Non-liability clause: The knowledge offered on this article is a part of a sponsor / paid sponsor / press launch content material, meant just for promotion functions. Readers are suggested to be cautious and conduct their very own analysis earlier than taking measures associated to the content material of this web page or the corporate. Coin Version is just not answerable for loss or injury suffered on account of or in reference to the usage of the content material, services or products talked about.

The passage from Pow to Pos: an evolution of the blockchain

The transition from proof of labor (POW) to proof of stake (POS) represents a big evolution of blockchain know-how. Pow, the consensual mechanism that feeds Bitcoin and Ethereum (as much as its improve), is predicated on minors resolving complicated cryptographic puzzles to validate transactions and safe the community. This mechanism is with a excessive vitality depth, requiring an unlimited energy of calculation and electrical sources, which raises issues regarding its environmental influence.

Then again, the POS is predicated on validators who’re chosen to supply and validate new blocks in response to the quantity of cryptocurrency which they “put” as assure. This transformation was well-known within the “Merge” occasion of Ethereum, which managed to maneuver the POW community to POS in 2022. The POS mechanism significantly reduces vitality consumption and opens up new alternatives for scalability, decentralization and safety.

This transition raises an necessary query on alternatives throughout the blockchain ecosystem, particularly with regard to the extractable worth of minors (MEV).

Zenmev: Adapting MEV methods for POS networks

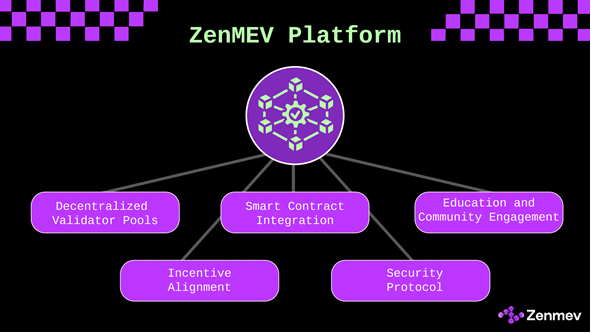

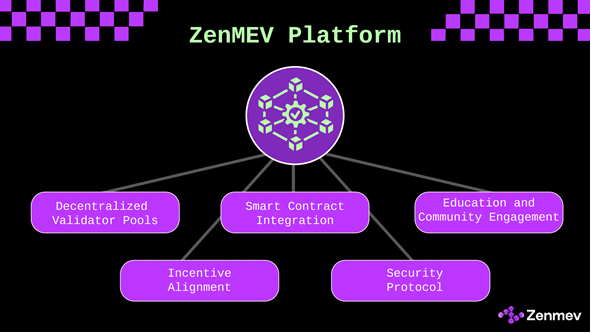

Zenmev is on the forefront of MEV innovation, making the most of superior methods to optimize MEV extraction in POS ecosystems. By specializing in transparency, safety and group engagement, Zenmev ensures that MEV alternatives align with the ideas of POS whereas maximizing profitability.

Decentralized validateur swimming pools

Zenmev facilitates decentralized validators swimming pools, permitting customers to place the property collectively. This method democratizes entry to MEV alternatives, guaranteeing that no single entity monopolizes block manufacturing or MEV extraction. By pooling sources, customers can take part in rewards centered on MEV with out having to take advantage of their very own validators, selling fairness and inclusiveness.

Automation of good contracts for MEV optimization

Zenmev's clever contracts automatize the transaction order, permitting efficient execution of MEV methods resembling arbitration and liquidations. In POS techniques, the place validators play a central position, automation ensures that MEV extraction is carried out clear and effectively. This maximizes yields for members.

Incitation and security alignment protocols

The Zenmev mannequin is aligned with the incentives of validators, stakers and customers. Validators are rewarded for the optimization of transaction orders, whereas stakers profit from MEV alternatives by participation mechanisms for revenue. Superior safety protocols shield towards malicious actions, sustaining confidence and integrity within the community.

Instructional sources and group dedication

Zenmev hierarte the precedence for the training of the blockchain group on MEV environments in POS. Because of collaborative sources, instruments and initiatives, Zenmev permits customers to know and capitalize on MEV alternatives, strengthening their position within the ecosystem.

