- ETH correlates with the transfer in BTC as shorts suffered an enormous wipeout of their positions.

- ETH can not overcome the promoting strain because the 20 EMA has damaged under the 50 EMA.

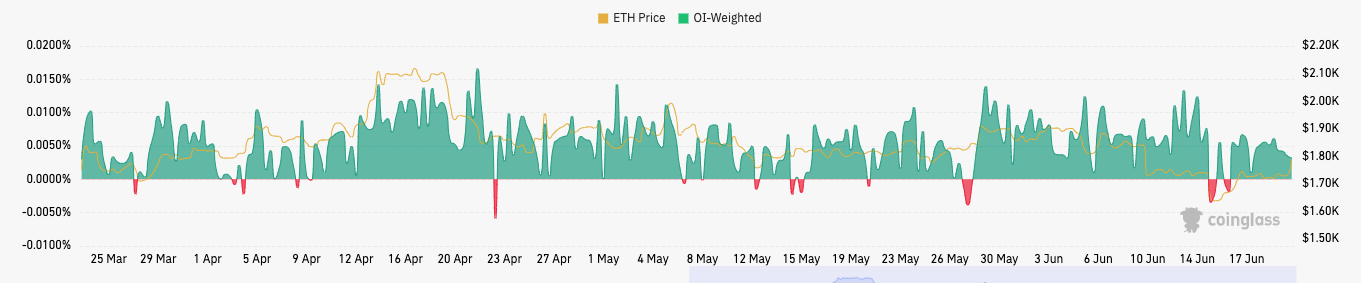

- The funding fee was optimistic, indicating widespread bullish sentiment and the danger of a possible high.

Previously 24 hours, over $25 million in Ethereum (ETH) positions have been liquidated. Moreover, Coinglass revealed that brief merchants accounted for many of this loss.

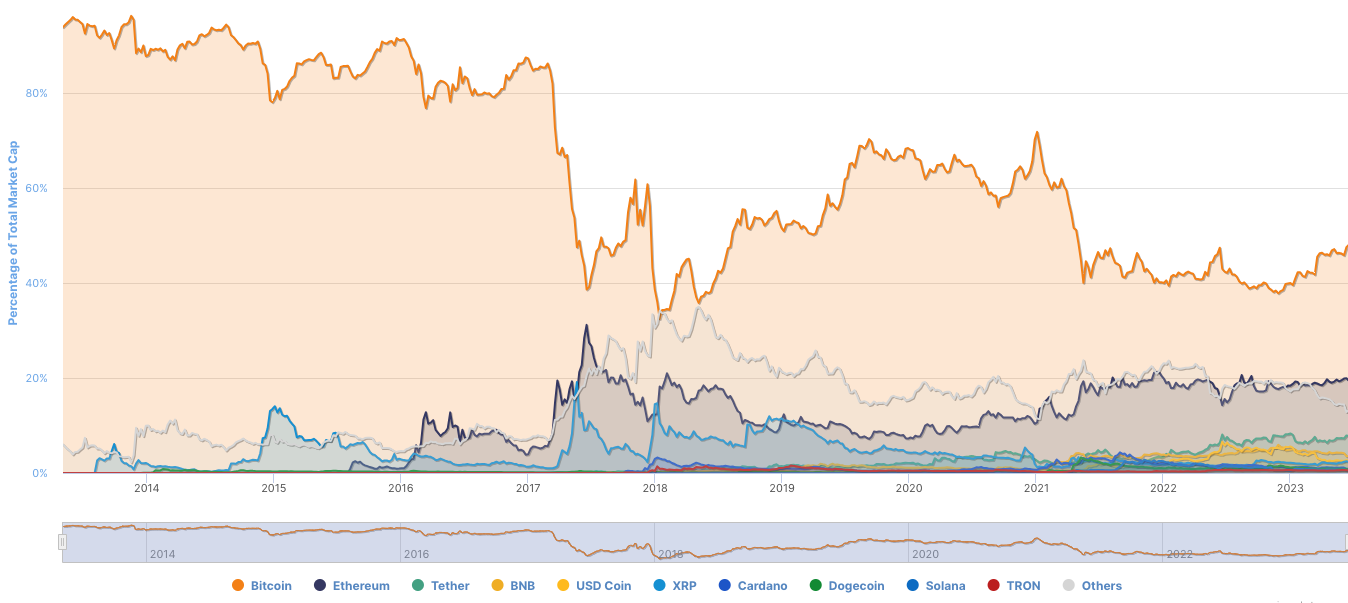

This was the results of ETH rising 5% to $1,814 – a worth it final reached two weeks in the past. The rise in value might shock merchants, particularly as present market situations are tilting in direction of a 50% dominance of Bitcoin (BTC).

Ethereum, alternatively, had a dominance of 19.42%, in line with CoinMarketCap. Usually, this suggests that altcoins may wrestle to outperform BTC. Thus, seeing ETH correlated with the motion of BTC might need left market contributors perplexed.

Drained Patrons Can Drive ETH Down

One of many causes ETH was in a position to break above $1,800 is the bullish push created at $1,650 on June fifteenth.

Though the value has steadily elevated since then, plainly purchaser exhaustion seems at common intervals. At one level, the surge in value needed to halt its transfer at $1,748 resulting from weak demand.

Regardless of an rise, the chance for ETH to return to a bearish state nonetheless existed. At press time, the 20-day EMA (blue) has damaged under the 50-day EMA (yellow).

Due to this fact, one other value improve is perhaps unlikely within the close to time period. And if the promoting strain appears to outweigh the shopping for momentum, then ETH might lose its grip on the $1,800 area.

One more reason why the altcoin won’t help the value improve is the Directional Motion Index (DMI). On the time of this writing, the +DMI (blue) and -DMI (orange) have been 21.79 and 23.41 respectively.

Values this shut indicated that management of the market was nonetheless divided with no authority to purchase or promote on a big scale.

Longs management the market

On the derivatives market facet, Coinglass confirmed the weighted funding fee to be 0.0032%. For context, the funding fee is meant to make sure that the value of the perpetual contract carefully tracks the underlying spot value.

Often, a optimistic funding fee for ETH implies that the longs are paying funding charges to the shorts whereas supporting a bullish bias. Conversely, if the funding fee was unfavorable, the shorts would pay the longs to keep up a bearish place.

Because it stands, the funding fee additionally factors to a possible peak forward. However that may solely occur if merchants proceed to be grasping.

Thus, the possibilities of a rally for ETH stay unsure. Nevertheless, if the broader market decides to copy the progress of the primary quarter, then one other spherical of brief selloffs might seem.

Disclaimer: The views, opinions and data shared on this value prediction are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates is not going to be chargeable for any direct or oblique damages or losses.