- Spot Ethereum ETFs noticed $333 million in inflows on Friday, November 29thwhich exhibits the institutional curiosity within the second largest cryptocurrency.

- Consultants attribute this renewed curiosity to expectations for clearer crypto regulation in the US and a optimistic outlook on DeFi.

The highest 10 U.S. spot Ethereum ETFs noticed $333 million in inflows on Friday, following a optimistic week of inflows totaling $466.5 million, surpassing Bitcoin which noticed $318.60 million on Friday and a weekly web outflow of $136.5 million.

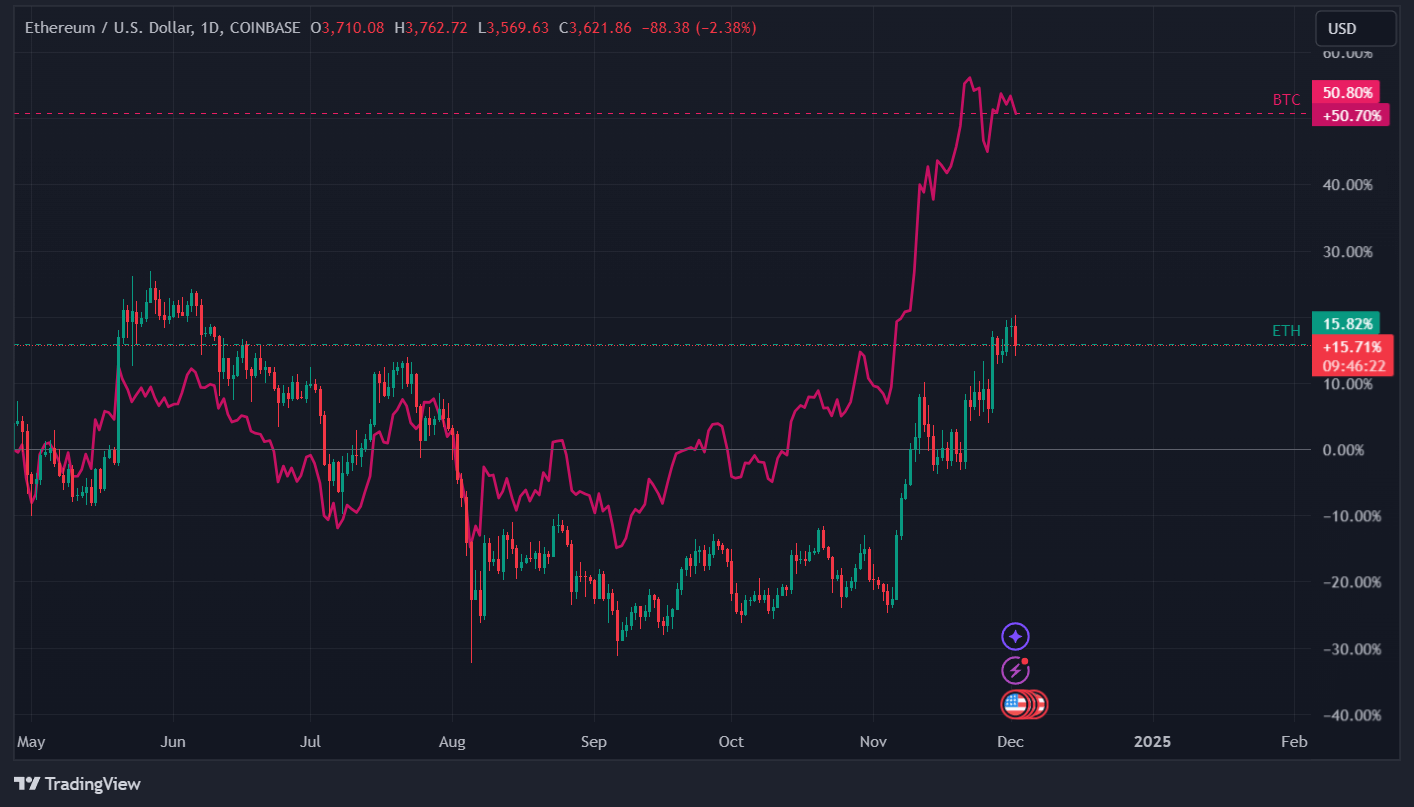

Since Ethereum spot ETFs had been accepted by the SEC in July 2024, the crypto worth has lagged that of Bitcoin and the broader crypto market regardless of the business's clamor for approval . The value of Ethereum fell roughly 32% within the first 15 days after approval, in comparison with Bitcoin which solely fell 15.02% in the identical interval after approval. Bitcoin ETF approval in January 2024.

