- Ethereum is presently holding beneath an essential resistance stage.

- Solana and Polkadot await a bullish breakout.

- Arbitrum value has risen from a vital stage.

The altcoin market is exhibiting indicators of development and rebounding, with some tendencies pointing in direction of the potential for a rally.

Whereas the broader market, together with altcoins like Dogecoin and XRP, is gaining momentum, it’s not but clear when a serious alt season will happen. Traditionally, February has been a powerful month for crypto, particularly Ethereum, and this yr may observe the identical sample.

Analyst Miles Deutscher listed the highest altcoins for February:

Ethereum (ETH)

The analyst stated that Ethereum stays a basic asset for a lot of portfolios. Even with its volatility, its huge ecosystem, sensible contract capabilities, and robust developer group make it essential for long-term publicity to the crypto area.

Ethereum is presently buying and selling beneath essential resistance at $3,350 and is down 4% over the previous week. The worth chart exhibits some fascinating value motion and it stays to be seen if ETH will surpass $3,400 quickly.

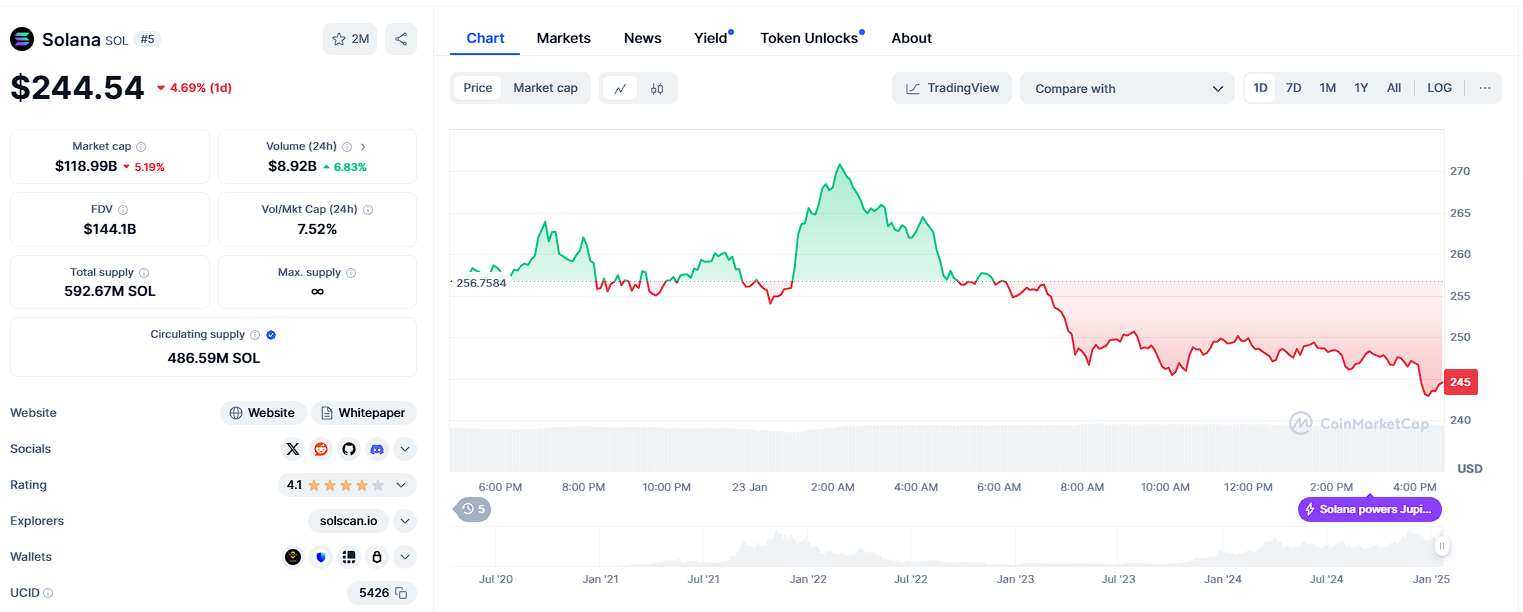

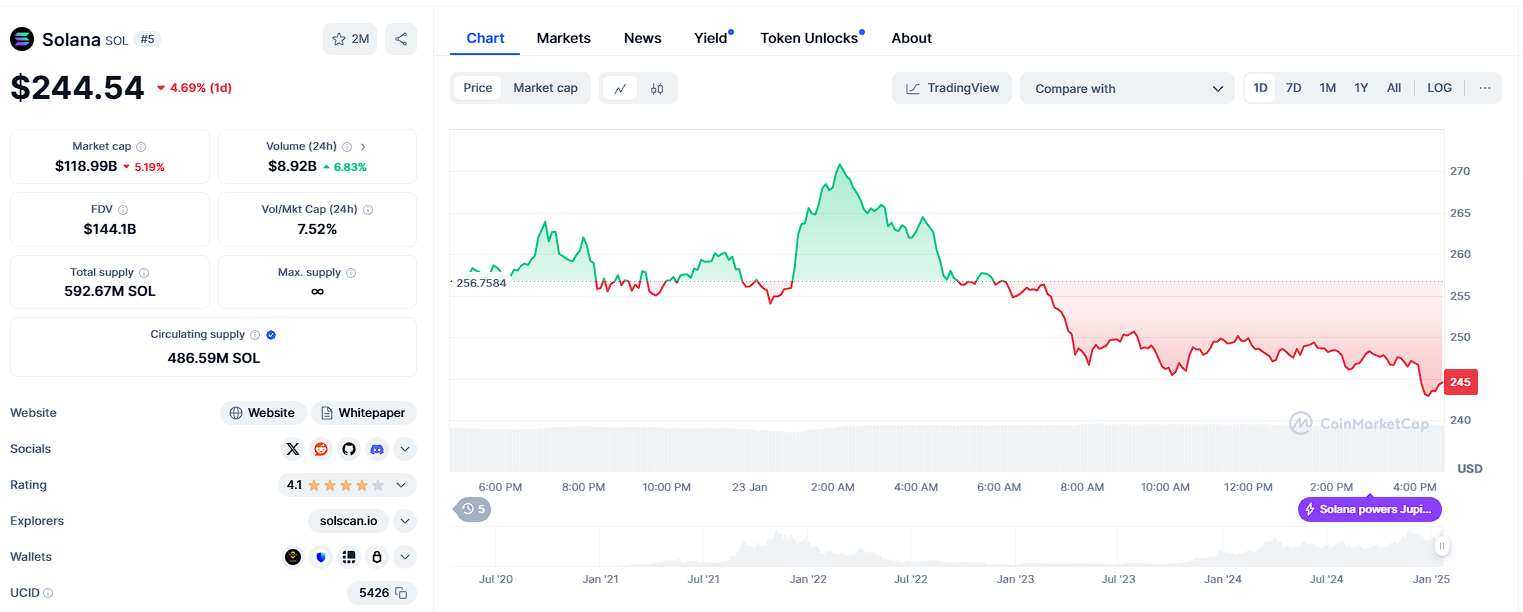

Solana (SOL)

Solana has change into a quick and scalable various to Ethereum, providing low transaction charges and a quickly rising ecosystem.

Though it has confronted challenges equivalent to community downtime, its technological enhancements and growing adoption make it a powerful candidate for long-term development.

Solana is up greater than 22% within the final seven days. The coin is now seeking to breach the $294 mark and attain new all-time highs.

