This does not imply that we could be celebrating Bitcoin’s continued rally quickly, however somewhat that bigger gamers have taken benefit of the sell-off interval to purchase cash.

It is going to be attention-grabbing to see how this metric evolves within the coming months.

It’s value remembering that the Bitcoin halving is approaching: there are 381 days, or somewhat 56,270 blocks, till the subsequent halving of miner rewards for mining a block.

Traditionally, this date has been good for Bitcoin costs, which began the varied bull market intervals exactly because of these updates.