Renewed curiosity in Ethereum

Regardless of Ethereum's dismal efficiency, current information exhibits rising curiosity as establishments and merchants flip to crypto.

Sygnum Digital Financial institution's Future Finance report, which measures market sentiments and behaviors {of professional} and institutional buyers, confirmed that 90% of the 405 conventional buyers surveyed had been presently invested in blockchain protocol cash (that are largely layer components 1).

The report additionally confirmed that 31% of respondents who already maintain cryptocurrencies deliberate to extend their allocation within the fourth quarter of 2024, whereas 32% deliberate to extend their portfolio over the following six months.

Amongst respondents who didn’t presently maintain cryptocurrency of their portfolio, 43% deliberate to extend their allocation over the following 12 months. Total, 79% of all respondents deliberate to extend advantages within the subsequent 6 months.

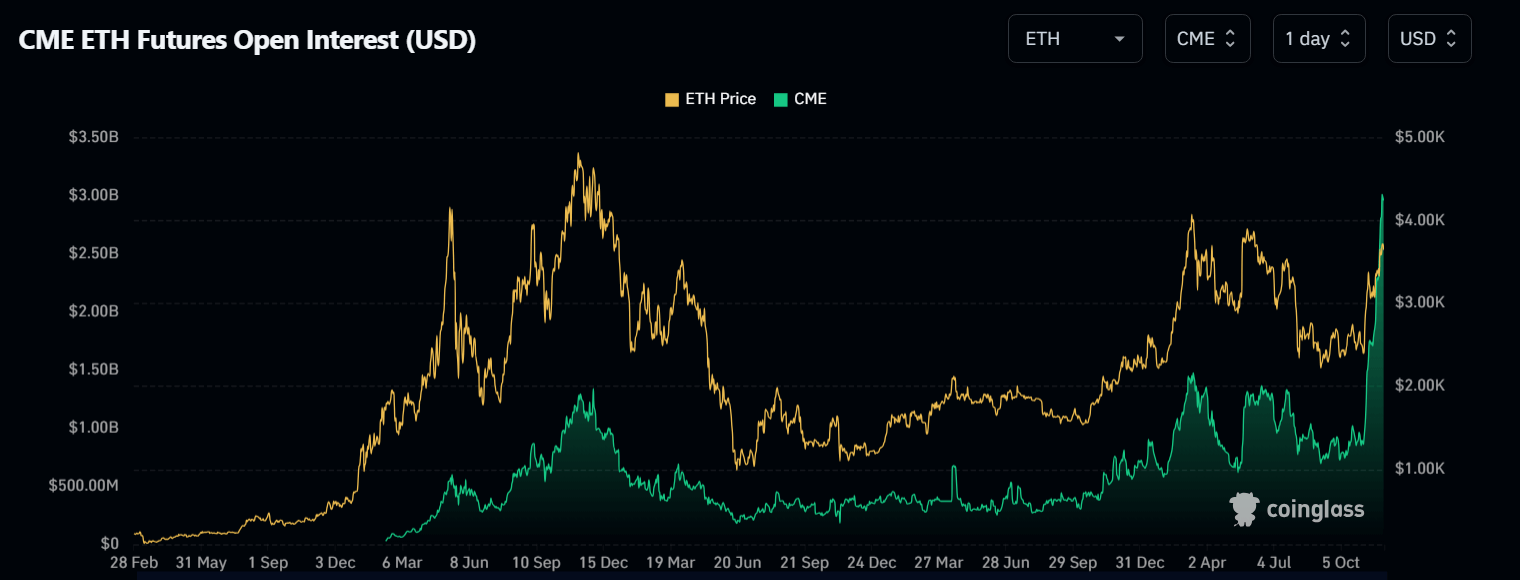

Ethereum Open Curiosity Rises

CME OI histories for Ethereum present that open curiosity has been growing since November 4.th and stands at $3.01 billion at press time, signaling elevated institutional curiosity in Ethereum.

