Crypto asset supervisor Grayscale questioned the U.S. Securities and Alternate Fee’s determination to approve a leveraged bitcoin (BTC) exchange-traded fund (ETF) in a July 10 letter.

The corporate’s Bitcoin Belief (GBTC) additionally hit its lowest level since Might 2022, in line with information from ycharts,

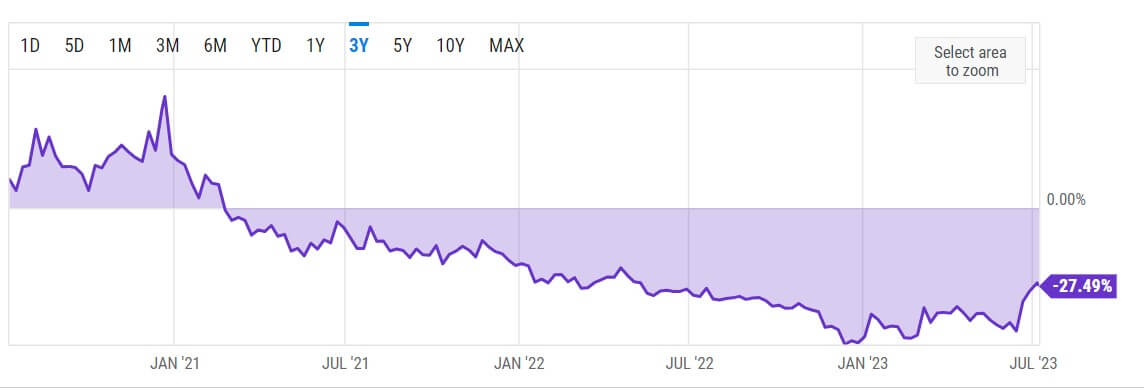

GBTC rebate shrinks

GBTC’s low cost to its internet asset worth (NAV) narrowed to 27.49% and its shares have been buying and selling close to $20, in line with information from ycharts.

Over the previous few weeks, GBTC’s low cost has narrowed additional and its inventory worth has outperformed that of Bitcoin. For context, whereas GBTC shares are up practically 43% prior to now month, BTC’s worth has solely gained 17% in the identical interval, in line with by forexcryptozone information.

Market watchers attributed GBTC’s improved efficiency to BlackRock’s bid for a Bitcoin spot ETF. For the reason that asset supervisor requested a spot BTC ETF on June 15, different conventional monetary establishments, together with Constancy and others, have requested an analogous ETF.

Grayscale Asks SEC About BTC Leveraged ETF

July 10, Grayscale essential the US monetary regulator’s determination to approve a leveraged BTC ETF – an funding fund that goals to generate amplified returns utilizing monetary derivatives and debt – arguing that the SEC’s actions show that it acts arbitrarily.

The agency wrote:

“The 2x leveraged bitcoin futures ETF makes use of leverage with the goal of doubling the efficiency of the S&P CME Bitcoin Futures Every day Roll Index each day. This exposes traders to an excellent riskier funding product. than conventional exchange-traded bitcoin futures.

Grayscale identified that the joy generated by this leveraged BTC ETF exhibits that “Ininvestors are wanting to BTC publicity with the protections of the ETF envelope.

The corporate added that the SEC had no good cause to disclaim approval of spot merchandise whereas approving leveraged futures merchandise.

Final yr, the SEC rejected Grayscale’s plan to transform its Bitcoin Belief into an ETF, forcing the corporate to file a lawsuit in opposition to the SEC, arguing {that a} money ETF was no totally different from an ETF. time period, which the SEC had beforehand accredited.

Grayscale put up challenges SEC ruling on leveraged Bitcoin ETF as GBTC reduce reduce appeared first on forexcryptozone.