- One other debate erupted over the standing of ETH as a safety with the previous CEO of Twitter at its heart.

- The bulls defended ETH at $1800, resulting in an extra rise in worth.

- The CMF indicator identified that ETH could quickly be overbought.

The previous CEO and co-founder of Twitter has affirmed his place that Ethereum (ETH) is a safety. Dorsey, who shared his opinion on the SEC’s motion of labeling a number of cryptocurrencies as unregistered securities, initially talked about three censorship-resistant property.

Jack is on the other aspect with Gary

As anticipated, his record included Bitcoin (BTC). Nevertheless, Dorsey omitted the second-largest cryptocurrency by market worth. When requested if he forgot Ethereum by mistake, Dorsey replied, “No, I did not.”

This assertion sparked important debate inside the cryptocurrency group and raised questions on Ethereum’s regulatory classification. The problem turned controversial however the Bitcoin maximalist didn’t inflate. The truth is, he sarcastically responded to a different person who referred to as him a “clown” for his earlier opinion, saying, “ETH just isn’t a safety? Educate me the wizard.

Previous to the latest debacle, there have been debates about whether or not ETH was a safety or not. However on April 28, Yahoo Finance reported that SEC Chairman Gary Gensler failed to contemplate the protection of altcoins. At the moment, Gensler mentioned, “It is now decentralized sufficient that we do not take into account it a safety.”

The struggle in opposition to compliance

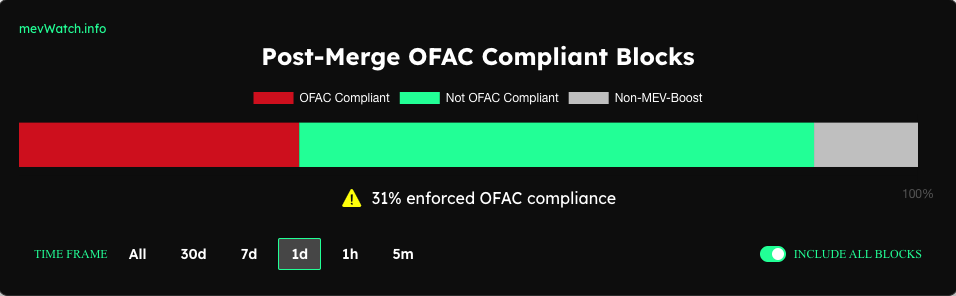

Amid the forwards and backwards, MEV Watch revealed that solely 31% of ETH’s post-merger blocks have been OFAC compliant.

OFAC, which stands for Workplace for International Property Management, is an company of the US Treasury Division, chargeable for commerce and financial sanctions. Moreover, the Treasury Division started monitoring the blockchain after it moved to proof-of-stake (PoS).

For Ethereum to be OFAC compliant, some MEV-boost relays should censor sure transactions on the community.

Subsequently, the rise means that almost all of Ethereum blocks haven’t interacted with sanctioned functions. However the present state has nonetheless raised eyebrows over blockchain decentralization.

ETH: Preventing again the bears

After its downtrend interval on June 5, ETH established a bullish swing, hitting $1,874. This represents a rise of three.86% over the previous 24 hours. The rise may very well be associated to the overall rebound within the crypto market.

Nevertheless, a bearish sample began to erase the beneficial properties after the worth was rejected on the resistance stage of $1,905. Regardless of a collection of bearish candles, the bulls ultimately defended the $1,808 assist. This brought about the worth to bounce again to $1,885 on the day by day timeframe.

The bulls nevertheless didn’t assist the present worth stage of $1,876. If this continues, a bearish superiority may seem and the worth of ETH would decline.

Alternatively, the Chaikin Cash Circulate (CMF) trended upwards. This means that ETH had optimistic money circulation. However with the indicator at 0.19, the cryptocurrency would possibly attain an oversold area.

Lastly, ETH would possibly want a rise in demand to maintain up with the bullish transfer. On the identical time, the worth is prone to reverse if the CMF ultimately reaches 0.20.

Disclaimer: The views, opinions and data shared on this worth prediction are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal threat. Coin Version and its associates is not going to be chargeable for any direct or oblique damages or losses.