Polka dot (DOT)

Polkadot's interoperability-focused method units it aside within the blockchain area, based on the analyst. Its technological base offers it robust potential within the medium and long run.

Though Polkadot has fallen greater than 9% over the previous week, it’s anticipated to see a powerful upside breakout, with a goal of $11.65, the excessive level reached on December 4.

Chain hyperlink (LINK)

Chainlink is paving the way in which for decentralized oracle options, offering real-world information to blockchains to be used in sensible contracts. As a bridge between off-chain and on-chain information, this is a vital long-term play.

Chainlink value surged 50% after January 15, reaching as excessive as $27.14 earlier than encountering resistance. The $32 stage is now an essential space to look at for LINK.

Avalanche (AVAX)

Avalanche is one other high-speed blockchain that competes with Ethereum and Solana. With a rising ecosystem and robust developer help, AVAX is a vendor to look at for medium-term development.

Avalanche value fell beneath the $48 resistance, exhibiting indicators of bearish strain, and is down 8% this week. A transfer above $40 is intently watched

Arbitration (ARB)

As a layer 2 scaling resolution for Ethereum, Arbitrum helps scale back congestion on the Ethereum community by offering sooner and cheaper transactions. With Ethereum's excessive gasoline charges, Arbitrum emerges as a sensible resolution.

Arbitrum value rose from $0.82 over the weekend to $0.67 on Monday, exhibiting a bearish motion. If it strikes greater, the subsequent resistance to look at is $0.78.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.