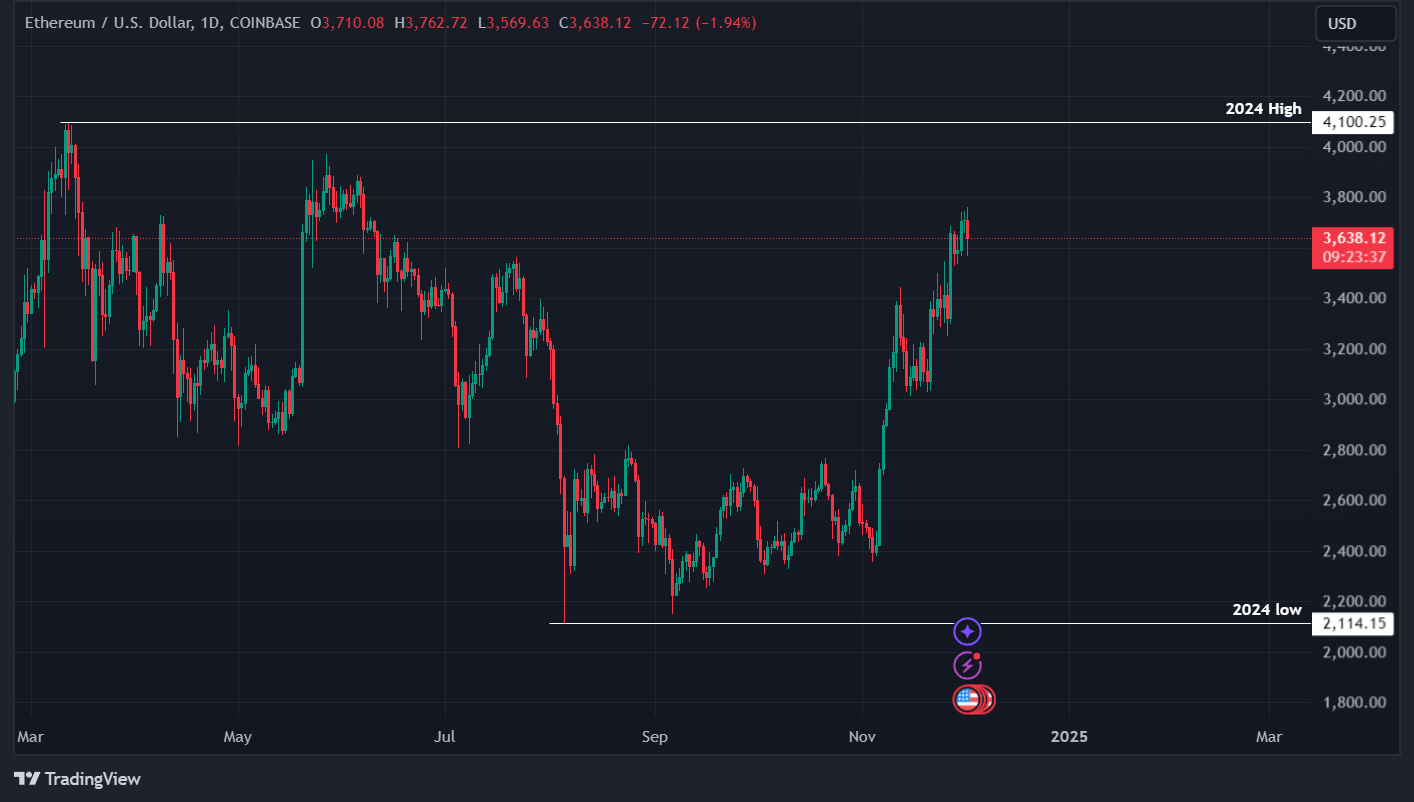

Ethereum has been on an upward pattern since hitting a yearly low of round $2,100 in August and is now nearing its yearly excessive at $4,100.

Ethereum is buying and selling at $3,600 on the time of writing, near its yearly excessive.