How level of sale networks can profit from MEV

Regardless of the modifications made by POs, Mev nonetheless performs an important position in optimizing the blockchain ecosystem. With intrinsically inferior vitality consumption of POS and extra decentralized nature, MEV change alternatives in a number of key areas:

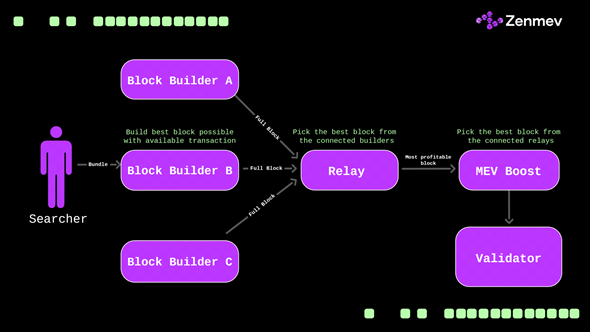

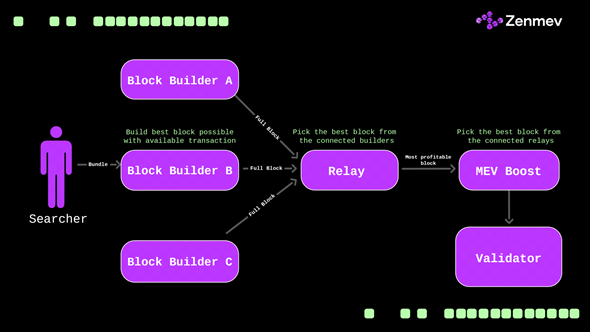

AGTMENT OF VALIDTOR PARTICIPATION: Within the POS, anybody with enough capital to widen can turn into a validator. This will increase the pool of members and the potential of aggressive validators to emerge. As an increasing number of validators be part of the community, competitors for the manufacturing of blocks will increase, creating extra alternatives for MEV extraction because of the management of competitions based mostly on competitors.

Decrease enter obstacles for validators: Not like POW, the place minors want costly tools and important vitality expenditure, the POS reduces obstacles to entry. Consequently, small actors can now take part within the validation course of, doubtlessly demolishing MEV extraction and decreasing centralization which frequently afflicts POW networks.

Community security enchancment: With POS, validators are inspired to behave actually to keep away from shedding their funds up to now. The integrity of the order and the validation of transactions will most likely be larger, which can scale back the probabilities of malicious conduct resembling main or sandwich assaults. This makes the networks constructive extra protected and reliable within the administration of MEV, encouraging extra customers to take part and belief the ecosystem.

New MEV mechanisms: POS networks introduce new mechanisms for MEV extraction. For instance, validators can use methods resembling discount (shedding a part of their participation for malicious conduct) to implement the order of honest transactions. As well as, POS techniques can implement options resembling “precedence fuel auctions” or different technique of rewarding validators to optimize transaction management, creating new layers of MEV alternatives.

Employed swimming swimming pools and Mev methods: Ignition swimming pools the place customers mix their sources to arrange on the community and share rewards can result in new methods for MEV. As these swimming swimming pools develop, they’ll exert extra affect on the community, which supplies them higher alternatives to extract the MEV. Swimming pools that target excessive -frequency transactions, resembling these concerned in decentralized financing (DEFI), can create worthwhile MeV methods, providing customers a strategy to win rewards with out the necessity for technical experience.

The transition of proof of labor to proof of participation has basically redefined the panorama of blockchain know-how, significantly modifying the way in which the MEV is extracted and distributed. Though the POS responds to many vitality and centralization issues related to POW, it additionally creates new alternatives and challenges for MEV.

Validators in POS networks are actually the primary gamers within the order of transactions, however their incentives and methods differ from these of minors in POW techniques. Because the POS networks are evolving, MEV should adapt to the brand new realities of the blockchain ecosystem. The POS presents benefits resembling elevated participation, decrease entry obstacles, improved safety and new MEV mechanisms which can most likely result in a extra equitable and decentralized method to MEV extraction.

Tasks like Zenmev contribute to filling the hole between these two worlds, guaranteeing that the MEV extraction stays simply, clear and helpful for all members in networks based mostly on POS. Whereas the blockchain house continues to mature, the evolution of the POW MEV in POs will play an important position within the formation of the way forward for decentralized funds and the know-how of blockchain as a complete.